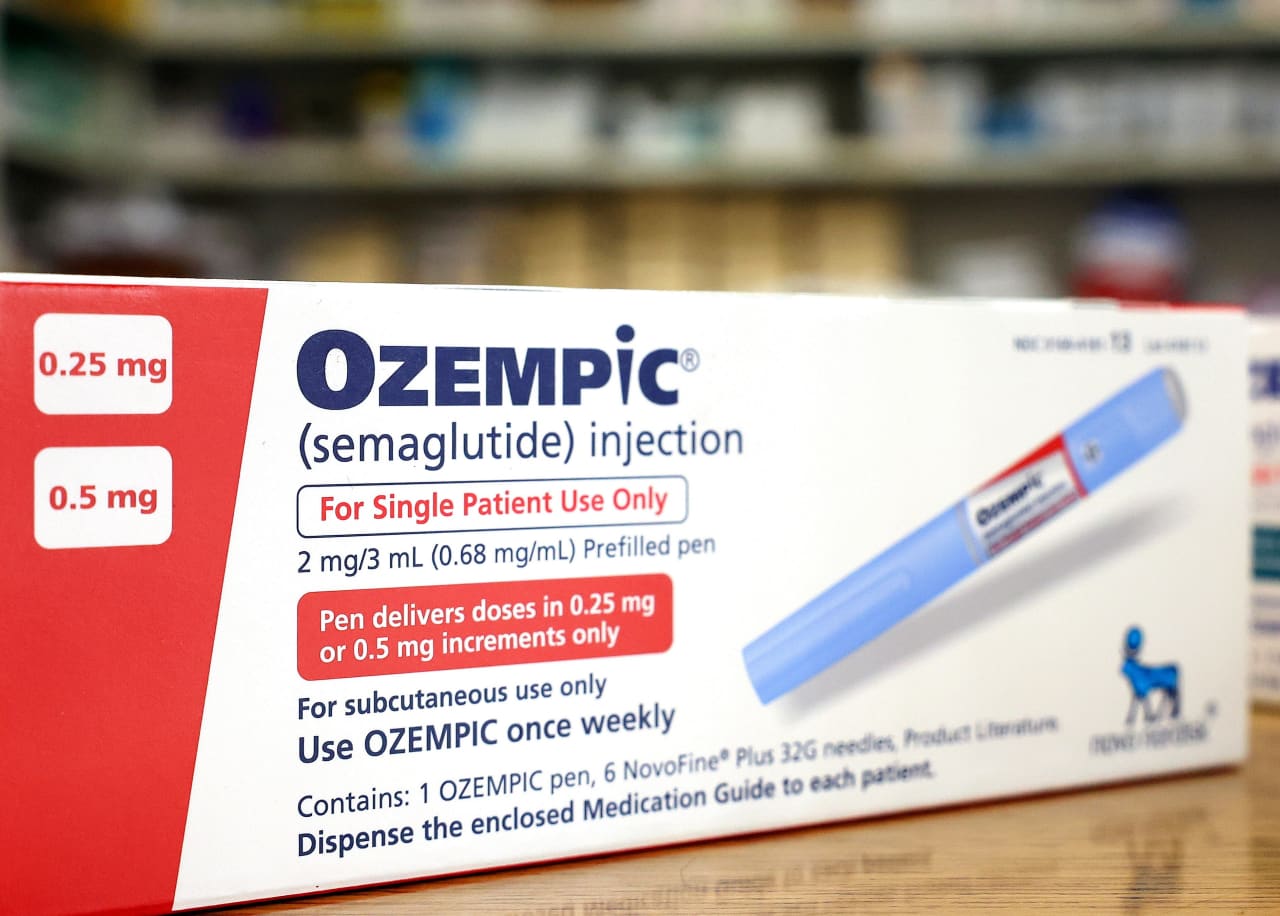

URGENT UPDATE: UBS has officially downgraded its rating for Novo Nordisk, the renowned Danish pharmaceutical company behind the blockbuster weight-loss drugs Ozempic and Wegovy. This significant shift was announced on October 3, 2023, due to increasing competition from compounding pharmacies and rival Eli Lilly.

The brokerage warns that compounding is becoming a persistent threat to Novo Nordisk’s market dominance. As compounding pharmacies gain traction, they could offer alternatives to Ozempic and Wegovy, potentially disrupting sales and impacting Novo Nordisk’s profitability. This news comes as consumers seek more affordable options for weight management, making it crucial for investors and stakeholders to understand the evolving landscape.

UBS’s decision reflects a broader trend in the pharmaceutical industry, where competition is intensifying. Investors are urged to reconsider their positions with Novo Nordisk, as the challenging market dynamics could hinder the company’s growth prospects.

The implications of this downgrade are immediate. Shareholders are likely to react swiftly, and potential investors may reassess their strategies in light of this new information. With health-conscious consumers increasingly turning to various treatment options, the pressure is mounting for Novo Nordisk to innovate and maintain its edge in the market.

Looking ahead, all eyes will be on Novo Nordisk as it navigates this turbulent period. Industry analysts will closely monitor the company’s responses and any strategic moves to bolster its competitive position against compounding rivals and Eli Lilly.

In a statement, UBS emphasized the urgency of this situation, stating, “

The compounding threat is here to stay, and investors must be prepared for a shifting landscape.

”

Stay tuned for further developments as Novo Nordisk’s response to this challenge unfolds.