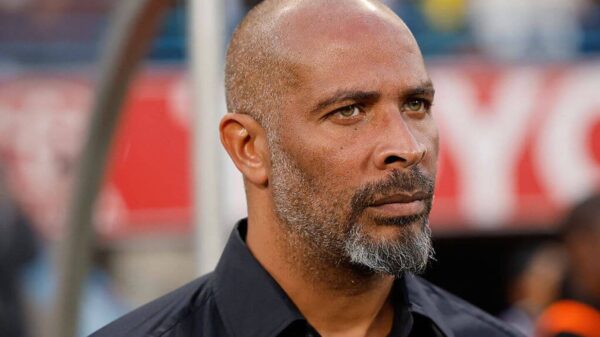

Federal Reserve Governor Michael Barr has raised alarms regarding the GENIUS Act, highlighting critical vulnerabilities in stablecoin regulation during a recent address at DC Fintech Week. He emphasized the need for stronger guardrails and consumer protections to ensure the safety and reliability of stablecoins as payment instruments.

In his speech, delivered on October 12, 2023, Barr pointed out that while the GENIUS Act establishes a foundational regulatory framework for digital assets, it requires further refinement. He stated, “Regulators have a lot of work to do to implement the act,” underscoring that both federal and state regulators must enhance oversight to fill existing gaps. According to Barr, this includes stricter controls over reserve assets, capital and liquidity requirements, and consumer safeguards.

The GENIUS Act, signed into law by President Donald Trump in July 2023, allows federally insured depository institutions to issue payment stablecoins under the supervision of their primary federal regulators. Nonbank entities can also enter the market, but they must receive approval from the Federal Reserve and meet specific standards related to reserves, redemption, and risk management.

Barr flagged potential weaknesses in the act, particularly concerning the types of reserves that can back stablecoins. He expressed concern about the use of uninsured deposits and foreign government-authorized currencies, including cryptocurrencies, as backing assets. He warned that significant drops in cryptocurrency values could jeopardize the one-to-one backing of stablecoin liabilities.

Moreover, Barr pointed to the risks associated with allowing stablecoin issuers linked to banks to engage in various activities without adhering to standard capital requirements. This situation could endanger both the banks involved and the broader financial system. “Appropriate capital requirements are another area where coordination among federal and state regulators is key,” he noted, suggesting that the GENIUS Act’s framework could help ensure state regulations align closely with federal standards.

The act also presents challenges in consumer protection, as it fails to clearly define what constitutes a stablecoin. Barr remarked that this lack of clarity means the act does not impose the fraud protections typically expected of traditional payment methods. He articulated the potential of stablecoins to enhance payment system efficiency, especially in cross-border transactions, while asserting that without adequate regulatory measures, these benefits remain unfulfilled.

Regulatory developments following the GENIUS Act will unfold over the next three years, during which time both federal and state authorities will establish rules for banks and determine the future role of nonbank issuers in the stablecoin landscape. The Federal Reserve will play a crucial role in shaping this regulatory framework, as the act maintains the status quo for master account access for nonbank payment stablecoins, avoiding an outright ban on their participation.

As discussions continue, the focus remains on creating a comprehensive set of rules that not only protect consumers but also mitigate risks to the financial system as a whole. The path forward will require significant collaboration among regulatory bodies to ensure that stablecoins can operate securely and effectively within the broader financial ecosystem.