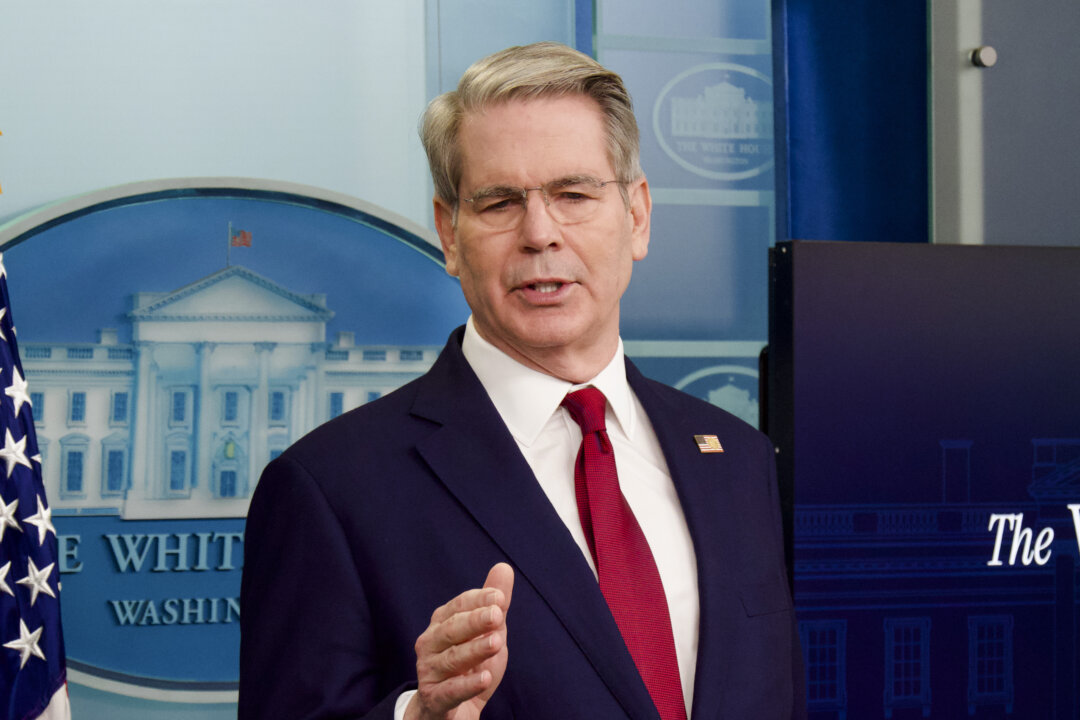

On September 5, 2023, Treasury Secretary Scott Bessent intensified his critique of the Federal Reserve, alleging that its current policies resemble risky “gain-of-function” monetary experiments. In a recent op-ed published in the Wall Street Journal and further elaborated in an essay and interview for The International Economy, Bessent expressed concerns that these practices distort financial markets, disproportionately benefit asset holders, and compromise the central bank’s independence.

Bessent’s remarks highlight a growing unease regarding the Federal Reserve’s approach to monetary policy. He argued that the institution should relinquish its supervisory authority over banks and significantly reduce its reliance on unconventional monetary tools. Instead, he advocates for a return to a more focused mandate that emphasizes interest rates and inflation control.

In his critique, Bessent calls for “an honest, independent, nonpartisan review” of the Federal Reserve’s entire structure. This review would encompass various aspects of the institution, including its monetary policy strategies, regulatory practices, communication methods, staffing, and research initiatives. He believes that such a comprehensive evaluation is essential to restore credibility and effectiveness to the central bank.

The call for reform comes at a time when the Federal Reserve faces scrutiny over its handling of inflation and economic stability. Many observers have noted that the central bank’s policies, particularly its quantitative easing measures, have led to significant increases in asset prices, benefiting those already wealthy while leaving broader economic disparities unaddressed.

Bessent’s position resonates with a growing faction of policymakers and economists who argue for a reexamination of the Federal Reserve’s role in the economy. He emphasized the need for a shift in focus back to traditional monetary policy tools, which he believes would enhance the institution’s credibility and effectiveness in managing economic challenges.

As discussions about the future of the Federal Reserve unfold, Bessent’s proposals may serve as a catalyst for deeper examinations of how monetary policy impacts both financial markets and the broader economy. His calls for reform reflect a significant moment in the ongoing dialogue about the balance of power and responsibility within the United States’ central banking system.