UPDATE: NVIDIA Corporation is on the brink of a historic milestone, approaching a staggering $5 trillion market valuation as the AI hype propels U.S. equity markets. As of 11:27 UTC, NVIDIA shares surged to approximately $201.03, marking a market capitalization of around $4.53 trillion.

This remarkable ascent highlights the ongoing enthusiasm for artificial intelligence and advanced computing technologies. NVIDIA’s stock jumped over 3 percent in premarket trading, reinforcing its position as the leading force behind this year’s equity gains. The S&P 500 and Nasdaq 100 futures both edged higher, while Dow Jones futures saw slight declines, indicating investors’ strong focus on growth and technology sectors.

NVIDIA’s upward trajectory is bolstered by recent reports detailing nearly $500 billion in new AI chip orders and ambitious plans to develop several supercomputing systems for the U.S. government. These announcements have solidified investor confidence in NVIDIA’s pivotal role in shaping global AI infrastructure through at least 2026.

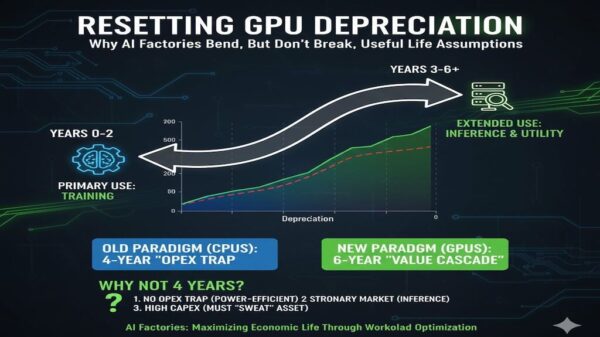

With significant demand for high-performance computing from major cloud service providers, enterprise clients, and national research institutions, NVIDIA’s outlook appears increasingly robust. Since the start of the year, the company’s stock has skyrocketed nearly 90 percent, making it the largest contributor to the S&P 500’s impressive performance.

NVIDIA’s success is also lifting other technology titans, including Microsoft, Alphabet, and Meta Platforms, all of which are set to release quarterly earnings later this week. Investors are keenly monitoring these results to assess whether the strong fundamentals can support the lofty valuations currently driving the market.

Despite the prevailing optimism, analysts caution that market breadth remains narrow, with gains concentrated primarily in a few major tech companies. Smaller firms and cyclical sectors have lagged, posing potential risks if sentiment towards AI or technology spending shifts.

Market participants are also closely watching the Federal Reserve’s upcoming policy decisions, with expectations of a quarter-point rate cut later today. A decrease in interest rates could further bolster high-valuation growth stocks, potentially fueling NVIDIA’s rally.

For now, NVIDIA’s momentum is emblematic of the 2025 bull market. Its near-record valuation not only showcases the power of the AI revolution but also highlights the immense trust investors have in the company’s ability to lead this transformative industry. Crossing the $5 trillion threshold would herald a new era for financial markets, establishing NVIDIA as the most valuable enterprise in history.

As developments unfold, NVIDIA stands at the forefront of a tech-driven financial landscape, captivating investors and the broader market alike. Stay tuned for further updates as the situation evolves.