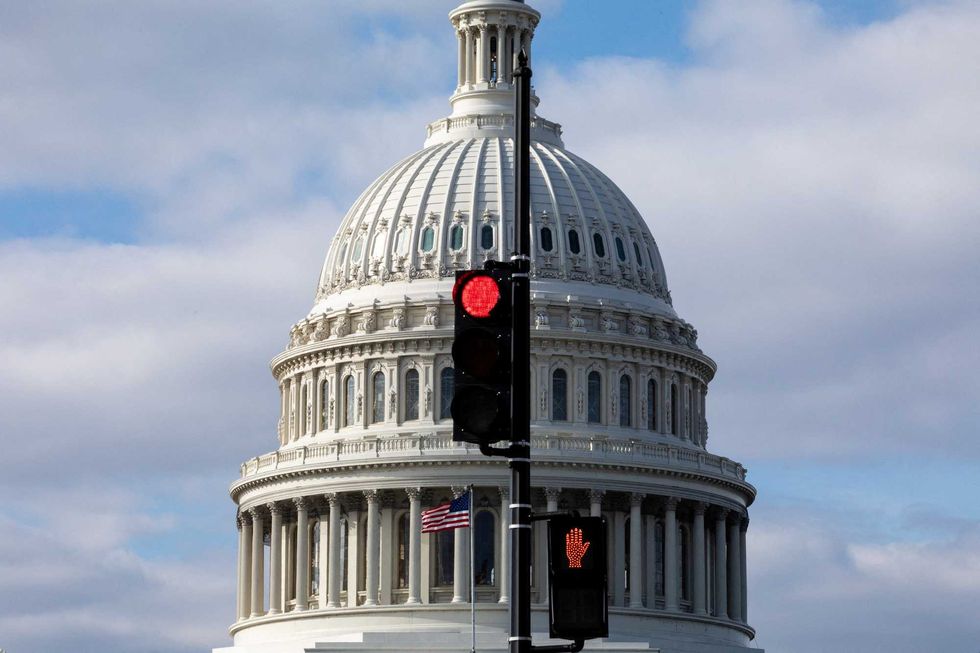

The deadline of December 15, 2025, for enrolling in Affordable Care Act (ACA) marketplace plans has passed without a resolution on federal subsidies, leaving millions of Americans facing significant increases in health care costs in 2026. Despite a final effort in the House of Representatives to extend these subsidies, Congress will adjourn for the year on December 19, heightening concerns for those who rely on financial assistance to afford their health insurance.

This situation is rooted in a long-standing debate regarding the role of government in health care. The ACA, enacted in 2010, aimed to address the increasing number of uninsured Americans, a figure that rose to approximately 49 million or 15 percent of the U.S. population prior to its passage. The ACA was designed to reduce this number by about 30 million people, yet as of now, around 26 million remain uninsured, primarily due to persistent political gridlock.

Historical Context of the Affordable Care Act

Before the ACA, many individuals lost their health insurance alongside job losses, particularly during economic downturns like the one experienced in 2008. The ACA significantly expanded health coverage by establishing marketplace subsidies and expanding Medicaid eligibility to low-income workers. However, Medicaid expansion has been contentious, with each state given the authority to decide its implementation. As of late 2025, 40 states and the District of Columbia have adopted this expansion, benefiting about 20 million Americans.

The ACA’s marketplace subsidies, which assist low and moderate-income individuals in purchasing health insurance, were initially less controversial. For example, individuals earning US$18,000 annually contributed only 2.1 percent of their plan costs. However, a legislative change in 2021 increased these subsidies to address financial strains from the COVID-19 pandemic, eliminating premiums for the lowest-income individuals and extending assistance to those above the previous income thresholds. These enhanced subsidies are now set to expire at the end of 2025, raising concerns about affordability.

Implications of Expiring Subsidies

With the expiration of COVID-19-era subsidies, many consumers will see a dramatic rise in health care costs. For instance, a person earning US$45,000 could see their monthly insurance payment jump by 74 percent, from approximately US$360 to over US$513. In addition, insurance premiums themselves are projected to rise by 18 percent in 2026. This combination could lead to a more than 100 percent increase in health insurance costs for many relying on ACA plans.

Some advocates for extending the subsidies argue that failing to do so could lead to 6 million to 7 million people leaving the ACA marketplace, with around 5 million potentially becoming uninsured by 2026. These concerns are compounded by recent cuts to Medicaid outlined in a tax and spending package signed into law by former President Donald Trump in July 2025. The Congressional Budget Office projects that these changes alone may result in more than 7 million individuals losing their insurance, leading to an overall increase in the uninsured population by as much as 16 million by 2034.

The debate surrounding ACA subsidies is particularly charged due to the increased financial burden on the federal government. Between 2021 and 2024, the number of individuals receiving subsidies doubled, greatly increasing federal expenditures while providing health insurance to millions. Critics of the subsidy extension argue that these costs are unsustainable and disproportionately benefit higher earners who do not require government assistance.

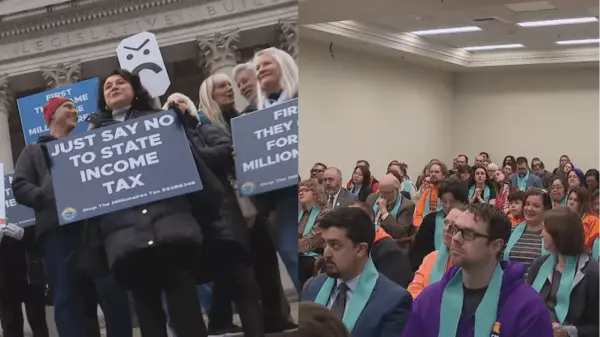

While federal policy plays a critical role in shaping health insurance coverage, state-level decisions also significantly impact the uninsured rate. For instance, in 2023, the uninsured rate varied widely across states, from approximately 3 percent in Massachusetts to 18.6 percent in Texas. Political leadership appears to correlate with insurance rates, as states governed by Republicans typically report higher uninsured figures compared to those under Democratic leadership.

Without a consensus on the fundamental issue of who should finance health care, the United States is likely to remain embroiled in this contentious debate for years to come. Solutions diverge sharply: those advocating for government responsibility favor expanding coverage funded through taxation, while proponents of individual responsibility push for market-driven reforms that emphasize competition among insurers and providers. The path forward remains uncertain as the country grapples with these critical health care challenges.