Investment analysts at Chardan Capital have reduced their price target for Rocket Pharmaceuticals (NASDAQ:RCKT) from $12.00 to $11.00. This adjustment was detailed in a research note issued on Monday, where the brokerage maintained a “buy” rating on the biotechnology company. The new price target implies a potential upside of 278.01% based on the stock’s current valuation.

Several other brokerages have also revised their outlook on Rocket Pharmaceuticals. On August 8, Cantor Fitzgerald lowered its price objective from $10.00 to $8.00, while maintaining an “overweight” rating. TD Cowen reiterated a “hold” rating on May 27, and BMO Capital Markets significantly reduced their target from $30.00 to $8.00 on May 28, also issuing an “outperform” rating. Conversely, Wedbush retained an “outperform” rating with a price target of $32.00 on May 16. Additionally, Bank of America revised its stance to a “neutral” rating with a new price objective of $4.00, down from $9.00, on July 25.

As a result of these evaluations, one analyst has assigned a sell rating to the stock, while nine analysts have given it a hold rating, and seven have issued buy ratings. According to data from MarketBeat.com, Rocket Pharmaceuticals currently holds an average rating of “Hold” with a consensus price target of $16.33.

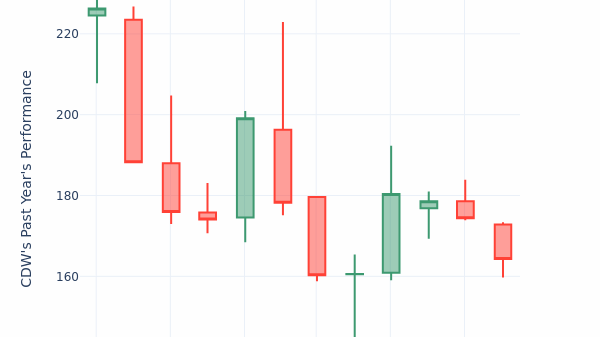

Current Stock Performance and Earnings

Rocket Pharmaceuticals shares opened at $2.91 on Monday. The company’s 50-day moving average stands at $2.95, while the 200-day moving average is $6.03. Key financial ratios indicate a current ratio of 6.39, a quick ratio of 9.19, and a debt-to-equity ratio of 0.05. The market capitalization is approximately $314.00 million, with a price-to-earnings ratio of -1.16 and a beta of 0.65. Over the past year, the stock hit a low of $2.19 and peaked at $22.01.

On August 7, Rocket Pharmaceuticals announced its quarterly earnings, revealing a loss of $0.59 per share, slightly below the consensus estimate of $0.57. This marks an improvement from a loss of $0.74 per share in the same quarter last year. Analysts forecast that the company will post an average earnings per share of -2.83 for the current fiscal year.

Institutional Investments and Stake Changes

Recent institutional trading reflects significant changes in ownership of Rocket Pharmaceuticals. XTX Topco Ltd increased its stake by 290.7% in the second quarter, acquiring an additional 100,038 shares, bringing its total to 134,445 shares valued at $329,000. Prudential Financial Inc. entered a new position in the same quarter worth about $25,000. Rhumbline Advisers raised its stake by 11.7%, owning 120,282 shares valued at $295,000 after purchasing an additional 12,644 shares.

Moreover, JPMorgan Chase & Co. increased its ownership by 98.0%, now holding 1,207,802 shares worth $2,959,000 after adding 597,713 shares. Amitell Capital Pte Ltd also acquired a new position valued at approximately $556,000. Currently, institutional investors hold 98.39% of Rocket Pharmaceuticals’ stock.

About Rocket Pharmaceuticals

Rocket Pharmaceuticals, Inc. operates as a late-stage biotechnology company, focusing on developing gene therapies for rare and severe diseases. The company is advancing three clinical-stage programs targeting Fanconi anemia, a genetic disorder affecting blood cell production; leukocyte adhesion deficiency-I, which impairs immune function; and pyruvate kinase deficiency, a rare autosomal recessive disorder leading to chronic hemolytic anemia.

As the company navigates these challenges, investor sentiment and market evaluations will be critical in shaping its future trajectory.