As the retail landscape evolves, both Amazon and Walmart are strategically positioning themselves to dominate the next phase of commerce in 2026 by focusing on monetization layers that extend beyond traditional sales. These layers encompass advertising, data utilization, artificial intelligence (AI) services, subscriptions, and media distribution. Their aim is to not only drive growth but also to gain control over demand and the economics of transactions, regardless of whether they directly fulfill those transactions.

Despite their similar aspirations, the two giants are charting distinct paths. Walmart capitalizes on its physical store presence, monetizing proximity to consumers, while Amazon leverages its digital presence to monetize visibility. These differing approaches will influence their future expansions; Walmart is poised to transform its stores into experiential hubs that merge shopping with media, whereas Amazon is better positioned to integrate commerce into various digital experiences seamlessly.

Strategic Moves Ahead of 2026

Recent announcements underscore the preparations both companies are making for the upcoming year. On December 17, 2025, Amazon revealed a significant reorganization of its senior leadership in artificial general intelligence (AGI). This restructuring consolidates its AI initiatives under the leadership of Peter DeSantis, highlighting a renewed focus on integrating AI across its operations, including retail and advertising. Following a recent AWS re:Invent event, analysts from Bank of America expressed optimism about Amazon’s evolving AI strategy, anticipating a future where AI becomes a core component of the retail experience.

Amazon’s commitment to AI is evident as it aims to redefine how AI is utilized, not only for product discovery and advertising but also for enhancing customer engagement. According to a report from PYMNTS Intelligence, during Black Friday, 42% of shoppers utilized AI assistants to find discounts, while 31% used them to compare products. This data reflects a growing trend where conversational interfaces serve as new avenues for commerce, merging content discovery with purchasing processes.

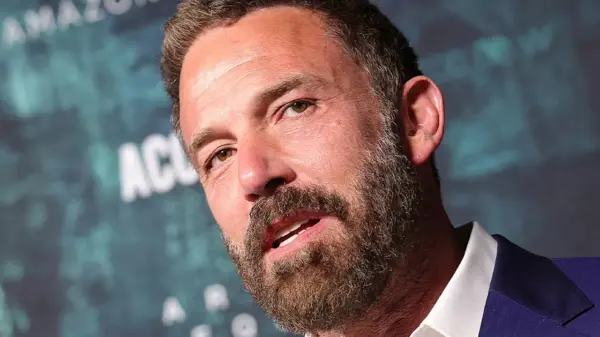

In an additional announcement on December 16, 2025, Amazon launched an Instagram experience on Fire TV, further illustrating its strategy to create engaging content surfaces that capture consumer attention. Aidan Marcuss, vice president of Fire TV, stated, “Our mission is to get you to the world’s best content fast, and we’re thrilled to welcome Instagram to Fire TV.” This partnership highlights Amazon’s intent to monetize every interface where consumer attention converges, from smart TVs to voice assistants.

Walmart’s Competitive Edge in Retail Media

On the other hand, Walmart has reported noteworthy growth in its retail media business, with a remarkable 33% increase in the U.S. segment year-over-year. This growth significantly outpaces the company’s overall revenue increase, underscoring the rising significance of retail media and membership fees, which now contribute approximately one-third of Walmart’s operating income.

Walmart Connect’s advertising sector has experienced growth rates of 33% domestically and 53% globally, including partnerships with companies like Vizio. This performance is particularly striking given the current environment of cautious consumer spending and scrutiny over brand budgets. The success of Walmart’s retail media initiatives emphasizes the structural advantage of leveraging first-party data derived from physical shopping behaviors at a national scale.

Walmart’s strategy reflects a deeper understanding of consumer intent, moving beyond traditional transaction-based models. The company is developing a layered ecosystem where commerce serves as the foundation, with monetization increasingly occurring above it. This evolution mirrors Amazon’s trajectory over the past decade, suggesting that Walmart envisions a future in retail where the economic landscape resembles platforms more than traditional retail stores.

As both Amazon and Walmart strategize for 2026, their focus on monetization layers signifies a shift towards ecosystem control in the retail sector, with implications for how consumer behavior, AI advancements, and advertising will shape the future of commerce.