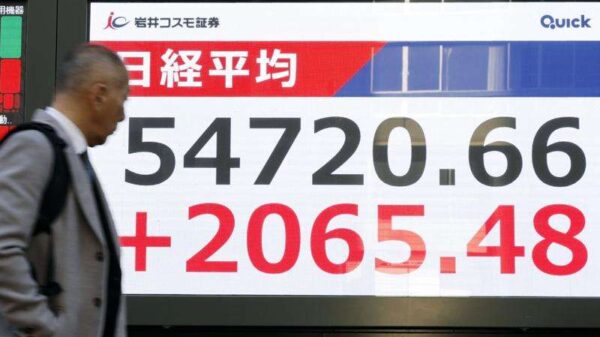

Alibaba Group Holding Limited (NYSE:BABA) saw its stock price rise by 4.02% to $152.47 during premarket trading on Friday. This increase is attributed to a wave of investor optimism surrounding Chinese technology stocks, particularly driven by advancements in artificial intelligence (AI) and supportive government initiatives.

The positive sentiment was further bolstered by news from Baidu, Inc. (NASDAQ:BIDU), which announced plans to spin off its AI chip unit, Kunlunxin, and separately list it on the Hong Kong Stock Exchange. This move is expected to enhance Kunlunxin’s value as a standalone public entity, appealing to investors focused on AI chip technology.

Baidu’s initiative aligns with the broader context of U.S.–China tensions over semiconductor technology. These geopolitical strains have resulted in restrictions from Washington and Beijing that limit China’s access to advanced AI chips manufactured by companies such as Nvidia Corp (NASDAQ:NVDA). In response, Chinese policymakers are actively promoting domestic chip adoption and have allocated billions of dollars to boost local semiconductor development.

According to a report by CNBC, Kunlunxin is anticipated to collaborate with domestic firms like Huawei, Cambricon, and Alibaba to create a more robust homegrown AI computing ecosystem. This initiative highlights the ongoing push within China to strengthen its technological self-sufficiency.

Strength in AI and Cloud Services

Over the past year, Alibaba’s stock has surged by 73%, largely due to its strategic investments and growth in AI capabilities. Its cloud division, Alibaba Cloud, has experienced triple-digit growth in AI-related revenue, driven by increased spending on AI and the introduction of new models such as Qwen3-Max.

Analysts from Nomura have noted that Alibaba is well-positioned to leverage the rapid acceleration of AI usage across China. They point to the company’s strong innovation track record, expanding software adoption, and the supportive policy environment for developing a domestic AI ecosystem, despite challenges in accessing advanced chips.

Alibaba’s efforts to scale its Qwen AI models across various consumer applications, cloud services, and hardware are likely to enhance user engagement and support further growth in its cloud segment. In a notable collaboration, Meta Platforms Inc. (NASDAQ:META) has adopted Alibaba’s Qwen models, which could deepen engagement and drive cloud revenue.

As the Chinese technology landscape evolves, Alibaba’s strategic focus on AI and cloud services positions it favorably for sustained growth. The company’s proactive measures in response to shifting geopolitical dynamics underline its commitment to leading the charge in AI innovation within China.

In summary, Alibaba’s recent stock performance reflects a broader trend of optimism in the Chinese tech sector, fueled by advancements in AI and supportive government initiatives that aim to strengthen domestic capabilities in semiconductor technology.