The global television market is undergoing a significant transformation as Chinese manufacturers, particularly TCL and Hisense, challenge the long-standing dominance of Samsung through competitive pricing and a strategic emphasis on larger screen MiniLED technology. In 2024, TV panel revenues increased by 19% year-over-year, reflecting heightened demand for large-screen models, despite rising price competition and shifting consumer preferences.

As the market adapts, the overall flat panel display sector experienced an 11% growth, driven largely by the surge in demand for larger displays. Shipments of Advanced TVs, specifically those measuring 75 inches or larger, saw a remarkable 79% increase in Q1 2025, with revenues climbing by 59%. This trend toward larger screens is reshaping competitive dynamics, offering growth opportunities even amid pressures on unit volumes.

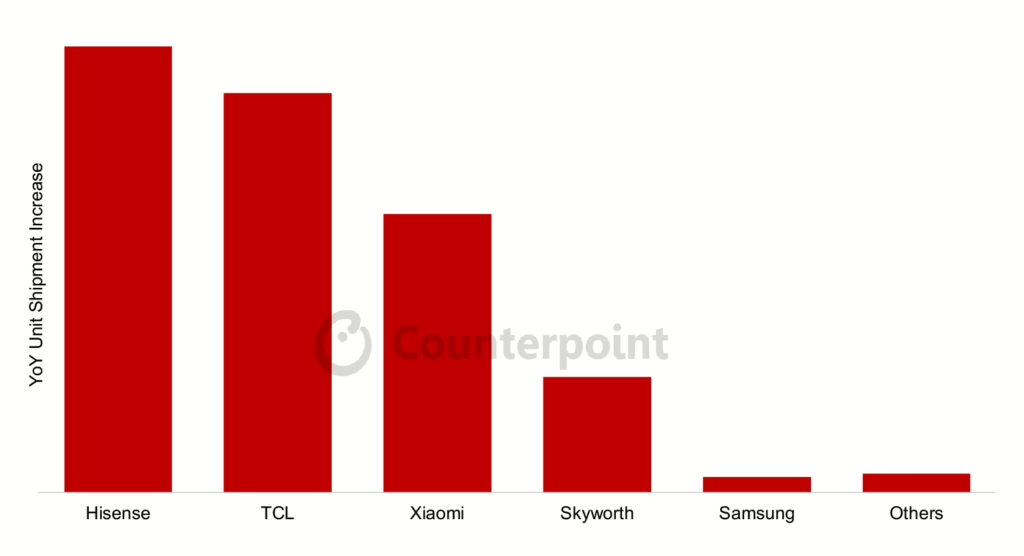

Chinese Competitors Gain Ground

Both TCL and Hisense have emerged as formidable contenders in the television landscape, achieving triple-digit percentage increases in shipments during Q1 2025. Hisense’s market share jumped from 14% to 20% in units and from 13% to 17% in revenue share year-over-year. Similarly, TCL saw its unit share rise from 13% to 19% and revenue share increase from 13% to 16%. For the first time in nearly two decades, Samsung faces a genuine threat to its leadership position.

Samsung’s focus on OLED technology has left it exposed to Chinese competitors, who leverage China’s LCD manufacturing strength to offer larger screens at more competitive prices. This shift has resulted in a decline in market positions for both Samsung and LG, as Chinese brands effectively promote large-screen MiniLED LCD models, diminishing the prominence of OLED in the premium market. By Q2 2024, MiniLED TVs surpassed OLED in both shipments and revenues, continuing to capture an increasing share of the market.

China Fuels Growth in Advanced TVs

China is emerging as the primary driver of growth in the Advanced TV segment, with revenues rising at an astonishing rate. Government incentives encouraging consumers to trade in older models, combined with aggressive promotions from domestic brands, have fueled this surge. Chinese brands are not only succeeding within their home market but also gaining traction in other regional markets, contributing to their global expansion.

Despite the strong performance in 2024, industry analysts caution that the current growth momentum may not be sustainable. They describe the year’s growth as a “reset” rather than a long-term trend, predicting that intensifying price competition will continue to pressure panel revenues after 2025. The landscape suggests that while unit growth in TV panels and larger screen sizes will persist, revenue growth will face constraints from ongoing price competition.

Manufacturers are entering a challenging environment where unit growth is accompanied by significant pressure on average selling prices. The successful strategies of Chinese brands illustrate a shift in market dynamics, prioritizing screen size over premium display technologies. Their ability to deliver large displays at competitive prices allows them to capitalize on changing consumer preferences.

The competitive response from established players like Samsung and LG may require enhanced focus on manufacturing efficiency and cost optimization. As the television market navigates this pivotal shift, manufacturers who can balance screen size, display technology, and competitive pricing will emerge as the leaders in an increasingly size-conscious landscape.