Homeowners on Chicago’s West and South sides are facing significant property tax increases, driven by rising property assessments. This shift poses a challenge to residents and developers who have invested in these communities. According to an analysis by the Illinois Answers Project and the Chicago Tribune, many homeowners could see their tax bills rise substantially due to reassessments that reflect an upswing in property values.

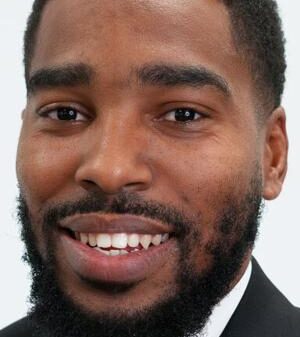

Leodus Thomas Jr., a developer who purchased his home in the Austin neighborhood for $135,000 in 2016, reported an increase in his property’s assessed value from $163,000 two years ago to approximately $260,000 this year. This surge translates to an estimated $700 increase in his annual tax bill. Thomas expressed concern that these escalating costs would inhibit his ability to further invest in affordable housing developments, stating, “Coming from the top, they want affordable housing in the city. But that’s almost impossible with how we’re being taxed.”

The situation is far from isolated. Over 37,000 residential properties on the South and West sides have seen their tax assessments double from 2023 to 2024. In neighborhoods such as Englewood and Roseland, median home values surged between 119% and 160%, significantly outpacing the citywide average increase of 22% during the same period. Mayor Brandon Johnson, who resides close to Thomas, experienced a 35% increase in his home’s assessment.

These sharp increases could leave many residents struggling to manage their tax bills this autumn. Even though property values have risen, homeowners in these lower-income areas often lack the financial flexibility to capitalize on the increased equity or to relocate to more expensive neighborhoods. A recent study highlighted that residents in the city’s economically disadvantaged neighborhoods are less likely to appeal their property assessments, which could help mitigate some tax burdens.

In contrast, wealthier neighborhoods have seen less dramatic increases. For instance, the Gold Coast experienced only a 3% hike in assessments. The disparity reflects broader economic trends, with some of the city’s most affluent areas benefitting from a slower rate of increase in property taxes compared to struggling neighborhoods.

As Chicago grapples with fiscal challenges, including funding for Chicago Public Schools and other local services, residents are increasingly concerned about how rising taxes will affect their ability to maintain long-term residency in their homes. Scott Smith, chief of staff to Cook County Assessor Fritz Kaegi, acknowledged that properties receiving above-average assessment increases are at a higher risk of seeing their tax bills rise significantly. “Generally speaking, if you are seeing above-average increases in assessments, that is where there is a risk of bigger tax bill increases,” Smith stated.

The recent assessment cycle has revealed dramatic shifts in property values, particularly in neighborhoods that have historically faced disinvestment. For example, homes in Englewood saw assessed values drop by 34% in 2021, with median tax bills falling from $1,308 to $677. However, in the current revaluation, home prices have rebounded sharply, often attributed to both local community efforts to revitalize properties and outside investment from speculators.

Investors are increasingly drawn to these neighborhoods, with many purchasing properties at prices that reflect a newfound interest in affordability. The Cook County Land Bank Authority has facilitated this trend by offering properties at below-market prices, prompting a wave of investment activity. Ri Prasad, a real estate agent operating in Englewood, noted that city-backed programs have helped attract buyers seeking affordable spaces, with some properties selling for over $449,000, far exceeding the neighborhood’s median sale price.

The implications of these assessment hikes extend beyond individual homeowners. Community organizations, such as the Lawndale Christian Development Corp, are working to ensure that development efforts prioritize the needs of local residents rather than speculative investments. Richard Townsell, executive director of the organization, expressed frustration that external investors often prioritize profit over community stability. “When you have outside investors, they don’t care. It’s just a number,” he said.

As the Cook County Assessor’s Office prepares to calculate and distribute tax bills later this year, many homeowners remain anxious about how the increased assessments will translate into actual tax liabilities. While assessment increases do not directly equate to doubled tax bills, the correlation remains clear: properties that experience valuation increases above the citywide median are likely to face higher taxes.

Kaegi’s office has emphasized the importance of outreach to help homeowners navigate the appeals process, but many residents, particularly in low-income areas, have not taken advantage of available resources. Despite efforts to educate homeowners about exemptions and appeals, many remain unaware of their rights or the potential for financial relief.

As Chicago moves forward, the community faces a critical juncture. With increasing property values signaling a potential shift toward gentrification, the balance between investment and affordability will be crucial. For homeowners like Thomas and many others, the stakes have never been higher as they seek to sustain their livelihoods in a rapidly changing market.