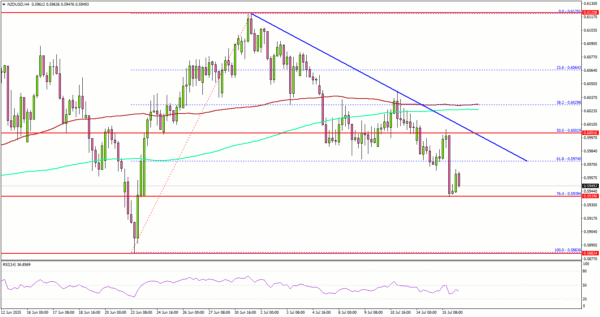

UPDATE: The New Zealand Dollar (NZD) has sharply declined against the US Dollar (USD), crashing below the critical 0.6000 support level. This development signals potential further losses, as market analysts warn of a bearish trend taking shape.

This urgent update comes as NZD/USD traded below 0.6050 and 0.6020, marking a fresh decline from a peak of 0.6120. Currently, the pair is also under pressure from a key bearish trend line forming with resistance at 0.6000, as seen on the 4-hour chart.

Traders are closely monitoring the situation, especially as immediate support sits near 0.5940, close to the 76.4% Fibonacci retracement level of the upward movement from 0.5883 to 0.6120. Analysts indicate that if losses continue, the next significant support could be around 0.5900, with a potential drop toward 0.5880 looming.

Meanwhile, the Euro has also faced challenges, as the EUR/USD pair has extended its losses, failing to defend the 1.1650 support zone. This decline adds to the growing concerns over currency strength as market dynamics shift.

Looking ahead, investors should prepare for the upcoming US Producer Price Index (PPI) data for June 2025. Forecasts indicate a month-over-month increase of 0.2%, compared to a previous figure of 0.1%, while the year-over-year forecast sits at 2.5%, down from 2.6%.

The current sentiment in the market reflects uncertainty, urging traders to remain vigilant as the NZD/USD continues to navigate turbulent waters. A move above 0.6030 could indicate a potential reversal, but for now, the outlook remains bleak.

Stay tuned for further updates as this story develops. The financial landscape is shifting rapidly, and the implications for traders and investors are significant.