European markets experienced a calmer trading atmosphere today, following a significant bond selloff that rattled investors. After sharp increases in yields across various countries, including the US, UK, and Japan, a slight retracement in yields has contributed to a more optimistic outlook for equities.

In the United States, the 30-year Treasury yields briefly surpassed the critical 5% mark but later retreated to 4.96%. This easing of pressure on bond yields has led to a positive shift in market sentiment. Futures for the S&P 500 and Nasdaq are both indicating a recovery, with increases of 0.5% and 0.7% respectively.

Global Bond Markets React

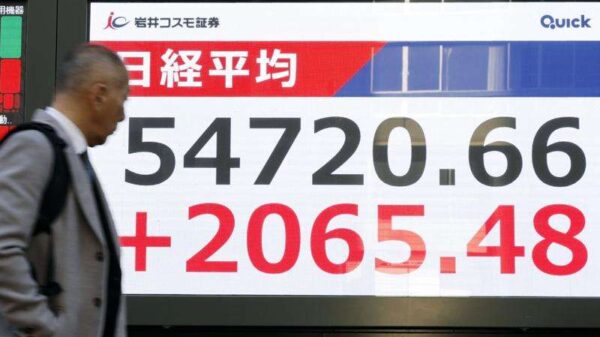

The bond markets have been at the center of attention, with 30-year yields in Japan reaching an unprecedented 3.29% and the UK’s climbing to 5.75%, the highest level since 1998. These movements reflect ongoing concerns about inflation and central bank policies. The Bank of Japan’s Governor, Kazuo Ueda, reiterated that there would be no immediate changes to their stance on interest rates, which may help stabilize Japanese markets.

In the UK, Finance Minister Rachel Reeves remarked that the economy is not broken, aiming to instill confidence among investors. The latest data from the Eurozone indicated a 0.4% increase in the Producer Price Index (PPI) for July, surpassing expectations of 0.2% month-on-month.

Market Movements and Commodities

Despite the calmer mood in equities, foreign exchange markets saw minimal volatility. The dollar has remained stable, with the EUR/USD exchange rate climbing slightly by 0.1% to 1.1648. The USD/JPY pair also saw a small increase of 0.2% to 148.63. Traders are currently facing resistance around the 200-day moving average at 148.83.

In commodities, gold prices have held steady following recent gains, currently trading around $3,547. This price point represents a successful breach of the $3,500 threshold. Silver remains above $40, currently at $40.90.

Conversely, oil prices have taken a hit, declining to $64.29 per barrel due to reports that OPEC+ may consider further output increases in an upcoming meeting. This drop from approximately $65.40 keeps prices just above their 100-day moving average of $64.25.

Overall, while the bond selloff has created some turbulence, the response in equity markets suggests a potential rebound. Investors will be watching closely as the situation develops. This article was written by Justin Low at investinglive.com.