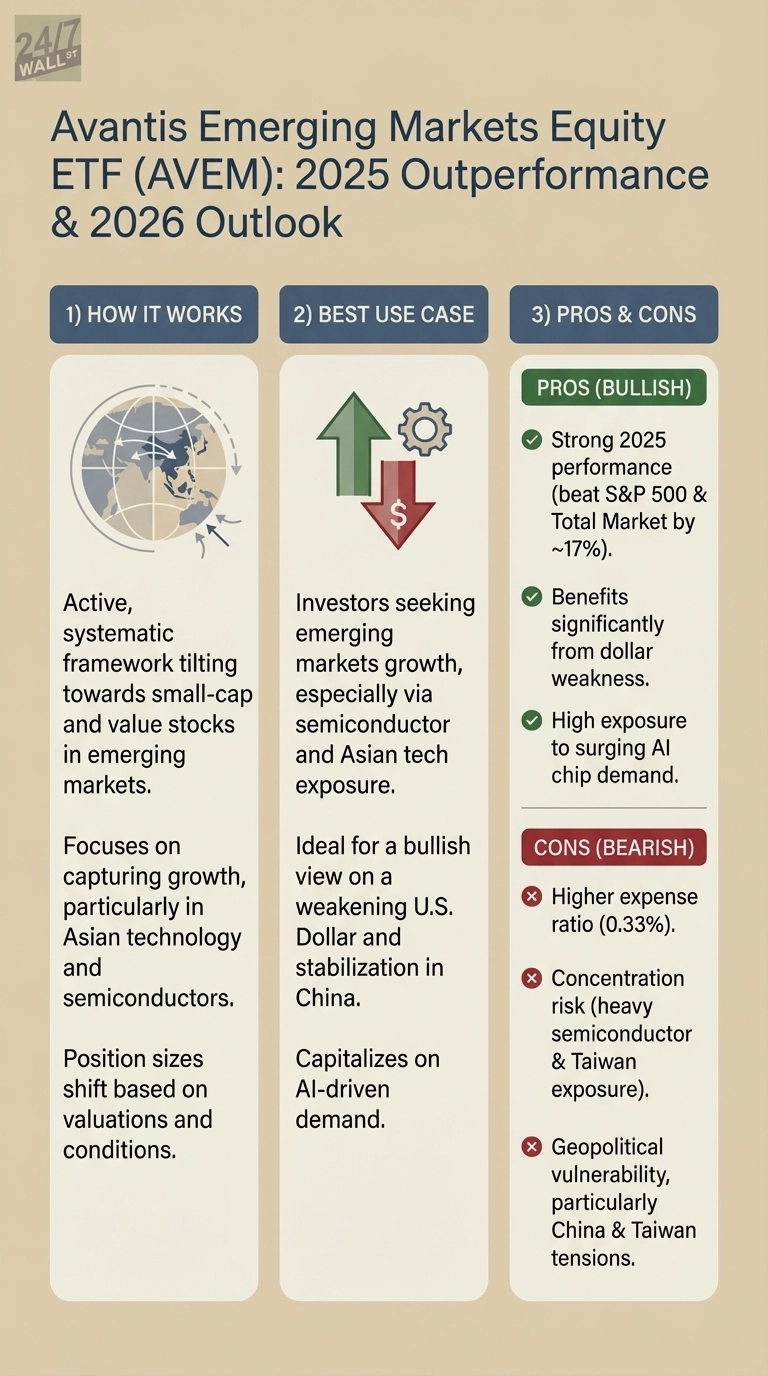

The Avantis Emerging Markets Equity ETF (NYSEARCA:AVEM) achieved a remarkable 35% return in 2025, significantly outperforming major Vanguard funds. Specifically, it surpassed the Vanguard S&P 500 ETF (NYSEARCA:VOO) and the Vanguard Total Stock Market ETF (NYSEARCA:VTI) by approximately 17 percentage points. With assets totaling $15.1 billion, AVEM has positioned itself as a leading player in the market, particularly with heavy investments in the technology and financial sectors of Asia.

One of the key factors contributing to AVEM’s success in 2025 was the weakness of the US dollar. A 9% decline in the dollar throughout the year enhanced the attractiveness of emerging market assets. This dynamic reduced the cost of servicing dollar-denominated debt, encouraged capital inflows into developing economies, and improved local currency returns for US investors. Observing the dollar index closely will be crucial for understanding AVEM’s potential performance in 2026.

The Impact of Dollar Fluctuations and China’s Economic Policies

The strength of the dollar will be a significant macroeconomic factor influencing AVEM in the upcoming year. Should the dollar strengthen again, it could dampen the momentum of AVEM despite individual company performance. Conversely, continued weakness could provide further support, particularly as the Federal Reserve’s monetary policy decisions and global economic growth expectations evolve.

Another major player in AVEM’s performance is China’s economic trajectory. The fund maintains substantial investments in Chinese technology companies, including Tencent and Alibaba, and banking institutions. Recent government measures aimed at bolstering the private sector and stimulating the economy have positively impacted the ETF’s returns. Continued support from Beijing in 2026 could further benefit AVEM, while potential tightening of policies or escalating geopolitical tensions could pose risks.

Sector Concentrations and Alternative Investment Options

AVEM’s portfolio is notably concentrated in the semiconductor sector, with its largest holding being Taiwan Semiconductor (NYSE:TSM), comprising 6.35% of its assets. Other significant positions include Samsung Electronics, SK Hynix, and MediaTek. The demand for semiconductors surged in 2025, largely driven by advancements in artificial intelligence. However, this high concentration also makes AVEM vulnerable to shifts in the semiconductor market and potential supply chain disruptions.

Investors should remain vigilant about geopolitical risks associated with Taiwan, as any increase in tensions across the Taiwan Strait could impact the ETF’s performance. While Taiwan Semiconductor’s expansion into Arizona may mitigate some risks, the concentrated nature of AVEM’s holdings remains a critical factor to consider.

For those seeking simpler or more cost-effective exposure to emerging markets, the iShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG) presents a viable alternative. With assets totaling $117 billion, IEMG offers greater liquidity and a lower expense ratio of 0.09%, compared to AVEM’s 0.33% fee. Unlike AVEM’s active management strategy, IEMG follows a passive index approach, which may appeal to investors seeking a straightforward investment method.

As investors look ahead to 2026, the key question will center on the sustainability of dollar weakness and whether AVEM’s semiconductor-heavy strategy can continue to harness growth driven by technological advancements. This ongoing analysis will be vital in determining the fund’s future trajectory in a rapidly evolving market landscape.