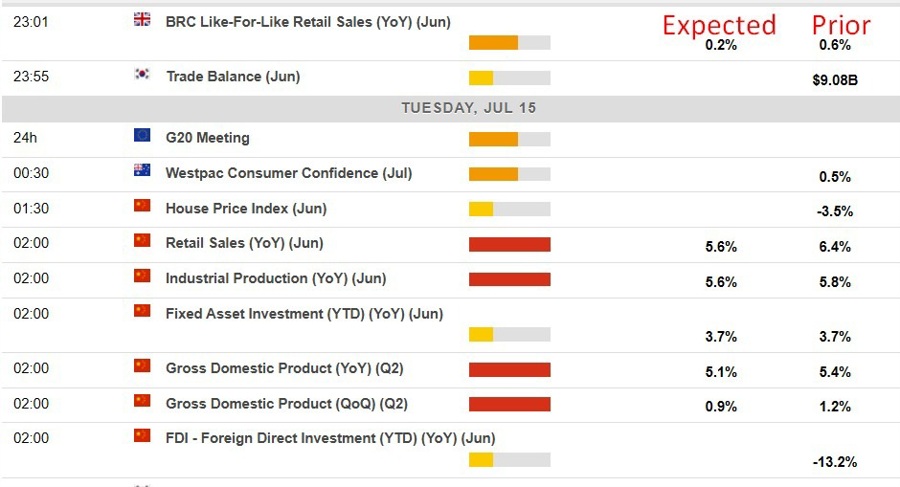

China is poised to release significant economic data on July 15, 2025, with expectations that the country’s Gross Domestic Product (GDP) for the second quarter will exceed the government’s annual growth target. Analysts predict that China’s economy likely expanded at a faster pace than the official benchmark, reflecting a robust performance during the period.

In addition to GDP figures, data for June will shed light on various economic activities. Industrial production and investment are anticipated to remain steady, while retail sales are expected to show a decline from previous months, landing at a still healthy 5.6% year-on-year growth rate. This mixed set of expectations highlights the ongoing complexities within the Chinese economy as it navigates recovery post-pandemic.

The outlook for equities in China appears optimistic, driven by increased investments from Sovereign Wealth Funds and Central Banks. Investors are increasingly betting on improvements in the Chinese economy, leading to a notable shift in financial flows. This trend raises questions about where these institutions are reallocating their resources, with many focusing on China as a primary investment destination.

President Xi Jinping has intensified his campaign against deflation, implementing policies aimed at stimulating economic growth. The government is expected to ramp up fiscal support in the latter half of the year, broadening its initiatives to bolster economic activity. This “anti-involution” policy reflects a strategic shift aimed at addressing current economic challenges while ensuring sustainable growth moving forward.

According to ForexLive, the economic data calendar for July 15 includes crucial indicators that will influence market sentiment. The release times are set in Greenwich Mean Time (GMT), providing a clear framework for investors to track the data as it becomes available.

As the financial community prepares for this data release, the implications of China’s economic performance will be closely watched, not only for local markets but also for its potential impact on global economic trends. The upcoming figures will offer a clearer picture of the trajectory of China’s recovery and its role in the international economy as the world continues to grapple with post-pandemic challenges.