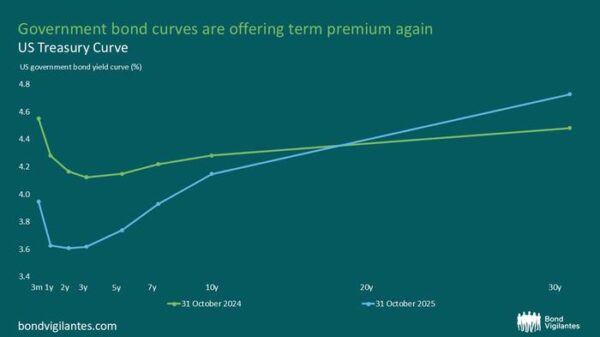

The landscape of US Treasury yields has changed dramatically over the past year, presenting both opportunities and challenges for investors. Elevated yields on long-dated US Treasuries are enticing for bond investors, particularly as short-term rates have decreased due to anticipated interest rate cuts. The long end of the yield curve, however, has not followed suit, with recent sell-offs prompting investors to consider locking in yields that are currently around 2-2.5%. This situation is noteworthy given that US Treasuries often serve as a global benchmark for various asset classes.

Concerns Amid Potential Gains

Despite the allure of higher yields, several risks warrant caution. One significant concern is the absence of a productivity boom in the US economy. The Congressional Budget Office (CBO) forecasts that federal debt will rise from 100% to 118% of GDP by 2035, marking the highest level in US history. Running fiscal deficits at high yields and elevated debt levels poses a risk, particularly when the CBO suggests that to stabilise debt metrics, the US must maintain a primary budget deficit-to-GDP ratio no larger than 1.2%. Current estimates indicate that budget deficits could range between 5% and 7% of GDP in the coming years, raising concerns about sustainability without significant productivity gains.

The potential for productivity improvements through advancements in artificial intelligence offers a glimmer of hope. If these anticipated gains materialise, they could significantly enhance the US fiscal outlook. Nevertheless, the CBO warns that if productivity growth falls short of expectations, debt could exceed 200% of GDP by 2055, underscoring the sensitivity of fiscal assumptions and the risks of miscalculating long-dated bond valuations.

Political Pressures and Fiscal Stability

Recent political events have also introduced uncertainties regarding the Federal Reserve’s independence. In August, former President Donald Trump attempted to remove Lisa Cook from the Fed’s board, citing allegations related to her mortgage records. While the Supreme Court allowed Cook to remain temporarily, Trump’s actions indicate a potential effort to exert influence over monetary policy. As Jerome Powell’s term as Federal Reserve chair concludes in May 2026, speculation arises that a new chair could adopt a more dovish approach, potentially leading to lower interest rates even if inflation remains above the Fed’s target. Such a scenario could prompt investors to demand higher long-term interest rates, complicating the fiscal landscape.

Tariff income is another area of concern as the US government has seen significant revenue growth from tariffs, with collections reaching $223.9 billion as of October 31, 2025. However, ongoing Supreme Court hearings could deem certain tariffs illegal, threatening to exacerbate the fiscal situation and potentially increasing long-term interest rates.

Shifts in Funding Strategy

In response to the evolving economic environment, Treasury Secretary Scott Bessent has indicated a preference for avoiding higher borrowing costs associated with long-dated bonds. The US Treasury recently confirmed plans to rely more heavily on short-term Treasury bills, which currently make up 20% of the US debt held by the public. This strategy aims to mitigate costs but increases the volatility of the funding profile. While this approach may be suitable in a scenario characterised by productivity growth, the risks associated with shifts away from a T-bill-heavy funding profile are significant.

Investors are weighing the attractive real yields of long-dated US Treasuries against these uncertainties. As the market navigates these complexities, many are opting to explore opportunities in other areas where confidence in yield direction is stronger.

In conclusion, while the potential for positive yields on long-dated US Treasuries is appealing, the interplay of fiscal pressures, political dynamics, and economic performance necessitates a cautious approach. Investors are advised to remain vigilant as these factors continue to evolve.