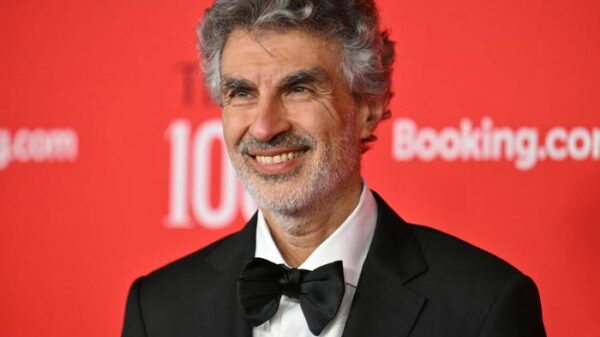

Billionaire investor Ray Dalio has raised alarms about the escalating national debt in the United States, which currently stands at an alarming $32 trillion. In an interview with CNN host Jake Tapper, Dalio outlined his concerns regarding the long-term implications of the rising debt and proposed measures to address the issue.

Dalio emphasized that the increasing national debt poses a significant threat to the economy and social stability. He pointed out that the burden of debt can lead to higher interest rates, reduced economic growth, and increased taxes, ultimately affecting the most vulnerable populations. “If we don’t address this issue, we risk undermining the very foundation of our economic system,” Dalio stated during the interview.

Proposed Solutions to Mitigate Debt Risks

According to Dalio, one of the critical steps to mitigate the risks associated with national debt is implementing a comprehensive spending review. This involves analyzing government expenditures and identifying areas where cuts can be made without harming essential services. He advocates for a balanced approach that combines both spending cuts and revenue increases to ensure fiscal responsibility.

Dalio also suggested that policymakers should consider a gradual increase in taxes on higher-income individuals and corporations to help reduce the debt burden. He believes that a fair tax system can generate necessary revenue while ensuring that those who can afford to contribute more do so. “It’s about fairness and sustainability,” he remarked.

During the discussion, Dalio shared insights into how other countries have successfully navigated similar challenges. He cited examples from nations that faced severe debt crises and implemented structural reforms that ultimately led to economic recovery. These examples serve as a roadmap for the United States, according to Dalio, who believes that proactive measures can prevent a potential crisis.

The Economic Landscape Ahead

As the U.S. government grapples with its fiscal policies, Dalio’s warnings come at a crucial time. The conversation around national debt is intensifying, especially as economic indicators show signs of strain. The Federal Reserve’s recent interest rate hikes have raised concerns about the potential for a recession, making it imperative for leaders to address the growing debt issue.

Dalio concluded the interview by urging lawmakers to act decisively. “We need to start a serious conversation about our national debt. It’s not just a financial issue; it’s a moral one,” he stated. His call to action resonates as the country faces a critical juncture in its economic policy.

The implications of Dalio’s insights extend beyond the financial realm, highlighting the interconnectedness of the economy, social equity, and governance. As the national debt continues to rise, the urgency for effective solutions becomes ever more pressing.