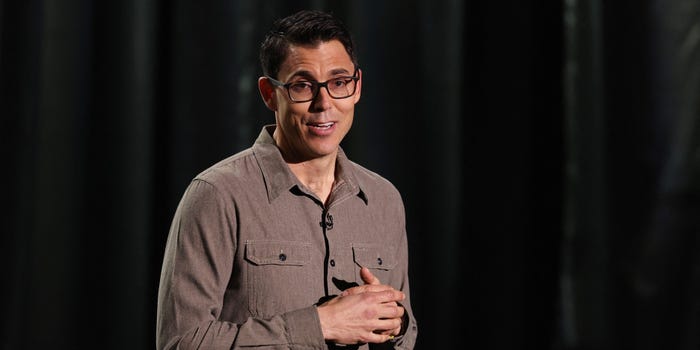

BREAKING: Rivian CEO RJ Scaringe confirms that after tearing down the popular Xiaomi SU7, the company found no groundbreaking technology that could explain its low price or success. This urgent revelation underscores the fierce competition in China’s electric vehicle (EV) market, where Rivian currently has no presence.

In a revealing interview with Business Insider, Scaringe highlighted that while the SU7 is a well-executed vehicle, its affordability is largely due to China’s unique economic landscape. The SU7, launched in January 2024 with a starting price of $30,000, has played a pivotal role in Xiaomi surpassing delivery expectations by November 2024. However, Scaringe noted, “there’s nothing we learned from the teardown.”

The Rivian CEO praised the SU7 as “a really well executed, heavily vertically-integrated technology platform,” yet emphasized macroeconomic factors like low labor costs and substantial government support as critical to its pricing strategy. “The cost of capital is zero or negative,” Scaringe explained, highlighting the distinct advantages Chinese manufacturers enjoy.

Rivian’s lack of a foothold in the thriving Chinese market, dominated by players like BYD and Xiaomi, raises questions about its future strategies. Scaringe expressed that if he were living in China, the SU7 would be a car he’d consider. Yet, he reiterated that the U.S. does not provide the same level of governmental assistance for production plants, making it challenging for American companies to compete.

The CEO’s comments come on the heels of the $6.6 billion loan awarded by the Department of Energy to Rivian to support a new manufacturing plant in Georgia. Scaringe’s insights expose the complexities of the EV market, where the differences in government policies significantly impact production costs and pricing strategies.

As Rivian and other American manufacturers strive to carve out a niche in the global EV landscape, Scaringe urges clarity around the factors driving China’s rapid electrification. He likens misconceptions about the industry to the “Wizard of Oz,” arguing that there are no hidden secrets—just calculable economic realities.

The urgency of Rivian’s situation is palpable as the company navigates a market increasingly dominated by cost-effective competitors. As Scaringe puts it, “Everything could be analyzed and calculated,” highlighting the critical need for American firms to adapt to these realities.

Stay tuned for more updates on Rivian’s strategies and the evolving landscape of the global EV market.