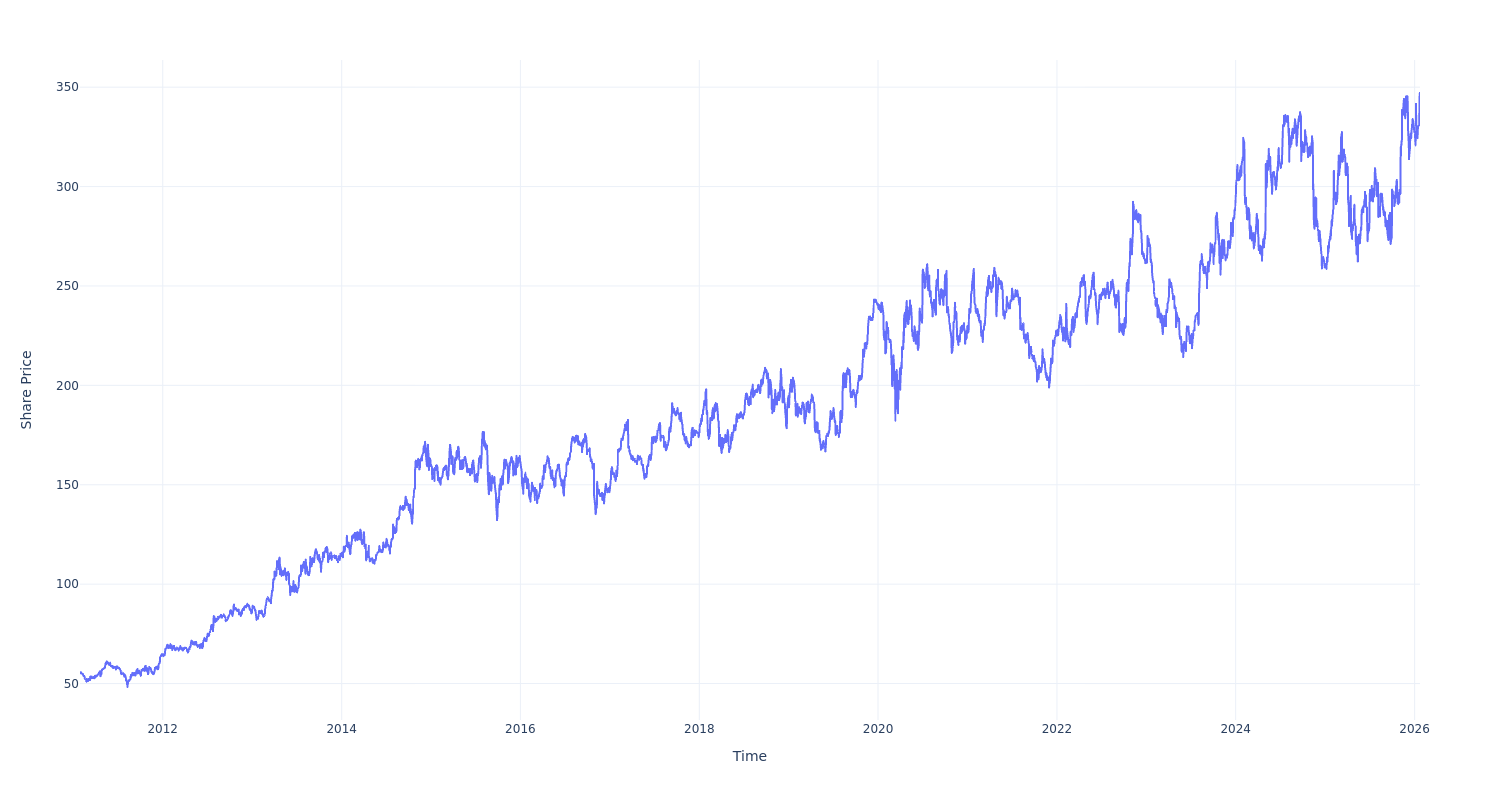

Amgen (NASDAQ:AMGN) has demonstrated notable performance over the past 15 years, surpassing market averages with an annualized return of **13.01%**. The company’s market capitalization currently stands at **$185.54 billion**, indicating its significant presence in the biotechnology sector.

Investors who purchased **$100** worth of Amgen stock 15 years ago would see their investment grow to approximately **$623.53** today, assuming a current stock price of **$344.63**. This impressive increase showcases the power of compounded returns over time.

Understanding Compounded Returns

The remarkable growth of Amgen’s stock highlights the importance of long-term investment strategies. Compounding allows investments to generate earnings not just on the initial capital but also on the accumulated earnings from previous periods. Thus, even modest annual returns can lead to substantial gains over time.

By focusing on a 15-year investment horizon, Amgen exemplifies how biotechnology companies can yield impressive returns, particularly as they innovate and expand their product lines. As the demand for advanced biopharmaceuticals continues to rise, companies like Amgen stand to benefit significantly.

Market Context and Implications

The biotechnology sector has experienced considerable volatility, yet Amgen’s performance underscores its resilience. As the market evolves, investors may look to similar companies that demonstrate consistent growth and strong fundamentals.

While past performance does not guarantee future results, the data suggests that long-term investment in biotech stocks can be rewarding. Investors should consider the potential of compounding when evaluating their portfolios, especially in sectors poised for growth.

This analysis was provided by Benzinga’s automated content engine and has been reviewed by an editor. It is important to note that Benzinga does not provide investment advice.