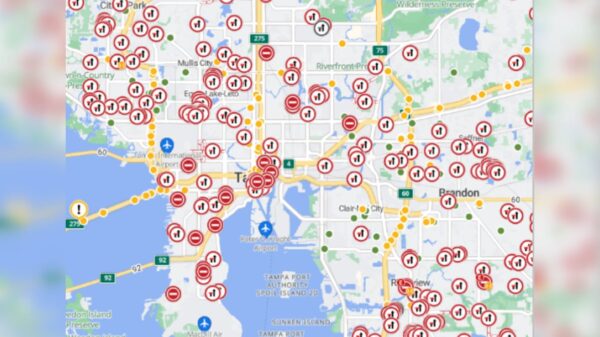

Clark County and the City of Las Vegas are set to decide this week on a significant extension of a property tax that funds police positions in the region. The proposed extension would allow a voter-approved property tax to remain in place for an additional 30 years, beyond its current expiration date in 2027. This extension is crucial for maintaining the budget for the Las Vegas Metropolitan Police Department (Metro), which currently supports approximately 825 officer positions.

The existing tax, known as a 0.2 percent ad valorem levy, translates to 20 cents for every $100 of assessed property value. Originally approved by voters in 1996, this tax has been instrumental in funding local law enforcement. As reported by the Las Vegas Review-Journal, the Clark County Commission was expected to consider the extension on October 10, 2023, while the Las Vegas City Council would take it up the following day.

If the tax is not extended, Metro could face a staggering annual budget gap of approximately $158 million, according to state lawmakers. The Review-Journal further notes that a homeowner with a property assessed at $500,000 could see about $310 of their annual tax bill tied to this levy.

Details of Senate Bill 451

Senate Bill 451 mandates that, starting from fiscal years beginning on or after July 1, 2027, local governing boards must impose a tax of 20 cents per $100 of assessed valuation specifically for the purpose of employing additional police officers. The law stipulates that the tax should be collected in the same manner as other ad valorem levies, with the revenue directed to the police department.

The bill gained strong bipartisan support in the Nevada Legislature, passing the Senate with a 17-4 vote and the Assembly with a 41-1 vote before being signed into law by the governor in May 2023.

Support and Opposition

Local government officials have framed the tax extension as a necessary measure for long-term budgeting rather than a tax increase. Sabra Smith Newby, Deputy City Manager of Las Vegas, emphasized earlier this year that extending the levy “would not raise taxes.” She cautioned that allowing it to expire would merely shift revenue among other property tax lines.

Critics, however, argue that a tax initially approved by voters should be subject to new approval if it is to be extended for decades. Concerns have been raised by lawmakers and watchdog organizations about maintaining expiring taxes through legislation, rather than seeking fresh voter consent. This has led to questions regarding the democratic implications of such a move.

As the county commission and city council prepare to vote on this extension, residents can access meeting agendas, reports, and livestream links on official websites. If both local bodies approve the measure, the 20-cent levy will remain in effect until 2057, ensuring a vital funding stream for Metro that city and county leaders deem essential for staffing levels. This vote marks the final local step in a process initiated when the state legislature granted authority for the extension earlier this year.