The effort to establish comprehensive cryptocurrency regulations in the United States is encountering significant obstacles due to the absence of a confirmed chairman for the Commodity Futures Trading Commission (CFTC). This delay threatens to stall the implementation of the CLARITY Act, a key legislative initiative aimed at solidifying the U.S. position as the “crypto capital of the world,” a promise made by Donald Trump during his presidency.

While the GENIUS Act has gained traction, the CLARITY Act has faced hurdles since its bipartisan approval in the House in July 2023, with a vote tally of 294-134. A competing framework, the Responsible Financial Innovation Act (RFIA), has emerged, emphasizing oversight by the Securities and Exchange Commission (SEC), which complicates the regulatory landscape further.

The primary issue for the CLARITY Act is the ongoing search for a Senate-confirmed CFTC chairman. Until this position is filled, the agency is limited in its capacity to enforce new regulations. Currently, Brian Quintenz, Trump’s nominee for the CFTC chair, faces opposition from influential figures in the cryptocurrency sector, which has hindered his confirmation process.

The urgency for Senate committees to pass the CLARITY Act is amplified by concerns that political dynamics may shift after upcoming elections, potentially complicating future legislative efforts. A delay until 2026 could significantly impact the chances of passing a comprehensive crypto markets bill.

The crypto industry operates on a global scale, making regulatory coherence vital. Investors, institutions, and exchanges often seek to establish operations in jurisdictions with clearer regulations. The uncertainty in the U.S. regulatory framework places domestic crypto issuers at a disadvantage, especially as regions like the European Union move forward with their own regulatory frameworks.

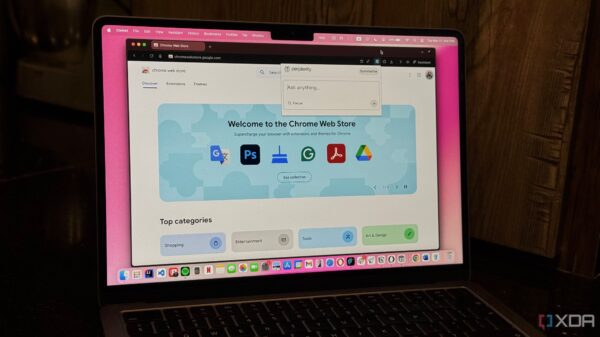

The Markets in Crypto-Assets Act (MiCA) in the EU has set a precedent by providing a clear legal framework for the crypto sector. This legislation focuses on defining the responsibilities of crypto asset issuers, a crucial aspect that remains ambiguous within U.S. regulations. MiCA categorizes crypto assets into three groups: e-money tokens, asset-referenced tokens, and other crypto assets, and outlines specific requirements for each category.

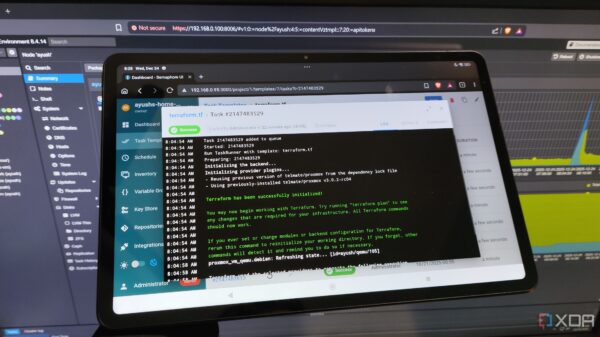

In the U.S., the SEC has often relied on the Howey Test to classify various tokens as securities, but legislative clarity is beginning to take shape with the proposed CLARITY Act. This act introduces the idea of a “mature blockchain,” suggesting that once certain conditions regarding control, value, and ownership are met, an asset may no longer be tied to a specific issuer.

As negotiations in the Senate proceed, both the agriculture and banking committees are working against a September deadline set by key officials, including the White House’s AI and Crypto Czar, David Sacks. The urgency to finalize the CLARITY Act before the end of the year is palpable, with stakeholders eager to avoid any delays that could push discussions into a more politically charged environment post-election.

Industry sentiment largely supports Quintenz for the CFTC chair position, with seven D.C.-based crypto associations expressing their backing in a letter to President Trump in late August, urging his swift confirmation. Yet, reports indicate that the White House is considering other candidates, which adds another layer of uncertainty to the situation.

Last Friday, a group of Democratic senators proposed a framework for market structure that would require bipartisan representation on the SEC and CFTC to ensure a quorum for digital asset rulemaking. This proposal highlights the ongoing tension surrounding regulatory appointments and the broader implications of political maneuvering within independent regulatory agencies.

As the U.S. grapples with defining its approach to cryptocurrency regulation, it is clear that the absence of a confirmed CFTC chairman is a significant barrier to progress. Without decisive leadership, the implementation of the CLARITY Act may continue to falter, leaving the future of cryptocurrency regulation in the country uncertain.