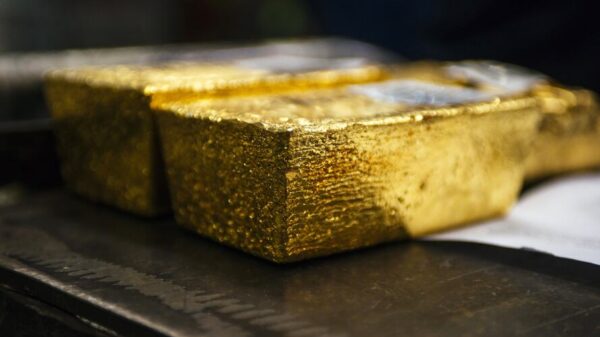

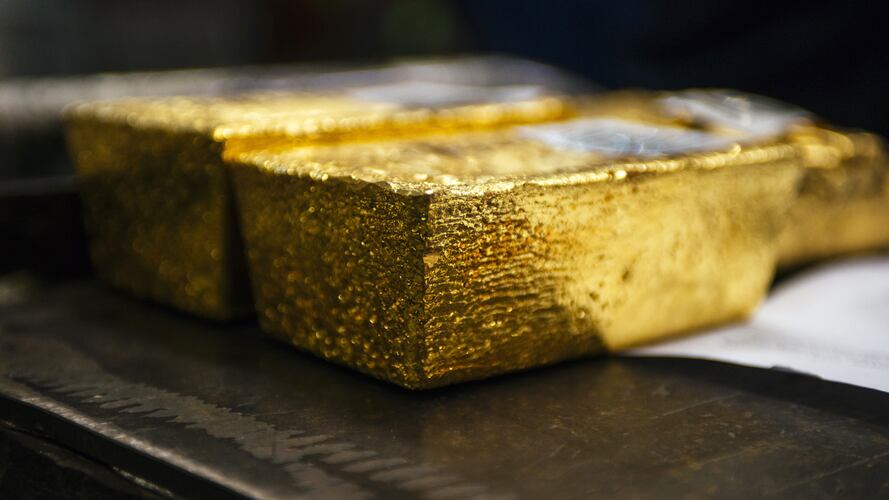

URGENT UPDATE: Gold prices have skyrocketed by 65.2% in 2025, raising critical questions for investors about whether now is the right time to buy. With gold outperforming US stocks significantly over the last three years, the precious metal has surged 168.2%, and analysts are buzzing about the implications for the market.

As of now, gold has maintained an average annual return of 11.0% over the last 26 years, outperforming the Vanguard Total Stock Market Index (VTSMX), which delivered an 8.1% return, including dividends. This performance puts gold in a favorable light, especially considering that the SPDR Gold Shares ETF (GLD) has returned 10.92% annually since its inception in November 2004.

Gold enthusiasts attribute this remarkable rise to a combination of factors, including high inflation and unprecedented US government debt levels. Experts warn that continued spending deficits could trigger hyperinflation, leading to a potential collapse of the dollar and the banking system.

However, historical context is vital. While gold has proven to be a hedge against inflation, it has also faced challenges. For instance, Japan has maintained substantial deficits without experiencing the predicted inflation. As a result, some analysts caution that gold’s rapid rise may not be sustainable.

Despite this volatility, gold remains an asset that diversifies investment portfolios and has minimal default risk. Yet, seasoned investors advise caution. A notable investor reflected on their own experience, revealing a “million-dollar mistake” made in the 1980s after buying gold during a significant price drop, which ultimately yielded disappointing long-term returns.

Historically, gold’s performance has fluctuated, often matching inflation rates rather than exceeding them. The current market conditions have introduced digital competitors like Bitcoin, which some argue could outperform gold due to its fixed supply of 21 million coins and ease of transferability. Bitcoin’s downturn contrasts sharply with gold’s recent success, emphasizing the need for investors to tread carefully.

For those considering gold as an investment, experts recommend allocating no more than 2-3% of their portfolio to this asset. It’s crucial to recognize that gold is currently close to its historical inflation-adjusted peak, which could mean a higher risk of price decline in the near term.

In conclusion, as gold continues to captivate investors with its impressive returns, the question remains: Is it the right time to invest? While its performance has been strong, the market’s volatility and competition from cryptocurrencies suggest that potential buyers should proceed with caution. The investment world is watching closely as developments unfold in this rapidly changing landscape.

Stay tuned for updates as this story develops, and consider the implications of the gold market on your investment strategy.