UPDATE: President Donald Trump has just signed the controversial GENIUS Act into law, a landmark bill aimed at establishing a regulatory framework for stablecoins in the U.S. financial system. Critics are raising alarms, suggesting that this legislation could enable the president to profit personally from the burgeoning cryptocurrency industry, a situation they deem a conflict of interest.

The GENIUS Act, officially known as the Guiding and Establishing National Innovation for U.S. Stablecoins, was passed with bipartisan support in the House of Representatives on October 12, 2023, by a vote of 308 to 122. The Senate had previously approved the bill last month with a vote of 68 to 30. This legislation is set to legitimize stablecoins—digital currencies pegged to fiat currencies like the U.S. dollar—and allows banks to create their own stablecoins.

Proponents of the bill argue that it provides a necessary framework for the stablecoin market, but opponents, including ethics watchdogs, warn that it falls short in protecting consumers from fraud. Meghan Faulkner of the Citizens for Responsibility and Ethics in Washington (CREW) stated, “There would have been a way to pass this legislation without the president himself being able to benefit from whatever legitimacy this could confer upon stablecoins.”

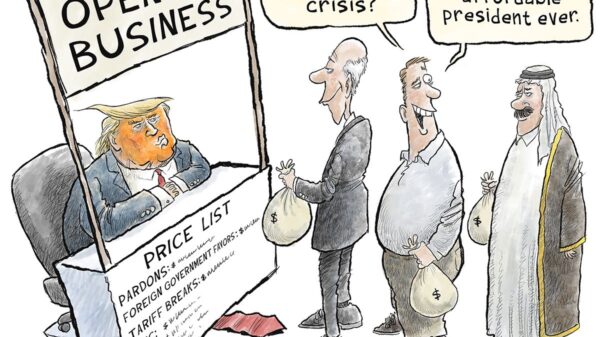

Critics point to the absence of an amendment that would have barred the president, vice president, and top officials from profiting off stablecoins, which ultimately failed to make it into the final bill. Bilal Baydoun, director of Democratic Institutions at the Roosevelt Institute, expressed concerns, stating, “If the president can basically issue his own currency, then the White House just becomes a storefront for personal gain.”

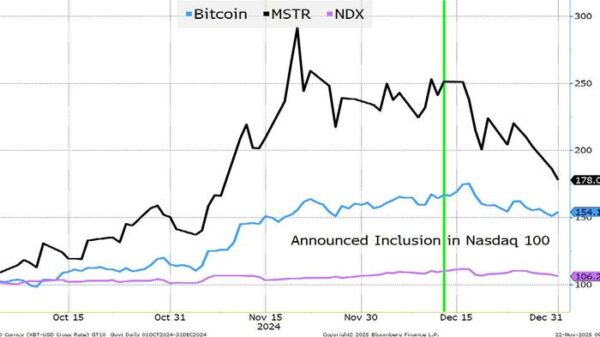

As the legislation unfolds, Trump’s financial ties to the crypto world are under intense scrutiny. Since assuming office, he has launched multiple ventures in the cryptocurrency space, including the $TRUMP meme coin and a stablecoin called USD1, which is pegged to the U.S. dollar. This spring, USD1 was utilized by the Abu Dhabi firm MGX in a $2 billion investment in Binance, with every transaction generating fees that financially benefit the Trump family.

The potential profits from these transactions could reach into the hundreds of millions, especially now that USD1 has received legitimacy through the GENIUS Act. “You can expect a rush of money flowing into USD1, which is only going to enrich the Trumps further,” stated Baydoun.

Trump’s recent embrace of cryptocurrency marks a significant shift from his previous stance, where he disparaged Bitcoin and other digital currencies in 2019 as “not money” with value “based on thin air.” While surrounded by industry leaders, Trump acknowledged the support he received from the crypto sector during his campaign.

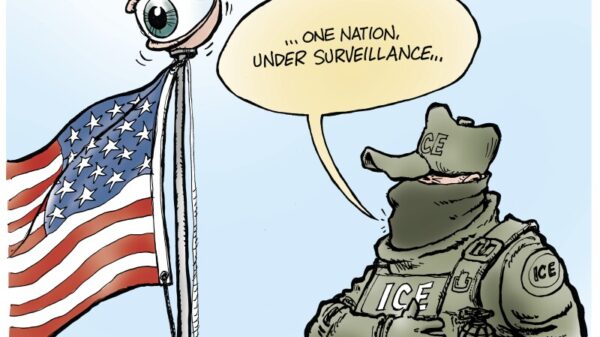

Since his administration began, there has been a notable increase in crypto deregulation. The Justice Department ended its crypto enforcement team and has reduced prosecutions against crypto firms. This spring, Trump hosted top $TRUMP token holders at his private club, raising further ethical concerns.

According to analysis from CREW, nineteen White House officials currently possess between $875,000 and $2.35 million in crypto assets, a situation that raises alarms about potential conflicts of interest. The analysis found that sixteen Trump staffers hold Bitcoin, with three owning Bitcoin ETFs, which collectively represent over $2 million in holdings.

As the nation watches these developments closely, the implications of the GENIUS Act could reshape the landscape of cryptocurrency in the U.S., as well as Trump’s financial future. The intersection of politics and personal profit in this legislation is sparking debates that may resonate through upcoming elections and policy discussions.

What’s Next: As the crypto landscape evolves, all eyes will be on how the GENIUS Act impacts both the market and Trump’s financial dealings. With the potential for rapid growth and profit in the stablecoin sector, ongoing scrutiny of the administration’s actions regarding cryptocurrencies is expected. Stay tuned for further updates on this developing story.