FuelCell Energy (FCEL), a clean energy company based in Danbury, Connecticut, reported its fiscal fourth-quarter earnings on December 18, 2023. The results exceeded analysts’ expectations, leading to a significant 22% intraday increase in the stock price. The company highlighted robust prospects driven by growing demand from data centers, which are increasingly requiring sustainable and efficient power solutions.

The surge in energy consumption from data centers has prompted FuelCell to focus its sales and marketing efforts on engaging with data center operators and financing providers. The company aims to position itself as a key player in powering these energy-intensive applications. As demand for artificial intelligence and related technologies rises, FuelCell anticipates scaling production, paving a path toward profitability. The company believes that achieving an annualized production rate of 100 megawatts could lead to positive adjusted EBITDA.

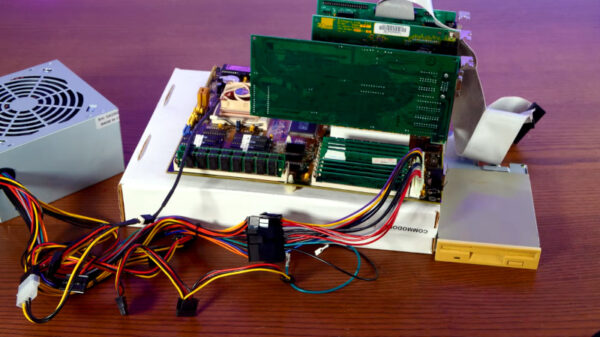

Founded in 1969, FuelCell Energy specializes in developing stationary fuel cell platforms that provide sustainable, efficient power generation. Its systems utilize molten carbonate technology to produce ultra-clean electricity with minimal emissions. The versatile platforms also facilitate carbon capture and sequestration, hydrogen production, and long-duration energy storage tailored for utilities, industries, and municipalities.

With a current market capitalization of $269.34 million, FuelCell’s stock has experienced volatility amid broader market conditions. Compounding these challenges are recent changes in tax legislation, known as the One Big Beautiful Bill Act (OBBBA), which significantly reduces the clean hydrogen production credit established under the Inflation Reduction Act (IRA). To maintain eligibility, facilities must begin construction by January 1, 2028.

Over the past 52 weeks, FuelCell’s stock has seen a decline of 10.6%, although it has rebounded by 37.17% in the last six months. At its peak, the stock reached a 52-week high of $13.98 in January but has since dropped 40% from that level. The stock also touched a low of $3.58 in May, reflecting a sharp recovery of 133% since then.

When analyzing FuelCell’s financial performance, the company reported quarterly revenue of $55.02 million, a 12% year-over-year increase. This figure surpassed Wall Street’s expectations of $43.96 million. The growth was primarily driven by an 18% increase in product revenue to $30.03 million, largely due to a significant contract worth $30 million with Gyeonggi Green Energy Co., Ltd. This contract pertains to supplying and activating 10 fuel cell units for GGE’s 58.8 MW power facility in Hwaseong-si, South Korea.

FuelCell has streamlined its product offerings and improved operational efficiency, which is crucial for managing thermal loads in high-compute environments. The company has also reported a reduction in its adjusted EBITDA loss, which decreased by 30% year-over-year to $17.68 million. Additionally, its adjusted net loss per share for Q4 was $0.83, down 55% from the previous year’s loss of $1.85 per share, and lower than the anticipated loss of $1.03 per share.

FuelCell announced proactive measures to strengthen its balance sheet and enhance liquidity. As of October 31, the company reported $278.10 million in unrestricted cash and cash equivalents, along with a total backlog of $1.19 billion, which is $30.41 million higher than the previous year.

Analysts on Wall Street have mixed views regarding FuelCell Energy’s financial trajectory. For fiscal year 2026, analysts forecast a reduction in the company’s loss per share by 29.3% year-over-year to $3.12, followed by a projected increase in losses to $4.45 per share in fiscal year 2027. Following the Q4 earnings report, analysts have largely maintained their existing ratings for FuelCell stock. Experts at Canaccord Genuity reiterated their “Hold” rating, maintaining a price target of $12, while acknowledging FuelCell’s potential upside. They emphasized the necessity for the company to demonstrate tangible outcomes from its data center initiatives.

Additionally, TD Cowen analysts reaffirmed their “Hold” rating, adjusting their price target from $7 to $9. This suggests a cautious but slightly improving sentiment regarding the company’s prospects. Currently, the consensus rating on FuelCell’s stock is a “Hold,” with one analyst recommending a “Strong Buy,” six opting for “Hold,” and two advising a “Strong Sell.” The consensus price target stands at $7.84, indicating a potential downside of 6% from current levels. However, the Street-high price target of $12 from Canaccord Genuity suggests a considerable upside of 43.9%.

The ongoing demand for sustainable energy solutions, particularly from data centers, is likely to support FuelCell Energy’s operations. Despite the company’s current losses, successfully scaling its operations could lead to profitability in the future. Investors may want to monitor the stock closely as the situation develops.