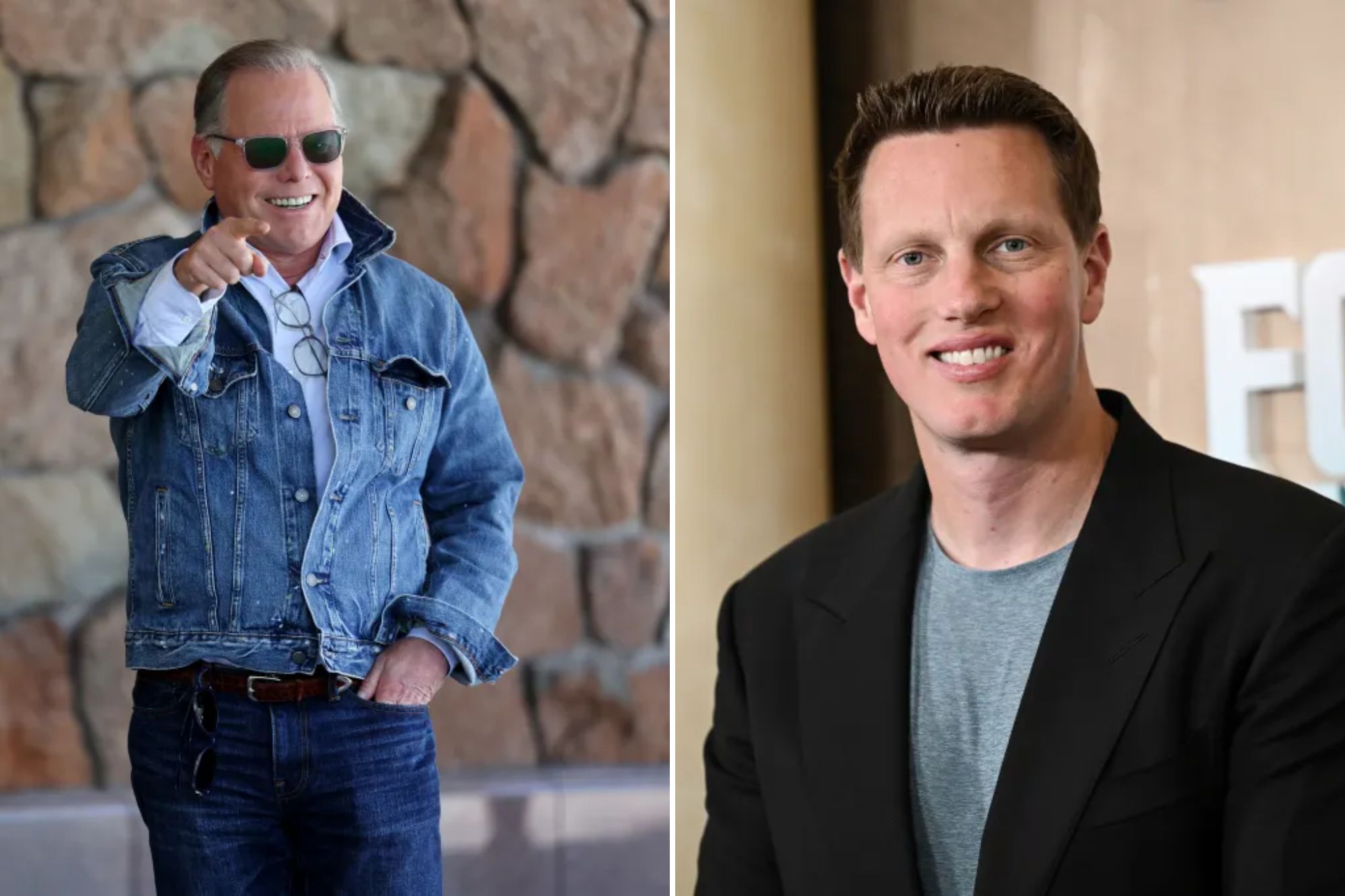

URGENT UPDATE: Warner Bros. Discovery has officially launched a high-stakes auction, igniting a bidding war for the media giant as interest surges from multiple suitors. The auction comes amidst growing pressure from Paramount Skydance, led by CEO David Ellison, who has made a series of aggressive offers, including a recent bid of $23.50 per share totaling $56 billion. This development was confirmed during a critical board meeting held Thursday morning.

As financial advisers from JPMorgan and Allen & Co. sift through expressions of interest, prospective bidders are now required to sign non-disclosure agreements to gain access to Warner Bros. Discovery’s financials. The company’s leadership, including CEO David Zaslav, is reportedly strategizing on how to navigate the competitive landscape, especially with Ellison intensifying his pursuit.

Sources reveal that Ellison has made three bids in recent weeks, each rejected by Zaslav, who aims to incite a bidding war that could push the sale price beyond $25 per share. Insiders suggest that Zaslav is bracing for another imminent offer from Ellison, potentially in the form of a public or hostile bid.

Ellison’s approach is uniquely influenced by political dynamics, believing he has support from former President Trump. This angle could complicate matters for rival bidders like Netflix and Amazon, who are facing potential antitrust challenges. Meanwhile, Comcast, which operates the MSNBC network, is viewed as a less favorable contender due to its ties to anti-Trump content, further underscoring the complexities of the bidding environment.

Despite the mounting pressure, Zaslav remains optimistic, viewing the auction as a culmination of his successful three-year tenure at Warner Bros. Discovery, which has included significant debt reduction and brand revitalization. The studio recently became the first to surpass $4 billion in box office revenues this year, while its HBO Max streaming service has attracted 73 million global subscribers.

As the auction unfolds, analysts believe that the value of Warner Bros. Discovery’s studio and streaming units could justify bids as high as $30 per share. Zaslav’s plan to split the company into two entities—one for its studio and streaming operations and another for its cable properties—could further enhance its appeal to bidders.

This ongoing bidding war is not just a corporate maneuver; it represents a significant moment in the media landscape, with potential implications for content creation and distribution in an increasingly competitive market.

Stay tuned for more updates as this urgent situation develops.