Prostatis Group LLC has significantly increased its holdings in the Invesco S&P SmallCap Momentum ETF (NYSEARCA:XSMO), raising its stake by 22.3% during the third quarter of 2023. According to a recent filing with the U.S. Securities and Exchange Commission (SEC), the institutional investor now owns 66,525 shares following the purchase of 12,149 additional shares during this period. This investment constitutes approximately 1.2% of Prostatis Group’s total holdings, making it the company’s 18th largest position.

As of the latest SEC filing, Prostatis Group’s ownership in the Invesco S&P SmallCap Momentum ETF is valued at approximately $4.89 million, which represents around 0.24% of the ETF’s total assets. The recent increase in shares reflects a broader trend among institutional investors, with several hedge funds also adjusting their positions in the ETF.

Other Institutional Investors Adjust Holdings

Several other notable investors have recently modified their stakes in the Invesco S&P SmallCap Momentum ETF. Osaic Holdings Inc. increased its holdings by 8.4% during the second quarter, now owning 1,750,582 shares valued at $119.08 million after acquiring an additional 135,949 shares.

Similarly, Envestnet Asset Management Inc. raised its stake by 4.1% during the same quarter, bringing its total to 1,580,283 shares worth $107.49 million after purchasing an extra 62,900 shares. Cetera Investment Advisers also made a notable increase, lifting its position by 8.8% to hold 1,278,102 shares valued at $86.94 million.

In a significant move, Raymond James Financial Inc. grew its position by 154.4%, now owning 1,033,548 shares worth $70.30 million following an acquisition of 627,318 shares. Additionally, Gratus Wealth Advisors LLC increased its stake by 2.0% in the third quarter, holding 486,777 shares valued at $35.81 million.

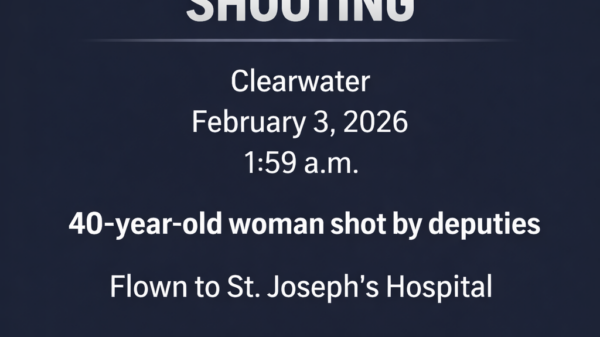

Current Market Performance of XSMO

As of the latest trading data, the Invesco S&P SmallCap Momentum ETF opened at $76.20. The ETF has experienced a 12-month low of $53.89 and a high of $79.18. Its 50-day moving average stands at $74.64, while the 200-day moving average is $72.65. The ETF currently boasts a market capitalization of $2.22 billion, a price-to-earnings (P/E) ratio of 19.29, and a beta of 1.07, indicating moderate volatility compared to the broader market.

The Invesco S&P SmallCap Momentum ETF, which launched on March 3, 2005, aims to track the performance of the S&P SmallCap 600 Momentum Index. This index consists of U.S. small-cap stocks selected based on their momentum characteristics, and holdings are weighted according to both market capitalization and momentum metrics.

As the market evolves, institutional investors like Prostatis Group LLC continue to play a vital role in shaping the dynamics of exchange-traded funds, reflecting confidence in small-cap momentum strategies.