The cryptocurrency market experienced a devastating collapse starting on October 10, 2025, resulting in approximately $23 billion in liquidations over the following week. This dramatic downturn erased months of gains and highlighted the fragility of investor sentiment in the digital asset space. The crash was exacerbated by a wave of forced liquidations, with nearly $19 billion lost on the initial day alone, indicating widespread panic among traders.

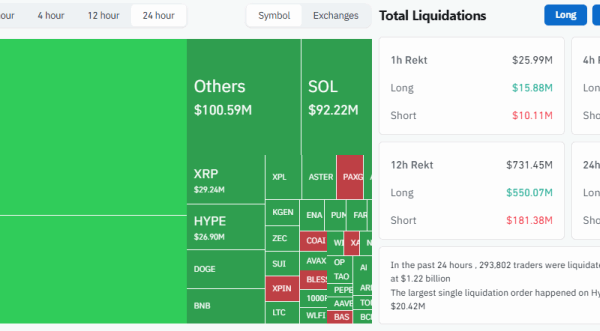

On October 17, the situation worsened as an additional $1.21 billion was liquidated, marking the second-largest daily loss in the month. Major cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and XRP, broke through critical support levels, with Bitcoin plunging to $103,600, Ethereum dropping to $3,700, and XRP reaching $2.20. This significant decline underscores persistent bearish pressure as the market grapples with ongoing volatility.

Market Conditions and Investor Sentiment

The initial crash on October 10 was only the beginning of a week filled with turmoil, as the crypto sector saw further liquidations totaling nearly $23 billion by October 17. Over 294,000 traders faced liquidation within a single day, revealing the sheer scale of the market’s vulnerability. While there were attempts at recovery between October 14 and October 17, these efforts were quickly overshadowed by a resurgence of bearish sentiment, with traders opting to close long positions.

Significant liquidations occurred on several days: approximately $700 million on October 14, followed by $450 million on the 15th, and around $730 million on the 16th. The largest single liquidation took place on October 17 on the Hyperliquid exchange, where an Ethereum position valued at $20.42 million was forcibly closed.

Factors Behind the Crash

A combination of global economic factors contributed to the abrupt downturn in the crypto market. Heightened trade tensions following President Trump’s renewed threats of a 100% tariff on Chinese goods sparked concerns that rippled across various markets. Simultaneously, an ongoing U.S. government shutdown has intensified investor anxiety, leading to a risk-off environment where traders preferred cash and stable assets over cryptocurrencies. This shift was reflected in the soaring price of gold, which reached an all-time high of $4,380 during this period.

The excessive use of leverage in the crypto market further exacerbated the situation, resulting in cascading margin calls that amplified volatility. This environment has led to a notable increase in Bitcoin ETF outflows, with over $500 million withdrawn from these funds, indicating a growing institutional risk aversion.

As traders look ahead, the focus is on the upcoming Federal Reserve meeting scheduled for October 29. Market analysts have assigned a 97% probability to a potential 0.25% rate cut, which could inject liquidity back into the market and possibly stimulate a short-term recovery for cryptocurrencies. Until then, the market remains volatile, with traders bracing for further fluctuations as they seek stability in an uncertain landscape.