Morgan Stanley has announced plans to integrate cryptocurrency trading into its digital investing platform, E*Trade, beginning in early 2026. This partnership with the digital asset infrastructure provider Zerohash marks a significant step for U.S. banks and investment firms as they increasingly embrace digital assets in their service offerings.

Jed Finn, Morgan Stanley’s head of wealth management, emphasized the importance of this move, stating that clients should have access to a diverse range of investment options, including digital assets, traditional assets, and cryptocurrencies, all within a familiar ecosystem. The initial offerings will include major cryptocurrencies such as Bitcoin, Ether, and Solana.

Zerohash recently celebrated achieving unicorn status, with a valuation of $1 billion following a funding round that raised $104 million. The round was led by Interactive Brokers, with participation from Morgan Stanley and SoFi, among others. This funding brings Zerohash’s total capital raised to $275 million.

“We are building the AWS of on-chain infrastructure,” said Edward Woodford, CEO of Zerohash. He highlighted the growing significance of cryptocurrencies, stablecoins, and tokenization, asserting that these technologies are not just emerging trends but are here to stay. Woodford’s comments reflect a broader shift in the financial industry as increasing demand for enterprise on-chain infrastructure becomes evident.

Investment in distributed ledger technology is accelerating as banks adapt to changing market conditions. Adam Berg, CFO at Zerohash, noted that many large bank CEOs and financial services executives are dedicating over 50% of their time to driving innovation in on-chain solutions. This trend highlights the urgency for financial institutions to stay competitive in the evolving digital asset landscape.

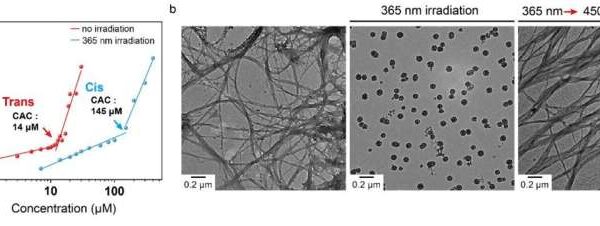

Zerohash provides infrastructure for three main types of digital assets: cryptocurrency, stablecoins, and tokenized assets. Woodford explained that all three categories share a similar technological foundation, which simplifies integration for clients. For example, the Ethereum blockchain supports both Ether and tokenized stocks, highlighting the versatility of the underlying technology.

The partnership with Morgan Stanley is part of Zerohash’s broader strategy to work with various financial institutions, including neobanks like Current and MoneyLion, as well as payment processors such as Stripe and Shift4. This diverse client base indicates the widespread demand for digital asset management solutions across the financial services sector.

Young Pham, chief strategy officer at technology firm CI&T, described the recent funding round as “great validation” for Zerohash’s role in the cryptocurrency and stablecoin infrastructure landscape. He noted that traditional financial services firms are increasingly pursuing digital asset management, with previous hesitations around governance and regulatory compliance dissipating.

This investment is expected to accelerate the development of capabilities in digital payments, asset custody, and settlement. Pham pointed out that the shift toward stablecoins is driven not only by the volatility of cryptocurrencies but also by the reliability of service providers in the sector.

As Morgan Stanley rolls out cryptocurrency trading services in partnership with Zerohash, the financial landscape is poised for significant transformation, reflecting a growing acceptance of digital assets in mainstream finance.