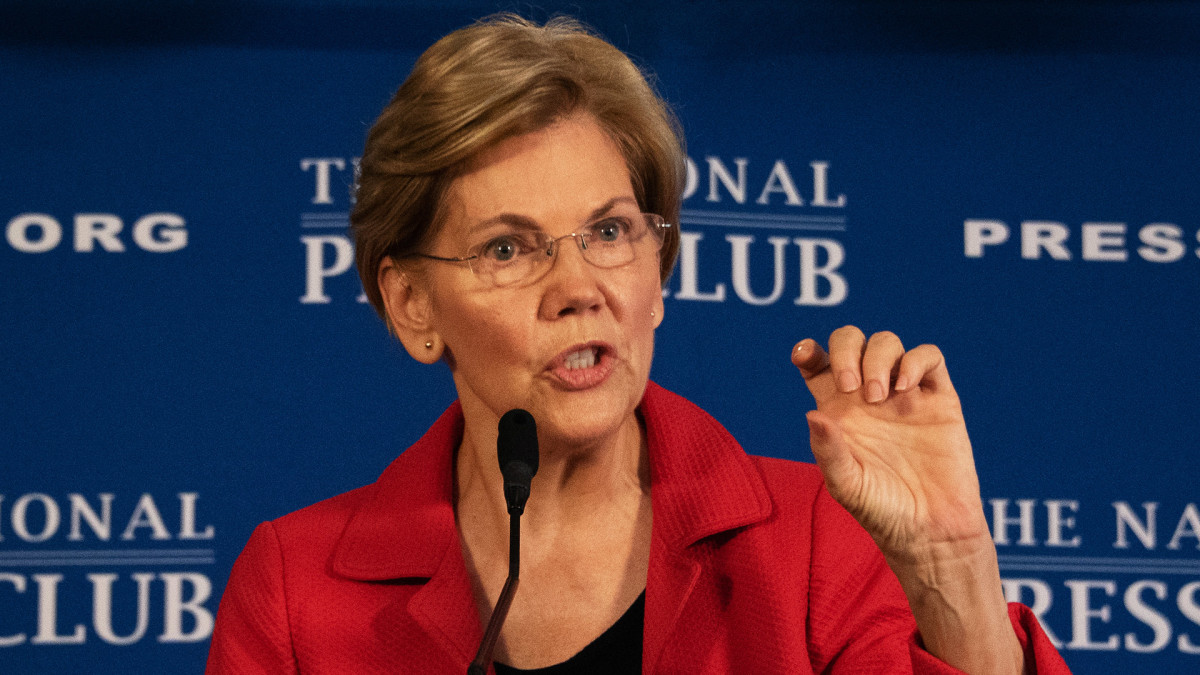

UPDATE: Senator Elizabeth Warren has fiercely criticized Paramount Skydance‘s hostile bid of $74.4 billion for Warner Bros. Discovery, calling it a “five-alarm antitrust fire.” As the media landscape shifts dramatically, concerns are escalating over potential monopolistic practices amidst fierce competition.

The announcement comes just days after Netflix revealed its plans to acquire Warner Bros. for $72 billion on December 5, 2023. Paramount’s immediate follow-up bid, made directly to Warner shareholders, has sparked urgent discussions regarding market dominance and consumer choice.

Warren’s strong statement emphasizes the implications of such a merger, as she argues it would violate antitrust laws designed to maintain fair competition. “A Paramount Skydance-Warner Bros. merger would be exactly what our anti-monopoly laws are written to prevent,” she asserted in her latest remarks.

In a pointed critique of the current political ties, Warren noted that Paramount’s bid is supported by a network of individuals connected to former President Donald Trump, including Jared Kushner and the Ellison family. “This raises serious questions about influence-peddling and national security risks,” she added, calling for a thorough review by the Department of Justice and the Committee on Foreign Investment in the United States.

This situation marks a pivotal moment in the media industry as Warren has been vocal about her concerns surrounding monopolistic mergers. Her office has outlined a timeline of her actions:

- December 5: Warren labels Netflix’s acquisition a “nightmare” for competition.

- November 21: Criticizes Paramount CEO David Ellison on The Late Show with Stephen Colbert.

- November 19: Joins Senators Bernie Sanders and Richard Blumenthal in warning the DOJ about potential corruption in a Warner Bros. deal.

- August 1: Calls responses from Paramount “dodgy” and demands an independent investigation.

- July 24: Critiques Trump administration’s approval of the Paramount merger.

- February 20: Urges DOJ to scrutinize the proposed Disney-Fubo merger.

Meanwhile, some industry experts argue that the competitive battle for Warner Bros. signifies a healthy market. Collider journalist Collier Jennings notes that if Warner Bros. falls under Netflix, it would create a formidable industry player, while Paramount’s bid challenges this notion by advocating for a more powerful media force.

As this deal unfolds, the stakes are high not only for industry players but for consumers as well. A merged Paramount and Warner Bros. could potentially reshape the landscape of television and streaming services, prompting viewers to brace for changes in content availability and pricing.

With both sides poised for a potential showdown, all eyes will be on the regulatory responses and the upcoming decisions from the DOJ. The implications of these mergers go beyond mere financial figures, as they could redefine the future of media consumption.

Stay tuned for more updates as this urgent situation develops, and consider how it may affect your viewing options in the near future.