Last weekend, markets experienced a significant downturn, with the Nasdaq 100 leading the decline at over 3%. The S&P 500 followed, dropping 2%, while the S&P 500 Equal Weight index fared slightly better with a 0.9% decrease. These shifts reflect an ongoing trend of market rotation, as discussed by Peter Tchir of Academy Securities. Tchir highlighted various factors influencing market dynamics, including the concept of “free” money and its implications for the economy.

Understanding “Free” Money

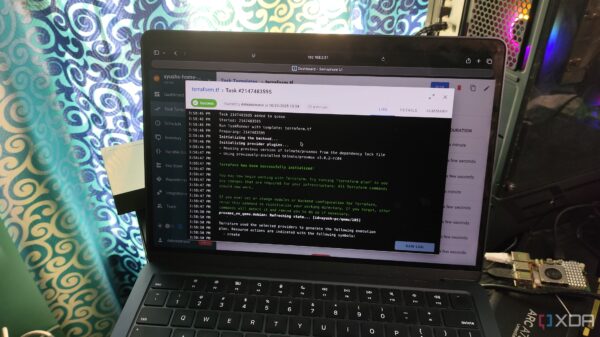

The term “free” money refers to the phenomenon where companies announce substantial spending plans, leading to an immediate increase in their stock prices. For instance, if a firm declares it will invest $10 billion and its stock value rises by $15 billion, it creates a scenario where the company feels incentivized to announce further expenditures. However, Tchir notes that this pattern is changing, particularly in sectors like artificial intelligence and data centers. Companies can no longer rely on merely announcing spending to drive stock prices higher, raising questions about whether they will scale back their investments.

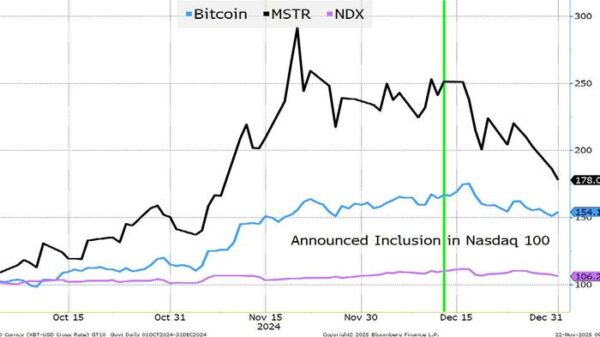

Another area of concern involves Digital Asset Treasury Companies (DATCs), which have seen their stock prices rise in tandem with their cryptocurrency holdings. As companies such as MSTR (MicroStrategy) once traded at a premium to their crypto assets, it was straightforward for them to raise capital, purchase cryptocurrency, and boost their stock value. Yet, as these companies now trade closer to their net asset value (NAV), creating “free” money has become more challenging.

The Intersection of Passive Investing and Digital Assets

Tchir also addressed the growing influence of “passive” investing, especially as it now surpasses traditional active investing. With index funds directing significant inflows towards a limited number of stocks, it raises the question of whether this form of investment is genuinely passive. The Nasdaq 100, for example, allocates a large percentage of its weight to just eleven companies, which can distort overall market valuations.

The most successful DATCs attract investors by providing access to unique opportunities, offering potential returns not readily available in traditional markets. Despite recent challenges in the U.S. market, access to these digital assets remains compelling internationally. On October 10, 2023, Bitcoin’s market cap fell from $122 billion to $105 billion, illustrating the volatility inherent in the cryptocurrency market and its correlation with broader equity markets.

The potential exclusion of DATCs from major indices, such as those managed by MSCI, could have significant ramifications for the cryptocurrency market. If these companies are removed from the indices, it may prompt forced selling and exacerbate existing market pressures. The decision regarding their inclusion is anticipated to be made by January 15, 2024.

As crypto markets continue to evolve, the interconnectedness between cryptocurrencies and traditional equities becomes more pronounced. The decline in Bitcoin’s market cap, which was nearly $2.5 trillion in early October, reflects not just a loss of value but also the potential for broader economic repercussions.

In summary, the concept of “free” money, once a driving force behind stock price increases, is facing a critical juncture. The ramifications of reduced spending and the challenges posed by passive investing could impact various market sectors. As investors navigate these uncertain waters, the potential for volatility remains high, making it essential to monitor developments closely.