The manufacturing landscape in the United States has undergone significant transformation over the past few decades, with profound implications for the economy. According to the **Bureau of Labor Statistics**, employment in the manufacturing sector plummeted from over **19.5 million** jobs in **1979**—representing more than **20%** of the workforce—to approximately **12.8 million** by **2019**, accounting for just **8.5%** of the workforce. This decline reflects broader changes in the U.S. economy, which has shifted increasingly towards service-oriented sectors.

In **1979**, the U.S. population stood at **225 million**. By **2019**, that figure had risen to over **328 million**, marking an increase of more than **45%**. Despite this population growth, the share of individuals engaged in manufacturing has consistently decreased for nearly **40 years**. Both durable goods, such as heavy machinery, and nondurable goods, including textiles, have experienced similar declines in employment.

While manufacturing jobs have dwindled, employment opportunities in other sectors have surged. For instance, jobs in education and health services soared from **6.8 million** to **24.1 million** during the same period. The education sector even reported a trade surplus of **$50 billion** in **2023**. The professional and business services sector similarly expanded, nearly tripling its workforce from **7.3 million** to **21.3 million**.

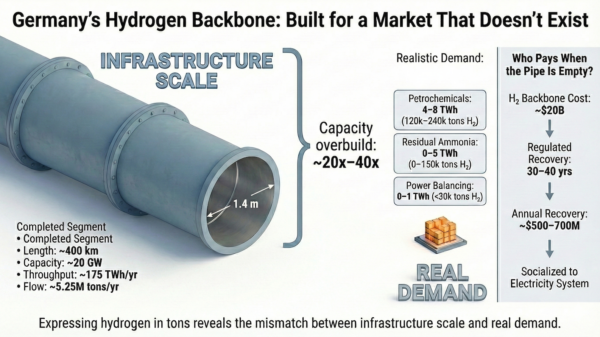

The shifting dynamics of the U.S. economy reflect a broader trend where opportunities arise in response to where capital flows. Countries unable to compete in service sectors have turned to different industries, often capitalizing on lower labor costs. Consequently, many forms of labor-intensive manufacturing are unlikely to return to the U.S.

Despite the overall decline, not all manufacturing sectors are faltering. The **aircraft industry**, for instance, reached a market size of **$219 billion** in **2023**, with continued growth anticipated. **Boeing** holds a significant share of this market, catering to both commercial and defense needs. Additionally, the pharmaceutical sector remains robust, with the U.S. producing **45%** of injectables and **22%** of solid oral medications.

Legislative efforts such as the **Inflation Reduction Act** and the **CHIPS and Science Act** have also aimed to bolster domestic manufacturing. However, experts like **Sheldon H. Jacobson**, a professor at the **University of Illinois at Urbana-Champaign**, argue that the term “manufacturing” is overly broad and can be misleading. He emphasizes that attempting to revive the manufacturing landscape of the **1970s** is both impractical and costly.

The challenge lies in identifying which sectors should be prioritized for growth. Labor-intensive industries, such as textiles and toys, are likely to remain overseas due to cost advantages. In contrast, the U.S. retains competitive potential in durable goods like transportation vehicles and pharmaceuticals. Some pharmaceutical companies are already increasing domestic production capacity, influenced by geopolitical tensions, particularly regarding relations with **China**.

National security concerns also play a role in manufacturing decisions. For example, the response to potential health crises, like influenza outbreaks, has prompted increased production capabilities for vaccines in the U.S. over the past decade. Balancing the need for local manufacturing with the costs involved remains a complex issue.

While tariffs may offer short-term solutions, they are not sustainable in the long run. Strengthening relationships and treaties with countries that maintain strong manufacturing capabilities could provide a more effective approach than imposing trade barriers. The fundamental principle of economics suggests that manufacturing will gravitate towards regions with the lowest production costs.

As the landscape of manufacturing continues to evolve, it is clear that government initiatives alone cannot dictate industry operations. Short-term tariff adjustments may shift dynamics, but long-term decisions will ultimately depend on market forces, with industries adapting to serve their best interests. The decline of traditional manufacturing has been steady over the past **40 years**, while other sectors have experienced remarkable growth. The economy’s evolution is a testament to the resilience and adaptability of market forces, which will invariably shape the future of manufacturing in the United States.