A recent study conducted by Credit One Bank reveals that two in five young adults, particularly from the Gen Z demographic, often incur debt to create an appealing social image. The findings highlight a growing trend among younger generations, where the pressure to impress peers during dating and social events is escalating.

The study indicates that 51% of both Gen Z and millennials have felt compelled to feign wealth or success. Notably, the pressure appears strongest among Gen Z, with 54% admitting to this behavior. Alarmingly, 38% of respondents acknowledged that they had either damaged their credit scores or taken on debt specifically to impress others. This financial strain is so significant that 37% of young adults would even overdraft their accounts for a date.

Gender differences emerge in the study, with men feeling the pressure more acutely. 46% of men reported they would consider going into debt for a single date, compared to just 28% of women. The research also found that a high credit score significantly influences perceptions of attractiveness; over half of the respondents indicated that a good credit score enhances a person’s desirability. Conversely, 70% stated they would lose confidence in a boss with poor credit.

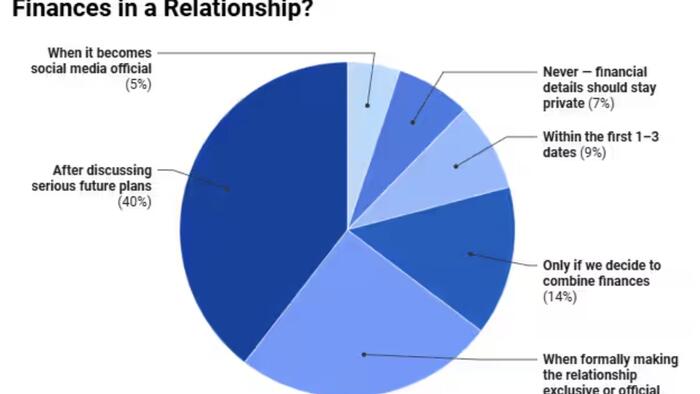

While discussions about financial backgrounds remain limited, especially in early relationships, the findings show that 54% of Gen Z and millennials prefer to keep their financial details private until a relationship becomes serious. Only 8% consider a poor financial history a dealbreaker for marriage. Interestingly, 48% of respondents would marry someone with financial difficulties, particularly if that individual is making strides toward improvement. Gender disparities persist, with men more forgiving of financial issues than women, who are twice as likely to end a relationship over money concerns.

Discussions around finances are notably awkward in friendships. The study found that over 70% of women rarely discuss financial matters with friends, while about 60% of men report the same hesitance. In contrast, when it comes to romantic partners, 67% of individuals check in on financial matters at least once a month, with 10% doing so daily.

Despite the discomfort surrounding financial discussions, loyalty among friends remains strong. More than 51% of respondents expressed a willingness to help friends experiencing financial crises, although one-third admitted they would proceed cautiously after receiving poor financial advice.

The drive for financial independence is evident, as 53% of young adults express a desire to rely solely on their own resources. Others indicated a willingness to seek assistance from family (27%) or a partner (20%). While many young individuals look online for financial guidance, with 21% seeking advice from platforms like ChatGPT, parents are still the primary source of financial counsel for 60% of respondents. In contrast, millennials are less likely to consult family (44%) and more inclined to seek advice from professionals (43%).

The impact of financial perceptions extends into the workplace, with 43% of respondents indicating they would lose confidence in a boss with poor credit. One in five would appreciate the honesty of a boss who disclosed such information. When asked about feelings regarding loved ones knowing their financial details, only one-third reported feeling proud. Men tend to exhibit greater confidence than women, and higher earners are generally prouder of their financial situations compared to those earning under $50,000.

In conclusion, while personal attributes still hold significant weight in relationships, financial considerations increasingly shape how young adults navigate social interactions. The interplay of debt-driven dating, social media influences, and the pursuit of independence indicates that financial discussions are not merely relevant; they often become pivotal in determining relationship success.