UPDATE: Coinbase has just announced a major expansion into prediction markets with the acquisition of The Clearing Company, marking a decisive shift in its strategy. This move, which is expected to close in January 2025, positions Coinbase to enhance its multi-asset trading capabilities and compete with established players in the rapidly evolving market.

This acquisition represents Coinbase’s tenth purchase in 2025, underscoring its commitment to diversifying beyond the volatile cryptocurrency trading sector. While the financial terms of the deal remain undisclosed, experts believe it will equip Coinbase with essential infrastructure to support event-based trading. The timing is critical as interest in prediction markets has surged, especially following the 2024 US presidential election, drawing attention from retail investors eager for new opportunities.

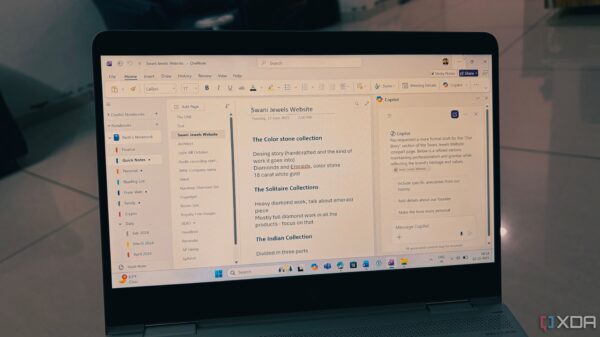

Coinbase’s recent launch of its own prediction markets platform reflects its ambition to expand into stock trading, putting it in direct competition with firms like Robinhood and Interactive Brokers. According to analysts at J.P. Morgan, this strategic pivot aims to foster more consistent customer engagement, reducing Coinbase’s exposure to the unpredictable nature of cryptocurrency trading.

However, this ambitious expansion comes amidst significant regulatory challenges. Coinbase is currently embroiled in legal disputes with state regulators in Connecticut, Illinois, and Michigan, seeking to clarify that its prediction market products fall under the jurisdiction of the Commodity Futures Trading Commission (CFTC). The company argues that state enforcement actions threaten its growth plans in this emerging sector.

The acquisition of The Clearing Company not only enhances Coinbase’s product offerings but also aims to solidify its control over execution, settlement, and compliance in prediction markets. With over 100 million registered users globally and approximately 11 million monthly active customers, success in this arena could position Coinbase as a formidable competitor against established names like Kalshi.

As tensions rise within the industry, Coinbase is betting on prediction markets as the next significant market disruption. The company hopes that its strategic infrastructure investment will allow it to navigate the complex regulatory landscape while capturing a leading position in this burgeoning market.

Stay tuned for further updates as this story develops and the implications of Coinbase’s expansion unfold.