UPDATE: In a significant development, Simon Sanchez High School is poised to receive a crucial $16.3 million funding increase to aid in relocating students to a new campus in Yigo. This funding is contingent upon the passage of the fiscal year 2026 budget bill, which is currently under deliberation. Lawmakers are racing against the clock to finalize amendments as discussions are expected to continue until 10 p.m. tonight.

Senator Joe San Agustin championed the inclusion of this vital funding as lawmakers worked through the budget act on the fourth day of deliberations. The financial boost will draw from a surplus of approximately $30.9 million in excess tax and fee revenue that GovGuam has generated above projections for 2025.

The urgency for the additional funds stems from rising construction costs, with Bureau of Budget and Management Research Director Lester Carlson stating that without this financial support, the buildout would be akin to “buying a Corolla and not a Lexus.” He further emphasized that GovGuam’s team is preparing to enter the bond market for construction financing as early as October.

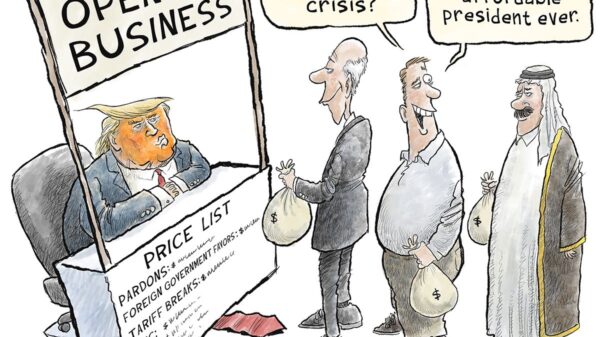

While the funding for Sanchez High is moving forward, attempts to provide tax relief for small businesses have hit a wall. The amended budget act will lower business privilege tax rates from 5% to 4.5% by October 1, 2025, and further to 4% by October 1, 2026. However, Senator Therese Terlaje‘s proposal to reduce the tax rate to 3% for businesses earning between $500,000 and $2 million annually was rejected, which she estimated could provide about $20,000 in tax relief for those businesses.

Senator Chris Duenas, the budget chairman, expressed his support for utilizing excess revenues, despite earlier reservations, stating, “This is the right thing to do.” He criticized the Leon Guerrero-Tenorio administration for delays in moving the Sanchez construction forward, which he claims have inflated costs.

As lawmakers continue to debate the budget amendments, the future of several proposed tax rate changes remains uncertain. Notably, an attempt by Senator Telo Taitague to maintain a 5% tax rate for military contracts exceeding $10 million also failed, as did efforts to adjust rates for larger businesses.

The urgency of the situation surrounding Simon Sanchez High School reflects broader concerns about education funding and fiscal management in Guam. As decisions unfold, the implications for local businesses and educational infrastructure remain a focal point for the community.

Stay tuned for further updates as the budget discussions progress.