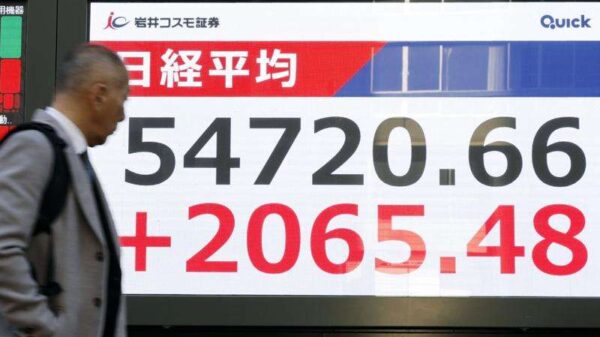

URGENT UPDATE: The Danish central bank has just confirmed it will not intervene in the foreign exchange market, despite the weakened Danish Krone (DKK) against the Euro (EUR). This decision signals that the current interest rate spread is likely to remain unchanged, raising concerns for investors.

The Krone is currently trading at approximately 7.456 against the Euro, reflecting a slight appreciation since its peak in mid-January. However, analysts from Nordea suggest that the longest period without intervention since the Euro’s introduction continues, as the central bank remains cautious amidst potential seasonal weakening due to upcoming dividend payments.

This decision is critical as it indicates the bank’s strategy to maintain stability in the face of fluctuating currency values. “The record-long period without intervention is still ongoing,” said a Nordea analyst, emphasizing the risks tied to the DKK’s performance against the Euro. As the Krone edges closer to previous intervention levels, the likelihood of a rate hike by Denmark’s central bank increases, which would widen the DESTR-€STR spread.

Investors and market watchers are advised to keep a close eye on upcoming economic indicators as the Danish central bank navigates this challenging landscape. The absence of intervention could lead to significant shifts in the currency market, impacting both local and international investors.

Authorities will continue to monitor the situation closely, especially as dividend payments are expected to rise in the coming months. As this situation develops, more updates are anticipated, and the implications for the DKK and Euro exchange rate could be profound.

Stay tuned for more breaking news on this developing story.