The future of XRP, the digital asset associated with Ripple Labs, is under scrutiny as discussions emerge about its potential inclusion in the United States’ crypto reserve strategy. Known for its rapid and cost-effective transaction capabilities, XRP has positioned itself as a viable candidate for the evolving landscape of digital finance. However, significant hurdles remain, particularly regarding regulatory clarity, which is essential for any cryptocurrency to gain acceptance as part of national reserves.

XRP stands out in the cryptocurrency market due to its ability to facilitate fast cross-border payments. Transactions using XRP can be settled in just 3-5 seconds, with a capacity to handle up to 1,500 transactions per second. This efficiency makes XRP attractive to financial institutions and central banks that prioritize speed and liquidity. As the cryptocurrency market matures, XRP has garnered attention from institutional investors, particularly in light of increasing adoption of Central Bank Digital Currencies (CBDCs) and blockchain technologies.

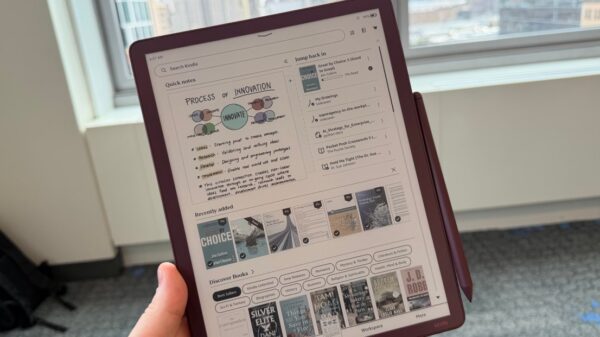

While the concept of a crypto reserve is still in its infancy, it poses intriguing possibilities. A crypto reserve, akin to traditional reserves of gold or foreign currency, would consist of digital assets held by governments to provide financial stability. Some experts suggest that a diversified basket of cryptocurrencies, including Bitcoin and Ethereum, could serve as a financial backstop in a future digital economy. The International Monetary Fund (IMF) has also hinted at the potential for digital equivalents to its Special Drawing Rights (SDRs), which could incorporate various cryptocurrencies.

Despite its promising attributes, XRP’s journey towards becoming a recognized reserve asset is impeded by regulatory uncertainty. The US Securities and Exchange Commission (SEC) initiated a lawsuit against Ripple Labs in 2020, questioning whether XRP qualifies as a security. Although a partial court ruling in March 2023 stated that XRP is not classified as a security when traded on exchanges, comprehensive legal clarity has yet to be established. The absence of a clear regulatory framework remains a significant barrier, as stability and transparency are vital for any asset considered for national reserves.

Ripple Labs has formed partnerships with over 100 financial institutions worldwide, enhancing XRP’s credibility in financial networks. The company’s technology has been evaluated for integration into real-time settlement systems, further bolstering its case for inclusion in a potential US crypto reserve. Ripple has also engaged with various governments to explore the launch of their own CBDCs, indicating growing institutional trust in XRP’s underlying technology.

Should the US decide to consider cryptocurrencies for its reserves, XRP could be part of a broader basket rather than a sole replacement for traditional assets. This approach could mitigate the volatility typically associated with individual cryptocurrencies. Analysts suggest that XRP, alongside Bitcoin and Ethereum, could each fulfill distinct roles within a diversified reserve system. Bitcoin may serve as a decentralized store of value, Ethereum could facilitate programmable financial services, and XRP would focus on expediting international transactions.

As discussions about the role of cryptocurrencies in national financial strategies continue, the question remains: Can XRP ever become part of the US crypto reserve? Theoretically, yes, but practical implementation requires substantial regulatory clarity and a shift in US monetary policy. Acknowledgment of cryptocurrencies as a legitimate asset class by the financial community is essential for this transition.

For now, the notion of XRP as part of a national reserve is speculative yet intriguing, reflecting the ongoing evolution of digital finance. The future of XRP, along with its potential role in the US crypto reserve strategy, will depend on regulatory developments and the broader acceptance of cryptocurrencies in the financial ecosystem.