Bitcoin’s price is currently around $112,734, having faced significant fluctuations today. The cryptocurrency dipped to a low of $111,370 before recovering slightly. As it settles near this mark, traders are observing key resistance at $124,500 and support at $111,400, with the market sentiment influenced by institutional flows and the latest shifts in Federal Reserve policy.

The recent trading session saw Bitcoin reach a high of $113,319, reflecting the ongoing volatility in the market. Over the past week, the price has dropped from levels between $114,000 and $118,000, now establishing a narrow trading range. The resistance levels at $112,500 and $124,500 are pivotal, as a breakout could lead to significant price movements.

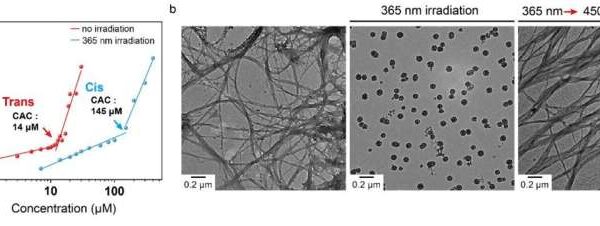

Chart patterns suggest a potential head-and-shoulders formation, which typically indicates market weakness if the neckline breaks. The Relative Strength Index (RSI) points to diminishing buying pressure, while recent outflows from Bitcoin ETFs suggest a decline in institutional demand—an essential factor in this month’s market dynamics.

The broader economic landscape is also shaping Bitcoin’s outlook. Following the Federal Reserve’s decision to cut interest rates, a temporary boost for Bitcoin and other cryptocurrencies was observed. Generally, lower interest rates encourage risk-taking among investors. However, mixed signals from Fed officials regarding future rate cuts have introduced uncertainty, prompting investors to monitor upcoming inflation data closely, particularly the core PCE index.

If inflation remains stubbornly high, the Fed may adopt a more hawkish approach, potentially dampening enthusiasm for Bitcoin. Conversely, if inflation eases, Bitcoin could see renewed strength as investors shift back towards digital assets.

Institutional activity continues to play a crucial role in Bitcoin’s trading environment. Recently, Bitcoin mining company CleanSpark secured a $100 million credit facility backed by Bitcoin from Coinbase, showcasing confidence in long-term mining operations. Additionally, Strive, supported by investor Vivek Ramaswamy, announced a $1.3 billion all-stock acquisition of Semler Scientific, which resulted in the addition of over 5,800 BTC to its balance sheet, raising its total holdings to more than 10,900 BTC valued at nearly $675 million. These developments indicate that Bitcoin is increasingly becoming integral to corporate financial strategies.

Recent weeks have witnessed sharp volatility in the cryptocurrency market, with over $1.5 billion worth of crypto positions liquidated in a single day, significantly affecting Bitcoin. This sudden drop briefly pushed the price close to $111,000 before it recovered some ground. Many of these liquidations stemmed from leveraged long positions, which are particularly susceptible to market swings. Some analysts view these liquidations as a necessary correction to clear excessive leverage, while others caution that ongoing ETF outflows and weak demand could further pressure Bitcoin’s price.

In the immediate future, analysts expect Bitcoin to maintain a range-bound position, likely trading between $112,500 and $113,500. A strong close above $112,500 could propel Bitcoin towards $117,000, while a breakout beyond $124,500 would be necessary for a significant rally. On the downside, falling below $111,400 may trigger heavier selling and push prices toward the $107,000 to $110,000 range. If institutional outflows intensify, Bitcoin could test the critical $100,000 level.

Looking ahead, if inflation data shows a decrease and the Federal Reserve signals aggressive rate cuts, Bitcoin’s price could revisit highs around $124,000. Some forecasts even predict that Bitcoin could reach $173,000 by the end of 2025, based on historical trends where September corrections are often followed by strong year-end rallies.

Recent research has attempted to enhance Bitcoin price predictions using artificial intelligence. One method employing deep learning and wavelet transforms reported an accuracy rate of approximately 82 percent for longer time frames. Another study pointed out that while the cryptocurrency market can exhibit inefficiencies, opportunities for consistent profits are rare due to rapid changes in market conditions.

As the Bitcoin market navigates through uncertainty, several risks could impact its performance in the coming months. Higher-than-expected inflation could prompt the Federal Reserve to adopt a tougher stance, making riskier assets less appealing. Continued ETF outflows could further diminish institutional demand, while stringent regulatory actions in major markets might add additional pressures. Moreover, risks such as exchange hacks, technical failures, or loss of retail investor trust remain concerns.

Conversely, potential catalysts could support Bitcoin’s price. A favorable move from the Federal Reserve may encourage greater capital inflows. Institutional investors and corporate treasuries expanding their Bitcoin holdings could spark renewed demand, while clearer regulations, particularly in the United States, might alleviate uncertainty. Improvements in Bitcoin adoption, such as enhanced payment systems or advanced technology layers, could further bolster its appeal. In addition, rising geopolitical tensions could drive investors towards Bitcoin as a safe-haven asset.

As of now, Bitcoin’s price is locked within the $112,000 to $113,000 range after retreating from recent highs. Key resistance levels are positioned at $112,500 and $124,500, while support is being tested at $111,400. The impending big move will largely hinge on US monetary policy, institutional flows, and overall investor sentiment. A decisive breakout above resistance could ignite a rally, while a drop beneath support may lead to deeper losses. Until then, Bitcoin is likely to continue experiencing sideways trading with high volatility, keeping market participants focused on economic indicators, ETF flows, and corporate developments for future direction.