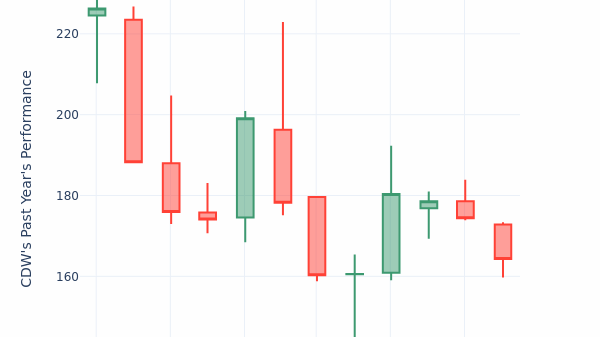

UPDATE: The latest inflation report from the Labor Department reveals that inflation has surged at an annual rate of 2.7% for September 2023, slightly outperforming economists’ expectations. This crucial data, released earlier today, is set to have immediate implications for consumers and the broader economy.

The rise in inflation comes as a surprise to many analysts, who had predicted a less favorable outcome. This unexpected increase could impact everything from interest rates to consumer spending as the economy navigates a challenging landscape.

Kelly O’Grady, a correspondent for CBS News, elaborates on the report’s significance. “This uptick indicates resilience in consumer demand but also raises concerns about the ongoing cost of living crisis,” she stated.

The report highlights that inflation remains a pressing issue for households, with prices rising across key sectors. Essentials like groceries and housing continue to see significant increases, straining budgets for millions.

In the wake of this announcement, financial markets are likely to react swiftly. Investors will be closely monitoring how the Federal Reserve responds, particularly regarding interest rate adjustments. A sustained rise in inflation may prompt the Fed to reconsider its current monetary policy, potentially leading to higher rates that could affect loans and mortgages.

WHAT TO WATCH FOR: As the economic landscape shifts, experts suggest that consumers should prepare for potential price hikes in essential goods. Additionally, analysts will be watching for statements from the Federal Reserve in the coming days for clues on future policy directions.

Stay tuned for further updates as this story develops. The implications of this inflation report could reshape financial decisions for families and businesses alike, making it a critical topic for discussion in the days ahead.