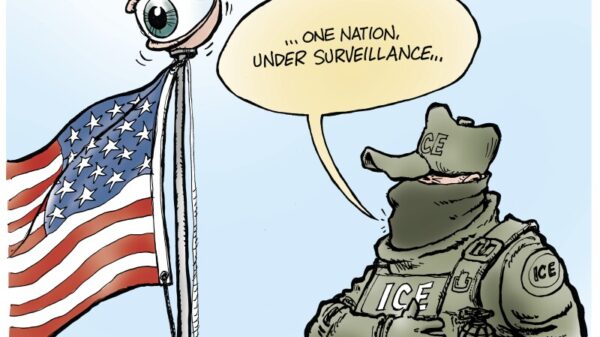

The upcoming vote on the Responsible Financial Innovation Act has intensified debates surrounding the cryptocurrency industry, with critics warning that the legislation could increase corruption and illicit activity. U.S. Senator Mark Warner of Virginia faces pressure to back the bill, following his previous support for the GENIUS Act, which has already stirred controversy.

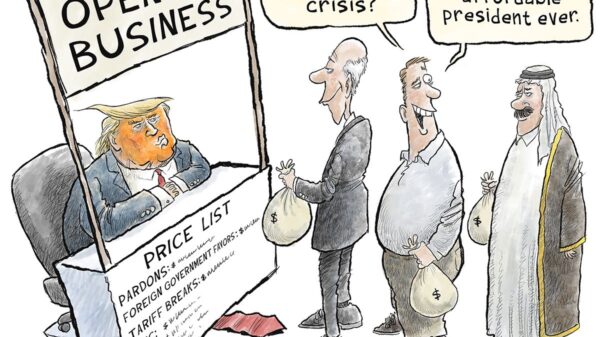

Former President Donald Trump once labeled bitcoin a “scam” and claimed it could facilitate illegal behavior. Yet, he now seeks to position himself as a pro-crypto leader, a stark shift that reflects the growing influence of cryptocurrency advocates in U.S. politics. In fact, the cryptocurrency sector reportedly spent over $119 million on political campaigns in the run-up to the 2024 elections, making it one of the most significant contributors in history, according to the advocacy group Public Citizen.

The crypto industry’s spending has notably targeted opponents of its agenda. For instance, it allocated approximately $40 million to defeat Senator Sherrod Brown, a noted critic of cryptocurrency regulations. Additionally, the sector spent $10 million to challenge Katie Porter during her California Senate primary bid, a move seen as a direct response to her opposition to the industry.

Critics, including researchers from Georgetown, indicate that the use of stablecoins—cryptocurrencies pegged to traditional currencies—has surged for illicit transactions. In 2024, such transactions exceeded $51 billion, up from $46 billion the previous year. Stablecoins like Tether, which has been linked to various illegal activities, play a significant role in this trend.

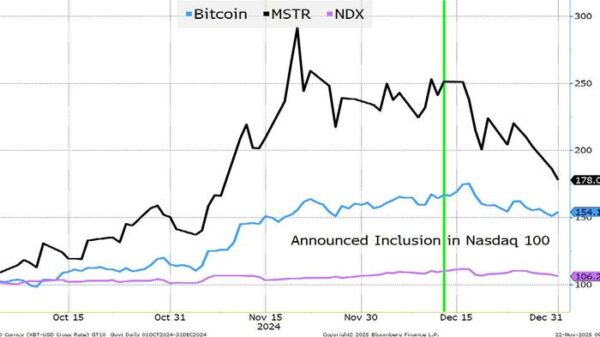

The proposed legislation this month would encompass a range of cryptocurrencies, including bitcoin, which holds a market value of around $2 trillion. Many argue that investing in bitcoin relies on the “greater fool” theory, suggesting that its value is derived solely from finding someone willing to pay more than the initial investment. This lack of intrinsic value has raised concerns about the potential for a financial bubble.

Despite the evident risks associated with cryptocurrencies, political spending appears to outweigh concerns among lawmakers. The cryptocurrency sector’s advertising strategies often avoid direct references to the industry, instead highlighting the broader virtues of pro-crypto candidates while downplaying the shortcomings of their opponents. This approach aims to circumvent the negative perception that many Americans hold regarding cryptocurrencies.

As the vote on the Responsible Financial Innovation Act approaches, there is increasing speculation about how Senator Warner will decide. Advocates hope he will reject the bill, demand accountability from Trump regarding his involvement in cryptocurrencies, and support stronger consumer protections against potential financial misconduct.

With the crypto industry reportedly amassing a war chest of $100 million for the upcoming mid-term elections in 2026, political dynamics are shifting. Senators may find it safer to align with the pro-crypto narrative, even as public opinion remains skeptical. Issues like war, health care, and social policies often dominate voter concerns, while cryptocurrency rarely emerges as a decisive factor.

As the situation develops, the outcome of the vote may have lasting implications for the future of cryptocurrency regulation in the United States. Advocates for responsible financial practices continue to call for transparency and regulation to mitigate the risks associated with this rapidly evolving sector.