UPDATE: A new report confirms that foreign buyers, led by Chinese nationals, are rapidly returning to the U.S. housing market, with significant investments totaling $56 billion from April 2024 to March 2025. Chinese buyers alone accounted for $13.7 billion, marking an astonishing 83 percent increase from last year’s $7.5 billion.

The National Association of Realtors (NAR) reveals that Chinese nationals purchased 11,700 existing homes in the U.S., representing 15 percent of all foreign buyers. This spike in investment comes as the Chinese housing market struggles to recover post-pandemic, driving buyers to diversify their portfolios in the robust U.S. real estate market.

Matt Christopherson, Director of Business and Consumer Research at NAR, stated, “Chinese buyers see a beneficial opportunity in diversifying their investment portfolios with exposure to stronger U.S. markets.” This shift occurs amid rising tensions between Washington and Beijing, leaving many to wonder how ongoing trade disputes may influence future foreign investments.

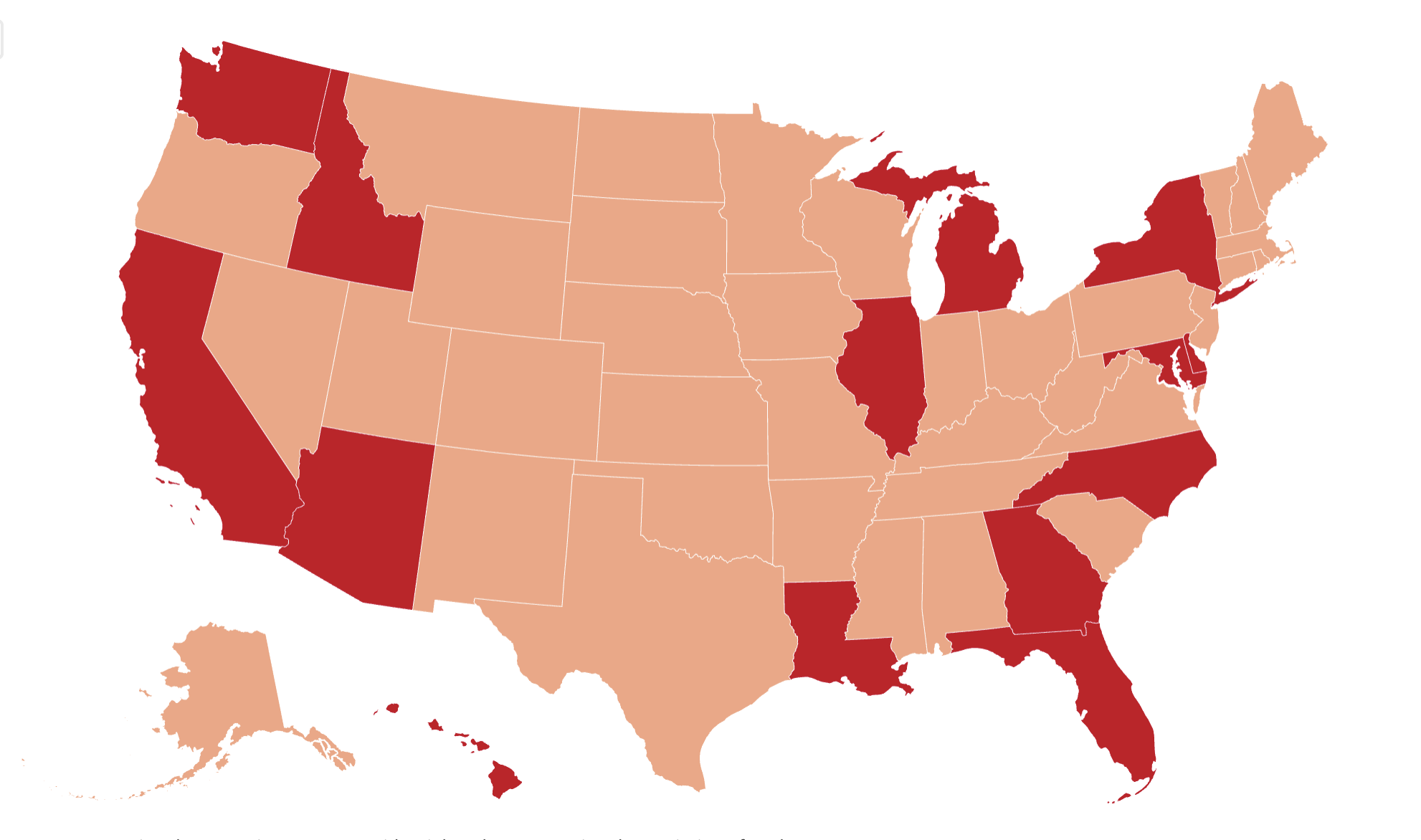

California stands out as the top destination for Chinese buyers, attracting 36 percent of their purchases. Other popular states include Maryland and New York, each capturing 9 percent of the market. Chinese buyers are also increasingly interested in Hawaii (5 percent), Georgia, Idaho, Louisiana, North Carolina, and Washington (each 4 percent), alongside Arizona, Delaware, and Florida (each 3 percent).

The appeal of California lies not only in its proximity to China but also in its thriving economy and cultural connections. Christopherson noted, “Low affordability in California brings strong rental demand, presenting an opportunity for those purchasing residential rentals.” Notably, 57 percent of Chinese buyers are resident buyers, often seeking detached single-family homes for primary residence or rental purposes, particularly in the D.C. metropolitan area.

As Chinese buyers increase their investments in the U.S. housing market, the implications for both economies remain to be seen. With $13.7 billion in real estate purchases, this trend could reshape market dynamics and influence housing prices across the country.

Stay tuned for further updates as this story develops, and keep an eye on how international relations may impact the U.S. housing market in the coming months.