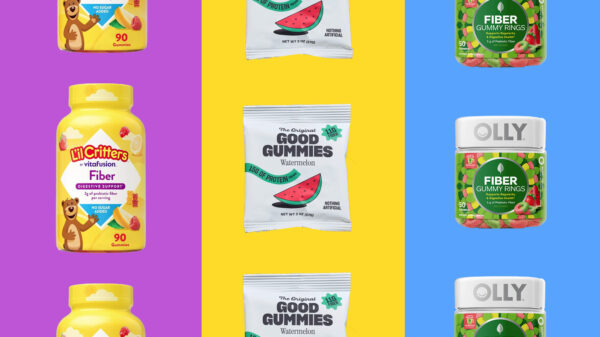

As consumer prices for food items like beef, coffee, and bananas continue to rise, the administration of President Donald Trump has reversed its stance on tariffs, exempting more than 200 food products from import duties. This decision, aimed at alleviating the financial burden on consumers, comes in light of soaring prices attributed to the previous tariffs imposed earlier this year.

In an executive order signed on November 13, 2025, the White House announced the lifting of tariffs on agricultural products that cannot be produced at scale within the United States, specifically highlighting coffee and bananas. Trump’s initial tariffs, introduced under the banner of encouraging U.S. self-sufficiency, faced significant backlash as essential imports remained critical to meet domestic demand.

Earlier this year, Trump characterized the tariff implementation as “Liberation Day,” claiming it was a necessary step to bolster U.S. agricultural independence. He stated in an executive order dated April 2, 2025, that “neither can a nation long survive if it can’t produce its own food.” Yet, as prices for coffee surged over 40% year-over-year and banana prices increased nearly 9%, it became evident that the U.S. could not sufficiently supply its own needs for these products.

Trump acknowledged the situation, stating, “We just had a little bit of a rollback on some foods, like coffee as an example, where the prices of coffee are a little bit high now. They’ll be on the low side in a very short period of time.” The exemptions will ease the financial strain on consumers as the administration seeks to address inflation concerns.

The tariffs originally imposed had reached as high as 50% on coffee imports from major producers like Brazil and Vietnam, and similar rates were applied to bananas from Central and South America. This approach aimed to discourage reliance on foreign goods, but it became evident that the U.S. lacks the capacity to produce enough coffee and bananas to meet its consumption needs.

Despite the rollback of tariffs, Trump maintains that the tariffs have served a purpose. He insists that they are a “revenue raiser,” and hinted at the possibility of distributing benefits to the public through direct financial assistance, proposing checks of $2,000 per person. However, any such measures would require Congressional approval, complicating the timeline for relief.

The legal landscape surrounding these tariffs is also contentious. In August, a federal appeals court ruled that Trump’s use of the International Emergency Economic Powers Act to impose tariffs was overreaching. The court found that the authority to levy taxes, including tariffs, is constitutionally vested in Congress. This ruling has been appealed to the Supreme Court, which is currently deliberating on the matter.

In the ongoing debate about tariffs, critics argue that the imposition of such taxes can lead to unintended consequences, like increased prices for consumers. While some sectors, such as the automotive industry, may benefit from protectionist measures, the tariffs on coffee and bananas demonstrated that certain products cannot be produced domestically in sufficient quantities.

Even as the Trump administration rolls back these tariffs, the broader inflationary pressures remain a concern. Average grocery prices in the United States were reported to be 2.7% higher in September compared to the previous year, increasing the urgency for effective policy responses.

As the situation develops, the administration faces pressure to address rising costs while managing the complexities of international trade and domestic agriculture. The future of tariffs and their impact on both consumers and producers remains uncertain as legal challenges and market forces continue to shape the landscape.