President Donald Trump has postponed the introduction of his controversial tariffs on numerous countries, initially set to take effect today, August 1, 2023. This delay, resulting from the absence of trade agreements, extends uncertainty for businesses while providing America’s trading partners additional time to negotiate deals that could help them evade substantial levies.

Many mainstream economists view this postponement positively, as tariffs have historically been known to inflict harm on the economies that impose them. Research indicates that tariffs can adversely affect both workers and consumers within those economies. While free trade can present its own challenges, high tariffs are seldom seen as a viable solution.

So far, the tariffs introduced during Trump’s administration have not significantly impacted inflation, economic growth, or job creation in the United States. Treasury Secretary Scott Bessent remarked that inflation is “the dog that didn’t bark,” suggesting that the anticipated negative impacts may take longer to materialize. However, some economists caution that inflation and employment could experience delayed adverse reactions that might emerge later this year.

According to Antonio Fatas, an economics professor at INSEAD, “The positives (of free trade) outweigh the negatives, even in rich countries.” He acknowledged that the US and Europe have both benefited from maintaining open trade policies.

Impact on Consumers and Businesses

Tariffs function as taxes on imports, typically increasing production costs and, consequently, consumer prices. Data from the Organisation for Economic Co-operation and Development reveals that approximately half of all US imports consist of intermediate goods essential for manufacturing finished products.

Economics professor Doug Irwin from Dartmouth College highlighted this issue during a recent podcast, noting that many American products, such as Boeing aircraft or automobiles, rely on internationally sourced components. When businesses face higher prices for imported materials, they often pass these costs on to consumers.

During Trump’s first term, steep tariffs on $283 billion worth of imports resulted in a complete pass-through of those levies into domestic prices, as revealed by a 2019 study co-authored by Mary Amiti of the Federal Reserve Bank of New York. This trend has been consistent, with forecasts indicating that new tariffs will similarly raise prices across the US economy. Federal Reserve Chair Jerome Powell remarked on June 18, 2023, that the country should expect goods inflation to rise further.

The introduction of tariffs is also expected to reduce the overall economic output of the United States. A 2020 study encompassing data from 151 countries over a period from 1963 to 2014 found that tariffs have persistent adverse effects on the gross domestic product (GDP) of the country imposing them.

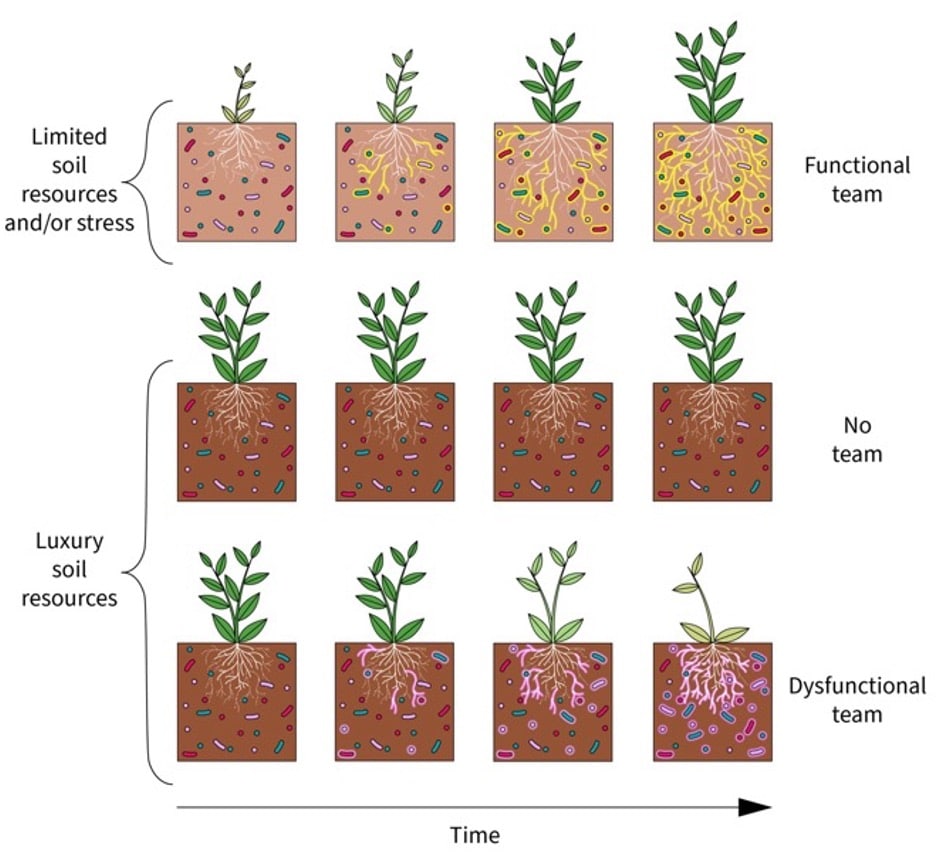

According to Gimber, when tariffs are low or nonexistent, countries can focus on economic activities that leverage their competitive advantages, which ultimately promotes higher productivity. Conversely, increased tariffs can hinder specialization and lead to lower labor productivity, disrupting economic stability.

Job Losses and Economic Uncertainty

The impact of tariffs extends beyond costs and prices; they also appear to contribute to job losses. Research indicates that rising import taxes can correlate with higher unemployment rates across various countries. Irwin pointed out that studies have shown job losses resulting from the 2018 steel tariffs, as more people are employed in downstream industries than in steel production itself.

A study by the Federal Reserve Board found that increased input costs from tariffs imposed in 2018-2019 led to job losses in American manufacturing. The negative effects, exacerbated by retaliatory tariffs from other nations, have often outweighed any modest boosts to manufacturing employment from those tariffs.

The uncertainty surrounding tariffs poses additional challenges to American businesses. Surveys conducted by the National Federation of Independent Business reveal that uncertainty regarding tariffs has already affected small businesses’ willingness to invest. These surveys indicate that the share of small businesses planning capital expenditures has reached its lowest level since April 2020, when the COVID-19 pandemic was at its peak.

The International Monetary Fund (IMF) has warned that increased US tariffs are likely to diminish overall productivity and economic output.

As the global economy continues to navigate the complexities of trade relations, the balance between protecting domestic industries and fostering international cooperation remains a critical concern. While free trade offers many benefits, it also presents challenges, such as job displacement in vulnerable communities.

Many economists advocate for targeted support, such as retraining programs, to assist workers affected by changing trade dynamics, drawing parallels to the broader concept of a just transition to a greener economy.

Ultimately, the long-term economic implications of Trump’s delayed tariffs remain uncertain. As businesses await clearer policies, the emphasis on free trade’s role in fostering global cooperation and economic growth will continue to shape discussions among policymakers and economists alike.