URGENT UPDATE: Bitcoin (BTC) is set to reach a new all-time high in 2026, marking a significant break from its traditional four-year cycle, according to Matt Hougan, Chief Investment Officer at Bitwise Asset Management. In a critical report released on Monday, Hougan emphasized that weakening forces behind Bitcoin’s cycles, combined with pro-crypto regulations and substantial institutional investment, will drive prices upward.

This transformative shift in the crypto landscape comes as major financial institutions like Morgan Stanley and Bank of America begin allocating significant capital into Bitcoin Exchange Traded Funds (ETFs). Just this month, Bank of America has authorized its financial advisors to recommend Bitcoin ETFs, tapping into a staggering $3.5 trillion in client assets and potentially channeling a portion into cryptocurrencies.

Historically, Bitcoin has followed a four-year cycle of three bullish years followed by a sharp pullback. However, Hougan argues that the dynamics have changed. He noted, “The forces that previously drove four-year cycles — the Bitcoin halving, interest rate cycles, and crypto’s leverage-fueled booms and busts — are significantly weaker than they’ve been in past cycles.”

With the last Bitcoin halving occurring in April 2024, many anticipated a pullback year in 2026. However, the emergence of new investor interest and regulatory clarity may redefine this pattern. The research arm of asset manager Grayscale supports this view, projecting a record-setting Bitcoin performance in early 2026 as the market transitions into an “institutional era.”

Furthermore, the current interest rate environment is favorable for cryptocurrencies. Unlike previous years, when rising rates put pressure on digital assets, the U.S. Federal Reserve cut rates three times in 2025 and is expected to continue easing next year, creating a more supportive backdrop for Bitcoin’s growth.

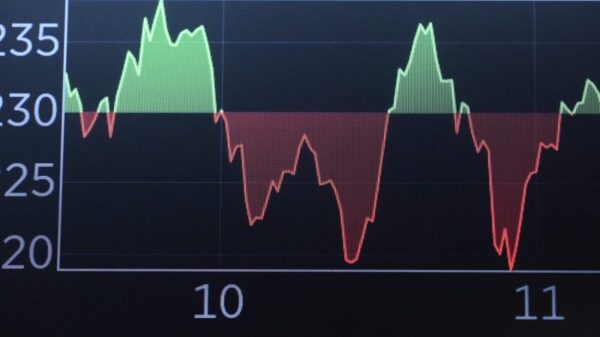

Bitcoin has also shown decreasing volatility, with its price fluctuations becoming less dramatic than those of tech giant Nvidia throughout 2025. Hougan predicts this trend will persist into 2026, along with a reduction in Bitcoin’s correlation with stock markets. This is particularly noteworthy as Bitcoin maintained a strong correlation with the NASDAQ-100 index in 2025, but recent data indicates that Bitcoin’s price movements are less aligned with equities as institutional adoption increases.

Currently, Bitcoin is trading at approximately $87,000, down nearly 1% at the time of this report. As investor sentiment shifts and institutional interest grows, all eyes are set on how Bitcoin will perform in 2026. The combination of lower volatility, institutional backing, and a favorable regulatory environment positions Bitcoin for potential record highs, making it a critical asset to watch in the coming year.

The market is buzzing with excitement, and as developments unfold, it’s clear that Bitcoin is on the cusp of a major transformation. Investors and crypto enthusiasts alike should stay tuned for further updates as this story evolves.