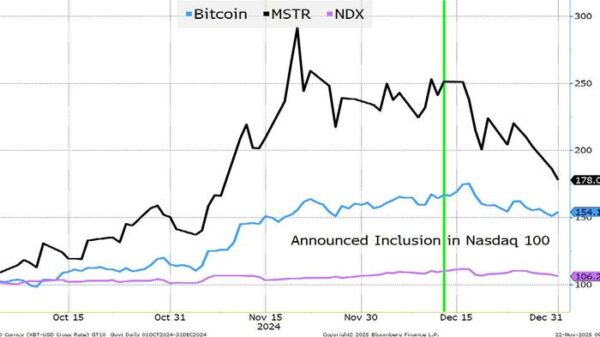

The stock market is reacting as investors reassess their expectations for major players in the artificial intelligence sector, particularly Nvidia. As the company prepares to release its March 2024 earnings report, scrutiny is intensifying around its ability to drive growth in the AI market, especially in light of fluctuating interest rates and recent comments from influential figures such as those at OpenAI.

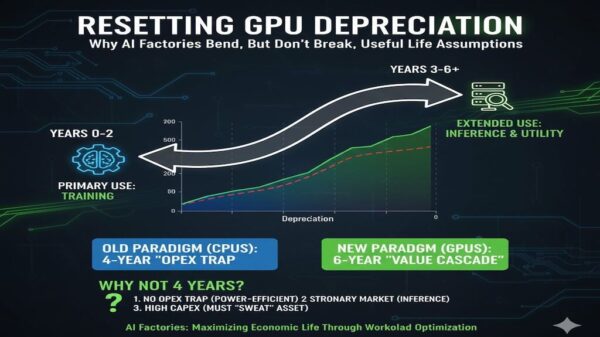

Nvidia has long been hailed as a leader in the technology sector, particularly for its graphics processing units (GPUs) that power AI applications. However, recent market dynamics are prompting a closer examination of whether the company’s growth trajectory can continue. Financial analysts are expressing concerns about the sustainability of Nvidia’s performance amidst growing competition and market uncertainties.

Market Sensitivity Influences Investor Sentiment

The current stock market environment is highly sensitive to various factors, including the direction of interest rates and external commentary from key industry players. Investors are increasingly focused on how these elements could impact Nvidia’s financial outlook. As interest rates rise, the cost of capital increases, potentially dampening investment in technology firms that rely heavily on future growth projections.

Moreover, recent remarks from OpenAI regarding the pace of AI advancement have added to the uncertainty. The organization’s leadership hinted at a more cautious approach to the deployment of AI technologies, which could affect the demand for Nvidia’s products. This commentary has led investors to question whether Nvidia can maintain its dominant position in the rapidly evolving AI landscape.

Analysts are now predicting that Nvidia’s upcoming earnings report will provide critical insights into the company’s performance and its future prospects. Expectations are mixed, with some forecasting a modest increase in revenue while others anticipate potential setbacks due to economic headwinds. The report is expected to shed light on how well Nvidia is navigating these challenges.

Future Growth at Stake

Despite its past successes, Nvidia faces considerable challenges that could hinder its growth. Competition from other technology firms is intensifying, with several companies developing their own AI solutions and hardware. This competitive landscape raises questions about Nvidia’s ability to maintain its market share and profitability.

Furthermore, as businesses reevaluate their technology budgets in light of rising costs, the demand for Nvidia’s GPUs may be affected. The company’s dependence on a few key sectors for revenue, such as gaming and data centers, could pose risks if these markets experience any downturns.

Investors will be watching closely to determine how Nvidia’s leadership plans to address these challenges. The company’s strategies for innovation, cost management, and market expansion will likely be key focal points in the earnings report.

As Nvidia prepares to unveil its results, the financial community remains alert to the implications for the broader AI market. The outcome of this report may not only influence Nvidia’s stock price but also shape investor confidence in the future of AI technologies.

In conclusion, the upcoming earnings report will be pivotal for Nvidia as it seeks to reassure investors about its role in the AI market. With various external pressures and a competitive landscape, the once-revered tech giant must demonstrate resilience to maintain its position as a leader in the rapidly changing technology sector.