Walmart announced a remarkable increase in its U.S. eCommerce sales, which surged by 28% in the third quarter of 2026. The results, released on November 20, reflect consumers’ ongoing preference for value, prompting many shoppers to utilize digital channels for their purchases. This trend contributed to a global eCommerce sales rise of 27%, with every market segment experiencing growth of over 20%.

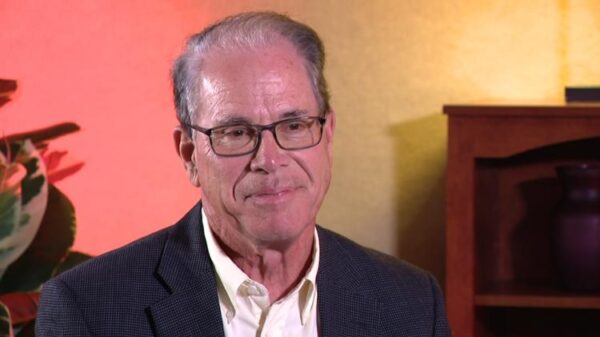

During a conference call with analysts, Walmart CEO Doug McMillon, who has announced his retirement, emphasized that there was an increase in transaction and unit volume across all segments. He noted that the retail giant is gaining market share in both grocery and general merchandise sectors within the United States. While consumers are still spending, the economic pressures vary across different income levels. According to McMillon, Walmart observed spending strength among higher-income households, while middle-income customers remained stable. In contrast, lower-income families have faced increasing financial challenges recently.

Walmart Chief Financial Officer John David Rainey commented on the overall economic environment, describing it as consistent with “pockets of moderation.” He also highlighted that early holiday activity appears to be strong, setting the stage for a robust fourth quarter.

Digital Growth Driving Sales

Walmart’s digital performance was a significant highlight in the latest earnings report. The company reported that U.S. eCommerce sales have now experienced above 20% growth for seven consecutive quarters, primarily driven by services such as pickup and delivery. Rainey noted that approximately 35% of store-fulfilled orders were expedited or delivered in under three hours, with sales through these channels witnessing a nearly 70% increase this quarter.

In addition, membership and other income in Walmart U.S. rose by 7.6%, with Walmart+ fee income growing at a double-digit rate. Globally, membership income increased by 17%. Rainey stated that the third quarter marked the best performance for Walmart+ in terms of net additions since the program’s launch, attributing this success to faster delivery times and the introduction of the OnePay credit card, which offers 5% cash back on Walmart purchases.

Strength Across Categories

Consumers have shown a continued preference for food and essential categories. However, Walmart also reported gains in discretionary spending areas. U.S. grocery comparable sales increased in low single digits, buoyed by strong performance in fresh food. Health and wellness sales rose by low double digits, driven by a higher branded drug mix and strong optical sales, while general merchandise saw low single-digit growth, led by fashion, home goods, and automotive products. Marketplace categories, including apparel, electronics, and toys, expanded by more than 40%.

Internationally, Walmart achieved strong results as well, with net sales rising 11.4% in constant currency and eCommerce growing by 26%.

As Walmart approaches the holiday season, executives expressed optimism. Rainey highlighted that early indicators from back-to-school and Halloween shopping were promising, suggesting that Q4 may align closely with the strong performance observed earlier in the year. Following the earnings release, Walmart shares rose by 6% in early trading.

The company continues to emphasize the importance of its pickup and delivery services, now available to 95% of U.S. households within three hours. At Sam’s Club, the introduction of free curbside pickup for all members has led to significant growth in club-fulfilled delivery.

Walmart’s third-party seller network remains a crucial growth driver, with U.S. marketplace sales climbing by 17%. The company’s advertising division, Walmart Connect, experienced a 33% increase in U.S. advertising revenue, while global advertising soared by 53%, aided by partnerships with companies like Vizio.

Management also introduced several advancements in payments and FinTech capabilities. The expansion of the OnePay credit card, integrated into the Walmart+ ecosystem, aims to enhance customer experience through cash rewards. New integrations powered by OpenAI allow customers to purchase items directly via ChatGPT, further streamlining the shopping experience.

As Walmart automates its distribution and fulfillment centers, more than 60% of U.S. stores are now receiving freight from automated facilities, with over 50% of eCommerce fulfillment now being automated. These initiatives are designed to improve efficiency and responsiveness to consumer needs as the company continues to adapt to a rapidly changing retail landscape.