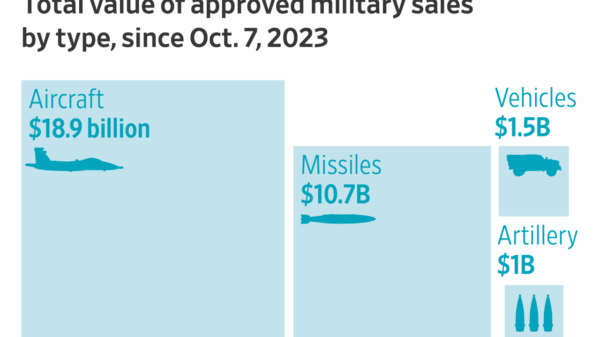

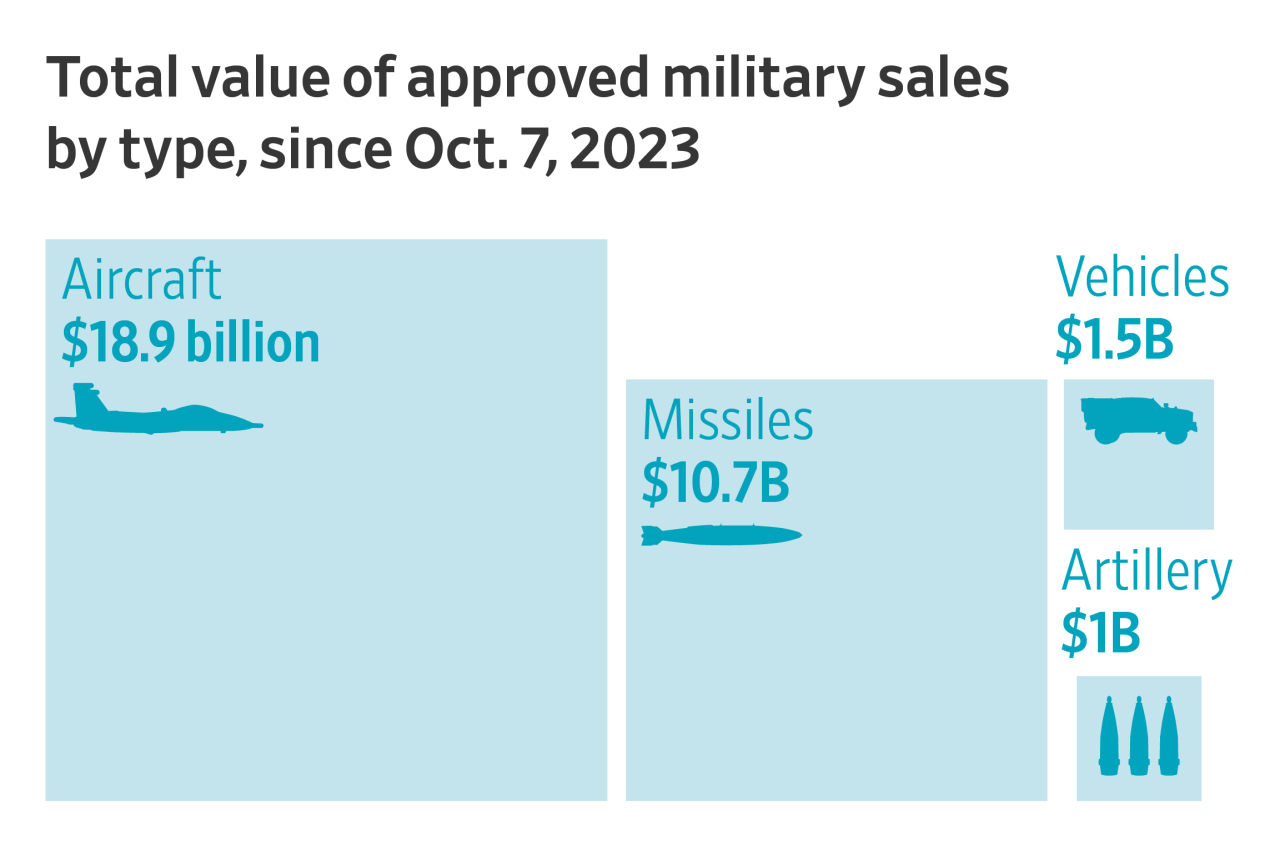

The ongoing conflict in Gaza has led to significant financial gains for American companies, particularly in the defense sector. While the humanitarian toll remains severe, U.S. firms are seeing substantial increases in sales, with estimates suggesting that the conflict has generated over $2 billion in revenue since hostilities escalated in 2023.

Many defense contractors, including major players such as Lockheed Martin, Northrop Grumman, and Raytheon, have reported record sales. The demand for military equipment, including missile defense systems and drone technology, has surged as the Israeli Defense Forces (IDF) continue their operations in Gaza. As countries around the world seek to bolster their military capabilities, U.S. firms are positioned to benefit significantly from these developments.

Growing Demand for Military Solutions

Sales figures reflect a notable trend in military spending. According to the U.S. Department of Defense, contracts awarded to defense contractors have risen sharply, with a focus on missile systems and surveillance technologies. The IDF’s reliance on advanced weaponry to counter perceived threats has resulted in increased orders for American-made military equipment.

In just the past few months, companies like Raytheon have secured contracts worth hundreds of millions. Each deal not only reflects the urgent needs of the Israeli military but also underscores the strategic relationship between the United States and Israel. This partnership has historically included significant military aid, with the U.S. providing around $3.8 billion annually to Israel.

Despite the controversy surrounding the conflict, these financial gains have prompted discussions within the U.S. Congress about the role of defense spending in foreign policy. Some lawmakers are advocating for increased oversight of military contracts, emphasizing the need for a balance between financial interests and humanitarian concerns.

Economic Implications and Ethical Considerations

The revenue generated by the conflict raises ethical questions about the role of U.S. companies in global conflicts. Critics argue that profiting from warfare highlights a troubling aspect of the defense industry, where financial success is intertwined with violence and instability. Organizations advocating for peace have called for a reevaluation of military spending, urging lawmakers to consider the societal impacts of their decisions.

Proponents of the defense industry counter that military preparedness is essential for national security and global stability. They argue that U.S. technology plays a crucial role in ensuring that allies, such as Israel, remain capable of defending themselves in a volatile region.

The intersection of business and conflict is not new. Historical patterns show that wars often bolster defense contracts, leading to profit spikes for companies involved in military production. Nevertheless, the current situation in Gaza has intensified scrutiny of these practices, as global audiences increasingly demand accountability and transparency.

As the conflict continues, the financial implications for U.S. firms will likely evolve. Analysts predict that as long as tensions persist, defense contracts and military sales will remain a significant component of the U.S. economy. While the exact figures may fluctuate, the underlying trend appears clear: American companies are benefitting from the ongoing turmoil, raising pressing questions about the moral implications of such profits.

The situation in Gaza remains fluid, and the humanitarian crisis continues to unfold. As the international community grapples with the conflict, the financial dynamics involving U.S. companies serve as a reminder of the complex interplay between war and commerce.