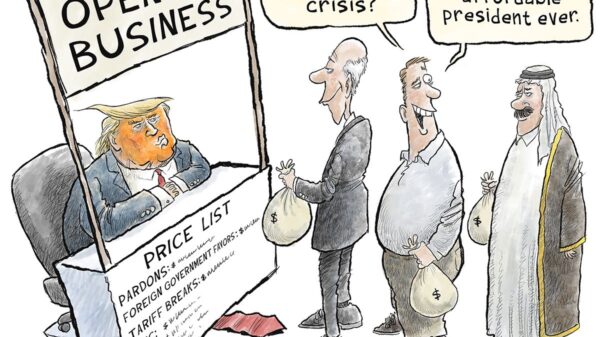

The Supreme Court’s impending decision regarding President Donald Trump‘s tariffs could necessitate the return of approximately $80 billion in customs duties to businesses. If the Court finds the tariffs unlawful, it would trigger a complex and bureaucratic process for issuing refunds, affecting countless companies that have paid these duties throughout the fiscal year.

Legal challenges to Trump’s tariffs stem from rulings by two lower courts, which determined that the president lacked authority under the International Emergency Economic Powers Act to impose these levies. The Supreme Court is slated to hear arguments on this issue in November 2023. If the Court affirms the lower court decisions, it could lead to significant financial repercussions for the administration and the businesses that have contributed to the $165 billion in customs duties collected this year.

The potential for refunds has left many importers uncertain. Refunds are traditionally slow, often involving cumbersome paperwork and lengthy processing times through US Customs and Border Protection (CBP). Lynlee Brown, a global trade partner at EY, noted, “Customs isn’t just going to hand importers a bunch of money.” The possibility of getting funds back has led some importers to question whether they will ever see reimbursement. Harley Sitner, owner of Peace Vans, expressed skepticism, stating, “I have zero faith we’d ever get anything. Just zero.”

Trump has long touted the revenue generated from tariffs as a source of national wealth, claiming they have made the country “very rich again.” The funds have been proposed for various policy initiatives, including reducing the national debt and providing financial assistance to struggling farmers. If the tariffs are invalidated, the administration may try to quickly reimpose similar levies using alternative legal frameworks, indicating a reluctance to relinquish the funds easily.

Challenges in the Refund Process

The mechanisms for issuing refunds are convoluted. Importers must navigate a strict timeline and adhere to specific procedures to secure their reimbursements, which are primarily distributed via paper checks. Despite efforts to modernize the payments system, including a plan to phase out checks by September 30, 2023, progress has been slow. Tom Gould, a customs consultant based in Seattle, warned that if refunds are required, it could result in “millions and millions of paper checks being mailed out.”

Moreover, the logistics of sending refunds can be complicated, particularly for foreign importers. Customs will only remit payments to approved domestic banks in US dollars, leaving international mail as a viable option for overseas businesses. This has raised concerns about potential mail theft, with reports of refund checks being intercepted and sold on the dark web.

While there are avenues for expediting refunds, such as leveraging existing data to automate processes, the likelihood of a streamlined approach remains uncertain. Experts suggest that each importer may have to file individual lawsuits or protests to recover their payments, further complicating an already intricate system.

Impact on Importers and Businesses

The uncertainty surrounding refunds has created a challenging environment for many businesses. Some importers have ceased bringing in overseas inventory due to unpredictable tariff charges, which can arrive months after goods are received. Sitner described his frustrations, recalling surprise tariff bills ranging from $221 to $17,000. “Just yesterday we got a small shipment from Germany worth $2,324 and it came with a $1,164 tariff charge. We can’t back out,” he lamented.

As the Supreme Court prepares to make its ruling, the implications of its decision are poised to reverberate throughout the business community. Many companies are left grappling with the potential financial ramifications of a ruling against the administration. The complexity and uncertainty of the refund process add another layer of anxiety for importers navigating the aftermath of a turbulent trade environment.

The White House and CBP have not responded to inquiries regarding the situation, leaving businesses to contend with the unknown as they await the Court’s decision.