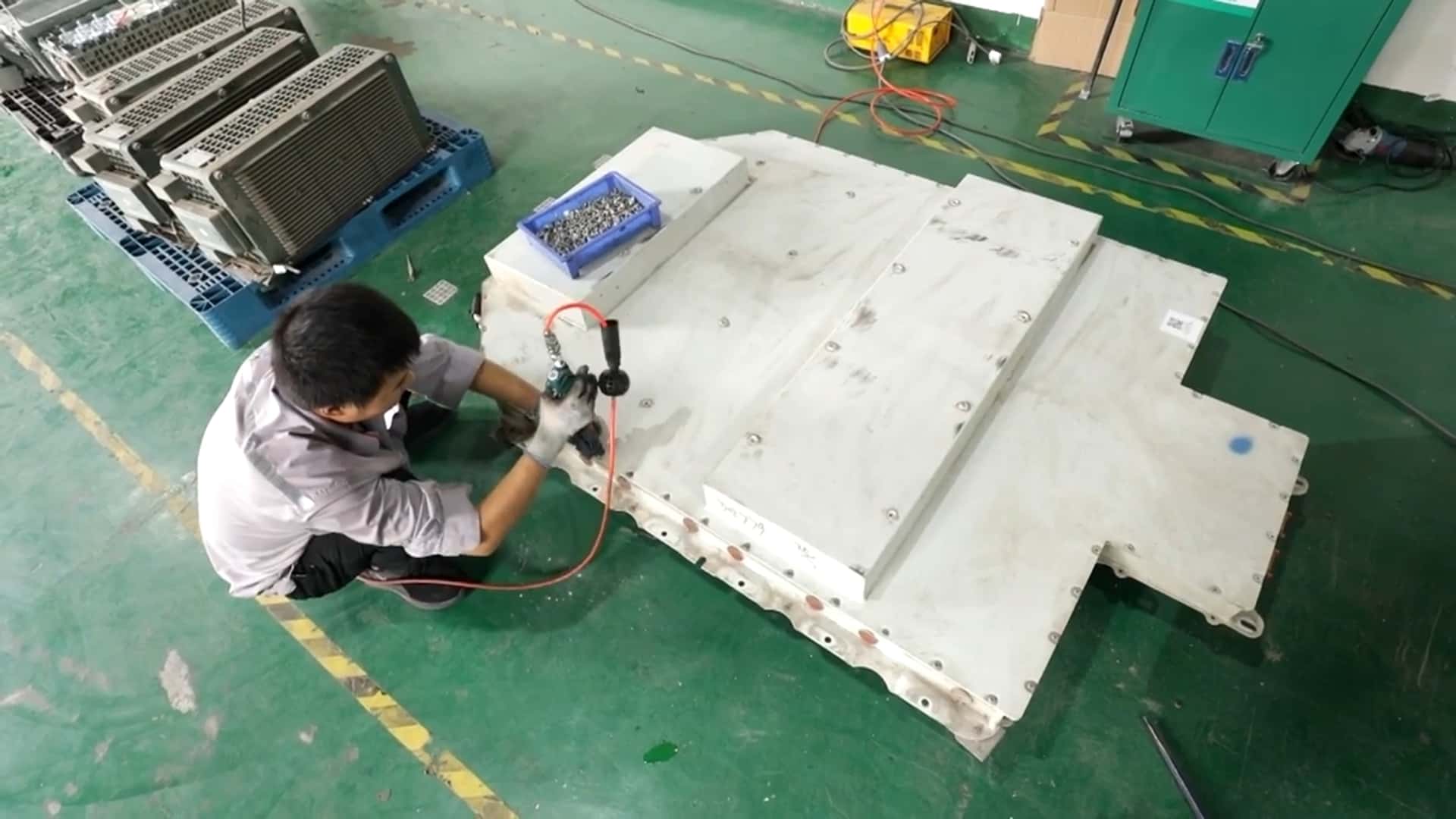

China has emerged as a leader in electric vehicle (EV) battery recycling, claiming to recover up to 99.6% of vital materials such as nickel, manganese, and cobalt from end-of-life batteries. This achievement positions China significantly ahead of its Western counterparts and raises questions about the future of battery recycling globally. As the demand for electric vehicles surges, efficient and sustainable recycling practices have become imperative.

China’s Recycling Standards and Innovations

In recent years, China has implemented stringent recycling standards to enhance its EV battery recycling processes. The country’s Ministry of Industry and Information Technology (MIIT) initially targeted a recovery rate of 85% for lithium, which was increased to 90% by 2024. Companies like Guangdong Brunp Recycling Technology, a subsidiary of battery giant CATL, have made significant strides in this area. They claim to have developed a fully automated recycling process capable of handling 120,000 tons of waste batteries, with plans to expand capacity to 1 million tons.

Reports indicate that some Chinese firms are not only exceeding recovery targets but also achieving remarkable purity levels in the extracted materials. For instance, while the recovery rate for lithium is slightly lower at 98%, many companies are successfully retrieving over 99% of key materials like nickel, cobalt, and manganese. These materials are essential for manufacturing new battery packs, thereby reducing the need for virgin resources and lessening the environmental impact of mining.

Global Implications and Competition

China’s advancements in battery recycling come at a critical time, as global demand for electric vehicles continues to rise. The European Union has proposed legislation mandating that batteries with a capacity greater than 2 kilowatt-hours must contain specific percentages of recovered materials by 2031. The EU aims for recovery rates of 16% for cobalt and 6% for lithium and nickel, figures that fall short of China’s current capabilities.

As the EV market evolves, the need for effective recycling methods becomes more urgent. The environmental impact of mining for lithium and other essential elements has drawn scrutiny, with ethical concerns surrounding labor practices and habitat destruction. By recovering materials from spent batteries, China is positioning itself as a self-sufficient leader in the field, relying on high-yield recycling instead of importing raw materials from regions like Africa and South America.

In the United States, companies such as Redwood Materials are also working to enhance battery recycling capabilities. Redwood claims to recover up to 95% of materials from end-of-life batteries. However, it has yet to achieve this at scale. Recent initiatives, including those outlined in the U.S. Inflation Reduction Act, aim to incentivize domestic battery recycling and reduce reliance on foreign sources.

As electric vehicles proliferate on roads worldwide, the demand for effective battery recycling will only intensify. The question remains whether the West’s aging EV battery packs will be shipped to China for processing, raising concerns about dependency on a nation that has established a stronghold in this crucial industry.

The landscape of EV battery recycling is shifting, and China’s leadership may well dictate the pace and methods used to recover valuable materials in the future. As the industry advances, the focus will increasingly be on creating a sustainable and circular economy that benefits both the environment and the growing electric vehicle market.