Hudbay Minerals Inc. has announced a significant strategic partnership with Mitsubishi Corporation, which will invest $600 million in exchange for a 30% interest in Copper World LLC, a subsidiary that owns the Copper World project in Arizona. This joint venture marks a pivotal moment for Hudbay, as it aims to enhance its position in the growing copper market while securing a trusted partner with a strong track record in mining operations.

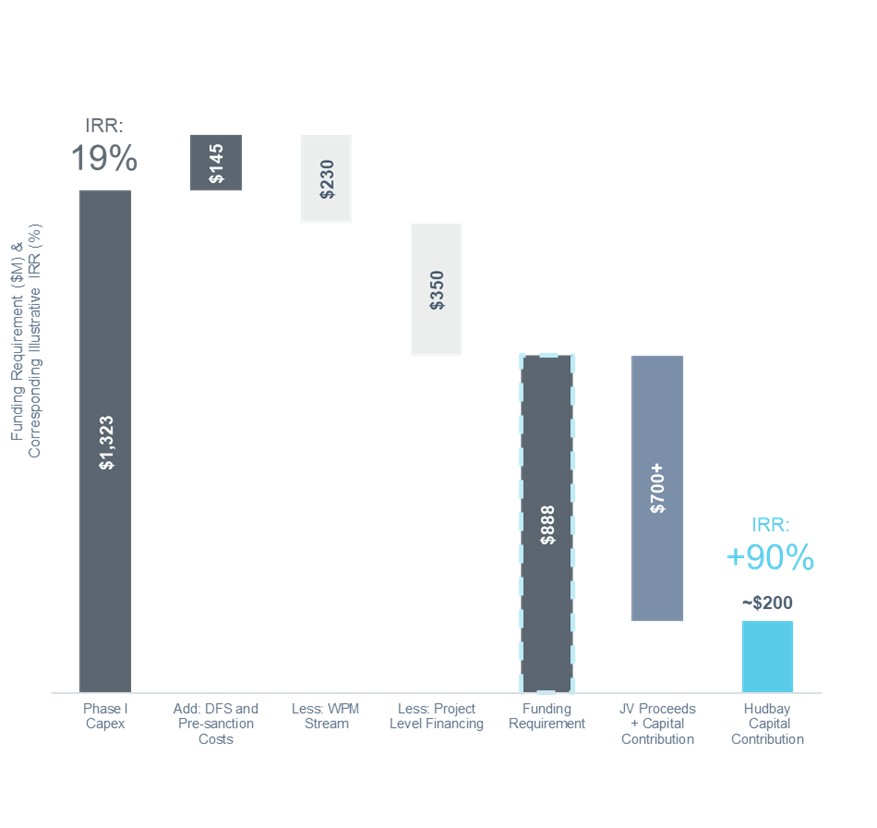

The investment consists of $420 million paid at closing and an additional $180 million within 18 months. This financial influx not only provides immediate capital but also significantly reduces Hudbay’s anticipated future contributions to approximately $200 million. The deal is expected to close in late 2025 or early 2026, pending regulatory approvals.

Strategic Implications of the Joint Venture

Mitsubishi’s entry into the Copper World project underscores the asset’s long-term value. The collaboration is projected to facilitate an estimated $1.5 billion investment in the U.S. critical minerals supply chain, positioning Copper World to produce 85,000 tonnes of “Made in America” copper annually over a mine life of 20 years. This not only aligns with U.S. energy independence goals but also supports the domestic manufacturing sector.

Peter Kukielski, President and CEO of Hudbay, expressed optimism about the partnership, stating, “Securing Mitsubishi as a partner is an important milestone as we establish a long-term strategic partnership to advance this high-quality copper project.” He emphasized the complementary strengths that both companies bring to the table and highlighted the job creation potential, with over 1,000 jobs expected during the construction phase and an estimated 3,000 indirect jobs once production commences.

Mitsubishi’s Chief Operating Officer of the Critical Minerals Division, Taro Abe, acknowledged the strategic importance of the investment, stating, “We are pleased to collaborate with Hudbay, whose operational and development expertise is well-recognized.” The partnership aims to unlock the full potential of Copper World, leveraging Mitsubishi’s extensive experience in the North American mining sector.

Financial Flexibility and Projected Returns

The joint venture is structured to allow Hudbay greater financial flexibility while enhancing the project’s internal rate of return (IRR) to approximately 90%, based on pre-feasibility study estimates. This increase is attributed to the significant capital being injected into the project, which also allows for the deferral of Hudbay’s first capital contribution until 2028 at the earliest.

Furthermore, Hudbay has reached an agreement with Wheaton Precious Metals Corp. to revise the existing streaming agreement for gold and silver produced at Copper World. This amended agreement includes an additional contingent payment of up to $70 million and adjusts ongoing payments to 15% of spot prices, offering increased revenue potential linked to market dynamics.

Hudbay’s financial strategy, referred to as the “3-P plan,” aims to secure crucial funding elements for the development of Copper World. The company has already achieved significant financial milestones, including more than $600 million in cash and cash equivalents as of June 30, 2025.

In conclusion, the partnership with Mitsubishi marks a transformative step for Hudbay Minerals, positioning it to capitalize on the growing demand for copper while contributing to the U.S. critical minerals supply chain. With a solid financial foundation and a trusted partner, Hudbay is well-equipped to advance the Copper World project toward successful production.