URGENT UPDATE: Bankruptcies in the United States are skyrocketing, with recent data revealing an alarming 11.5 percent surge in filings over the past year. According to the Administrative Office of the U.S. Courts, a staggering 542,529 bankruptcies were filed in the 12 months ending June 30, compared to 486,613 the previous year.

This trend underscores the escalating financial distress facing both businesses and individuals across the country. The significant increase comes amid ongoing economic pressures, including persistent inflation and rising living costs, which have left many struggling to stay afloat.

The report covers the final months of Joe Biden‘s presidency and the onset of Donald Trump‘s second term, complicating the attribution of these trends to any specific administration. Despite a resilient economy characterized by healthy GDP growth and solid labor market conditions, the ramifications of Trump’s tariffs on consumers are beginning to take their toll in 2025.

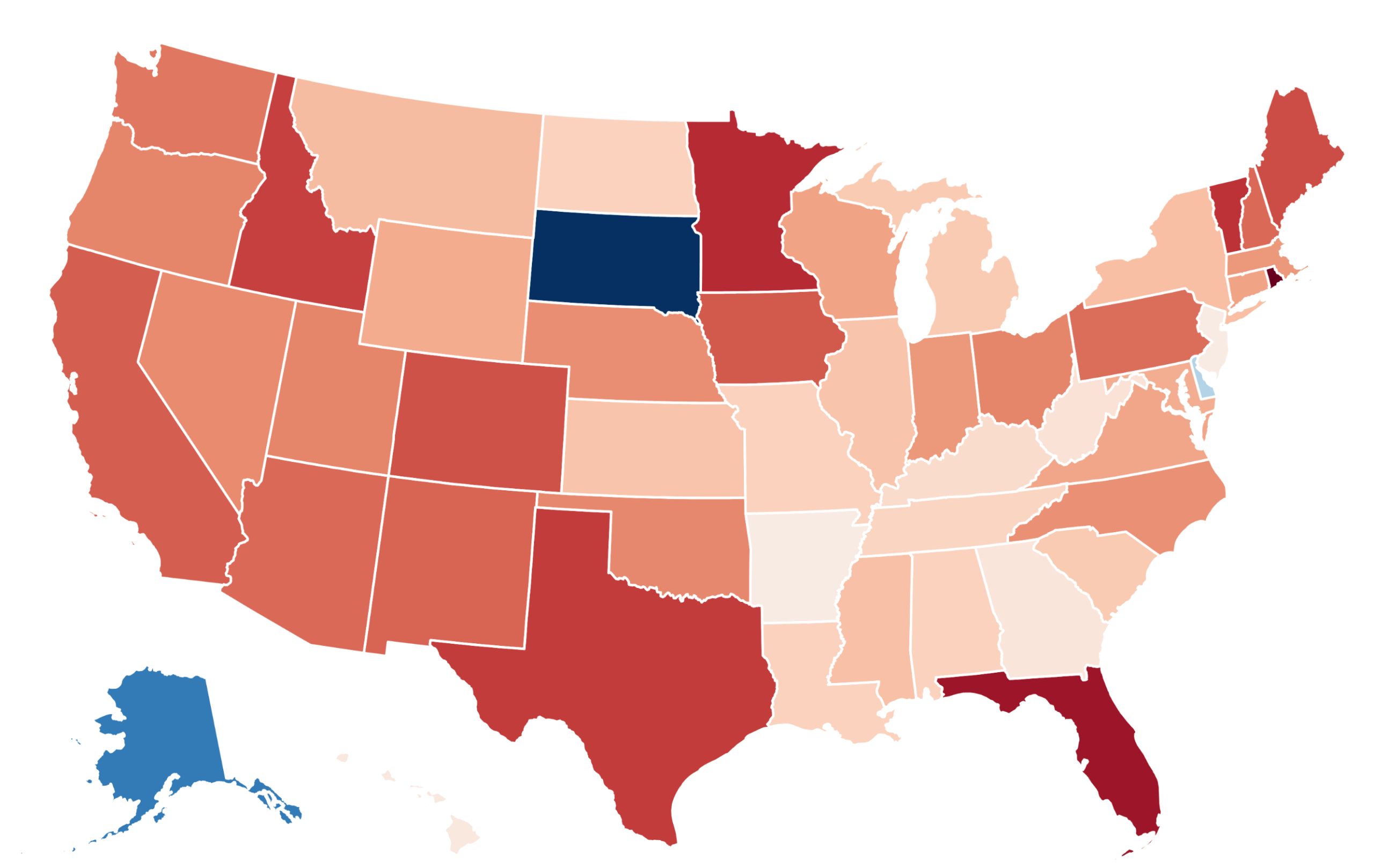

A detailed analysis by Newsweek has produced a map highlighting the states with the most pronounced increases in bankruptcy filings. Notably, Rhode Island leads the nation with a staggering 27.6 percent rise in filings, followed closely by Florida and Minnesota, where filings surged 23.5 percent and 21 percent, respectively. The complete list of states experiencing significant increases includes:

1. Rhode Island: 27.6 percent

2. Florida: 23.5 percent

3. Minnesota: 21 percent

4. Vermont: 20.3 percent

5. Texas: 19.4 percent

6. Idaho: 19.1 percent

7. Maine: 17.9 percent

8. Colorado: 17.6 percent

9. Iowa: 17.0 percent

10. California: 16.6 percent

Only three states—South Dakota, Alaska, and Delaware—reported declines in bankruptcy filings during this period, highlighting a concerning trend of financial instability across the majority of the country.

The increase in filings is not limited to businesses; personal bankruptcy filings also rose significantly. Individual filings climbed 4.5 percent to 23,043 from 22,060, while non-business filings jumped 11.8 percent to 519,486 from 464,553.

According to a report from financial analytics firm S&P Global, corporate bankruptcies in the first half of the year have reached their highest levels since 2010, putting 2025 on track to be one of the busiest years for filings in over a decade. Additionally, a recent analysis from LegalShield indicated that personal bankruptcy inquiries surged to their highest level since the pandemic began during the first quarter of the year.

Matt Layton, LegalShield’s Senior Vice President of Consumer Analytics, highlighted the pervasive issue of debt contributing to rising consumer stress. “When you combine record debt, rising delinquencies, and prolonged financial stress, topped by price pressures driven by tariff uncertainty, the risk of a summer surge in bankruptcy filings becomes very real,” he stated. He emphasized that debt is the common thread behind increasing consumer anxiety, from missed mortgage payments to maxed-out credit cards.

Looking ahead, the next set of U.S. courts data on bankruptcy filings is expected to be released in late October, covering the quarter ending September 30. Stakeholders and individuals alike will be keenly watching these forthcoming figures to gauge the evolving landscape of financial distress in the country.

As the financial situation continues to deteriorate for many Americans, the urgency for relief and support grows ever more critical. Stay tuned for updates as this situation develops.