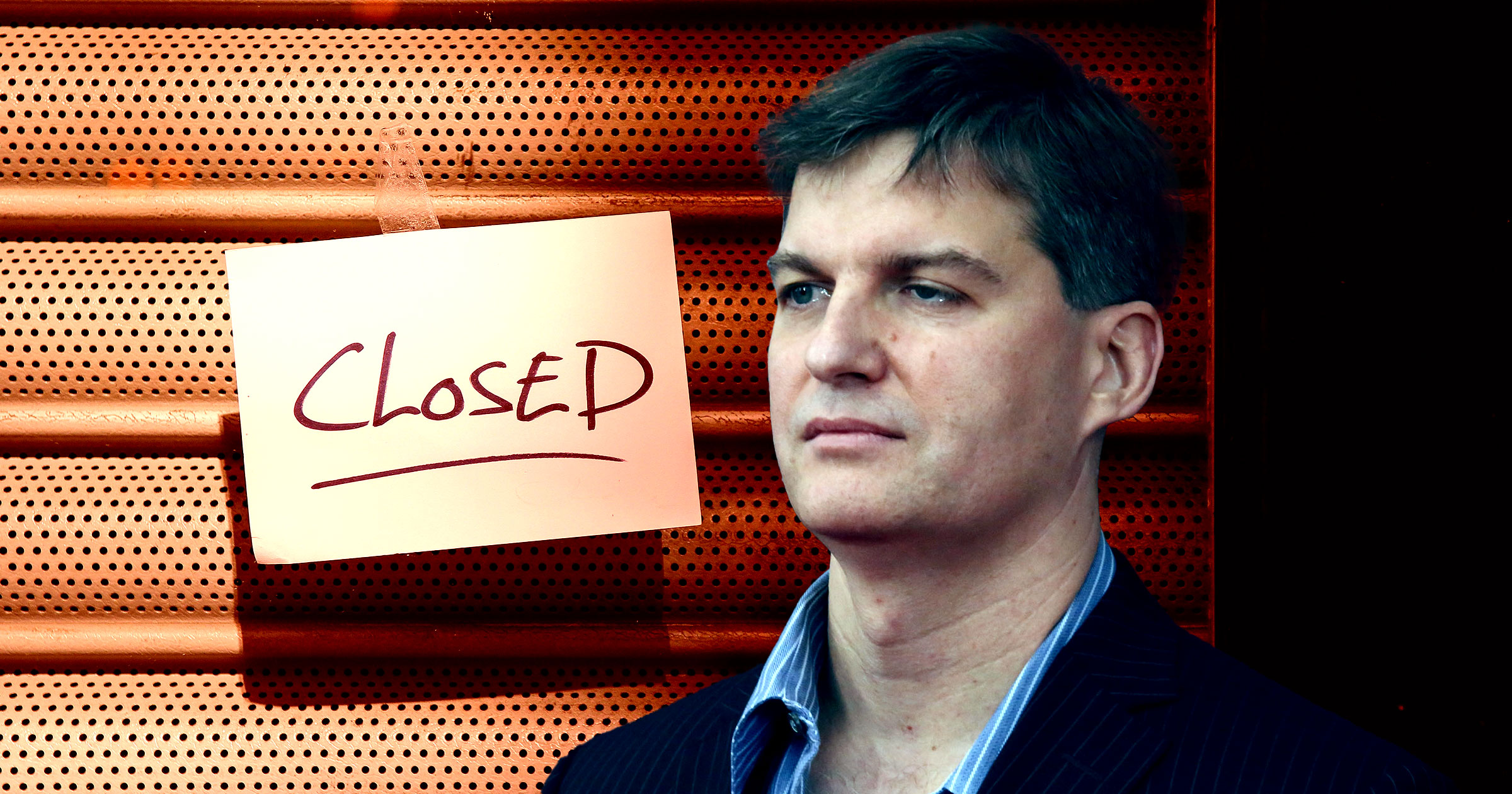

Michael Burry, the asset manager renowned for his successful short of the U.S. housing market before its collapse in 2008, has announced the liquidation of his hedge fund, Scion Asset Management. This decision comes shortly after Burry disclosed significant short positions against AI companies, notably Nvidia and Palantir, valued at over $1 billion. The news has intensified discussions surrounding the potential for a bubble within the AI sector that could impact the broader U.S. economy.

In a letter dated October 27, 2023, Burry informed investors that he would be “liquidating the funds” and returning capital by the end of the year. This announcement coincided with reports that his fund had deregistered with the U.S. Securities and Exchange Commission, prompting speculation about the future of Scion Asset Management. However, deregistration does not necessarily indicate the fund’s closure; it simply relieves Scion of reporting obligations to regulators.

Burry’s foray into shorting AI stocks has not gone as planned. Despite a slight tech selloff earlier in the month, companies like Nvidia have seen their stock prices rise by over 37 percent, while Palantir has surged by 126 percent year-to-date. Both companies are experiencing inflated valuations, with Palantir reaching a staggering price-to-earnings ratio exceeding 200. Burry acknowledged the misalignment between his valuation estimates and current market prices in his investor letter.

As noted by the Financial Times, Burry is not the first prominent short seller to withdraw from the market amid the rampant enthusiasm surrounding AI. Other notable figures, including Jim Chanos and Nate Anderson, have also exited their positions.

In a twist, Burry later clarified that the scale of his investment against Palantir was much smaller than initially reported. In a tweet, he stated he had “spent $9,200,000, not $912,000,000,” contradicting earlier claims about the size of his short positions. He added that his investments would allow him to sell Palantir shares at $50 in 2027.

Following the decision to liquidate his hedge fund, questions linger about Burry’s future endeavors. In a cryptic tweet, he hinted at a new direction, stating he would be “on to much better things” after November 25, 2023. This statement has led to speculation regarding whether Burry plans to continue his investment strategies privately, potentially in a family-office setup that would allow him to manage his own capital without federal oversight.

Bruno Schneller from Erlen Capital Management suggested that Burry’s withdrawal from the public eye does not signify the end of his investment strategies. “Don’t count him out, just expect him to operate off the grid for a while,” Schneller commented, indicating that Burry may continue to pursue his investment philosophy independently.

As the AI industry continues to grow and evolve, the implications of Burry’s withdrawal and the broader trends in short selling remain to be seen. The market’s reaction to these developments will likely shape conversations about AI valuations and potential risks in the coming months.